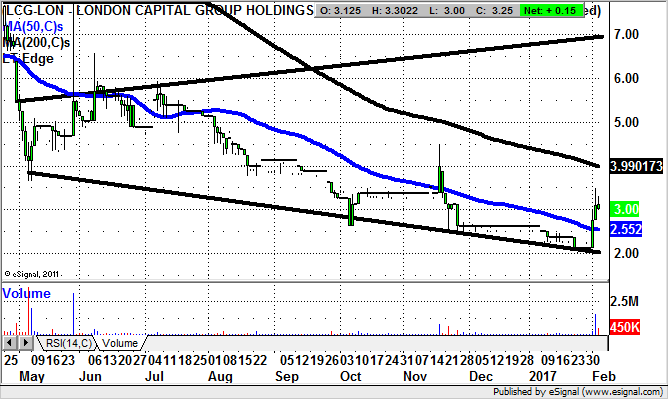

London Capital Group: Initial 200 day line targets 3.9p

It has not exactly been a pleasant ride for shareholders of London Capital Group (LON:LCG). But it does appear from a charting perspective that things may finally be on the move.

The end of last year witnessed quite a bombshell from the FCA – who presumably to both justify its existence and to distract from the fact it has never delivered any material benefit to either the industry or, more importantly, the consumer, came up with what appeared to be a draconian consultation paper.

This caused the likes of IG Group (LON:IGG) and Plus500 (LON:PLUS) to collapse. But really, there was nothing new in there apart from the FCA assuming that just because you understand leverage you will not lose money. Clearly they don’t know anything about trading, which doesn’t exactly help if you are supposed to be a regulator.

As far as London Capital Group is concerned, where we had the big share price collapse over two years ago, the FCA move made little difference. What we do have is a situation where the shares are trading at net cash, and hence probably ripe for being taken private. It would appear from the trading volume that there is “smart” money buying, and that the extended overhang here is about to be cleared.

On this basis one would suggest that while there is no end of day close back below the 50 day moving average at 2.55p, the upside here, initially over the next 2-4 weeks, is seen as being the 200 day moving average at 3.9p. But only a weekly close above the 200 day line really gets the bear market here out of the picture. The top of a broadening triangle at 7p would then be in focus.

Comments (0)