Intelligent Energy: Imminent 50 day line break targets 15p

One of the most difficult things to get right in terms of timing stocks and markets is to get on board successfully after a bearish phase. We are reminded of this with the present position at Intelligent Energy (LON:IEH).

It would appear that Intelligent Energy is leading the battle in terms of the development of zero-emissions vehicles and the commercialisation of hydrogen fuel cells. That said, a cynic such as myself would suggest that given the interventions of the fossil fuels lobby, which is clearly ongoing, we would have been much nearer this goal as we approach the 2020s if there was a will at a Government level to sort this out. Instead, pollution and geopolitical strife associated with fossil-fuel-supplying countries has been the way so far this century.

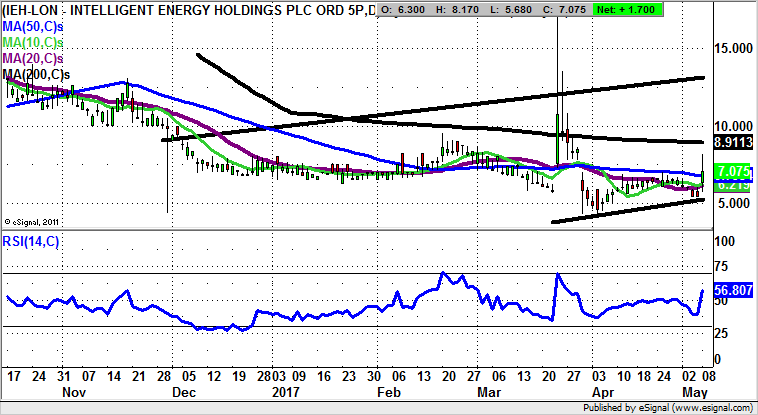

But as for the current charting configuration of Intelligent Energy, after the initial flurry in the stock today on the fuel cells research programme, it can be seen how the technicals are waiting on a sustained clearance of the 50 day moving average at 6.77p. This is also the top of a bullish falling wedge formation which can be drawn in from September. Therefore we are looking to a clearance of this notional double resistance on a weekly close basis, something which could trigger a move to the main post September resistance at 15p plus over the following 2-3 months.

Comments (0)