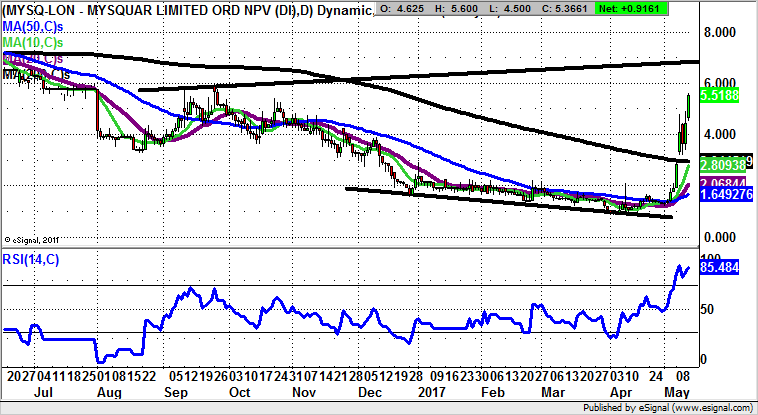

Mysquar: Fresh technical target to 7p up from 4p

I do not normally follow up on “winning” calls, as one usually ends up acquiring the appearance of being a nasty hybrid between a used car salesman, an estate agent and a politician. But it has been a good week for a Mysquar call I made seven days ago.

The reason for covering the technical position of Mysquar – the social media, entertainment and gaming platform based in Myanmar, just a week after the initial call higher from near 2p, is ostensibly that the old 4p target has been hit easily. Usually the first target in a move for a stock or market is the one to stick to. However, in this instance, after the latest reports of a revenue jump we are looking at a situation where there has clearly been fresh impetus for the buyers. It is also likely to be the case that those who had shorted the stock on the basis that it was a classic jam tomorrow tech play which would never cross the line appear to have been overly pessimistic.

This is especially the case given the way that the average daily revenues are up by almost 30% and the company suggests it is ahead in its journey to monetisation – not something our friends at Snap Inc can really confess to at this time.

As far as the daily chart configuration is concerned we can draw a fresh broadening triangle heading up to 7p – effectively one year resistance. At this stage only back below the former December resistance at 4p would really delay the upside scenario.

Any insight into good Japanese stocks?