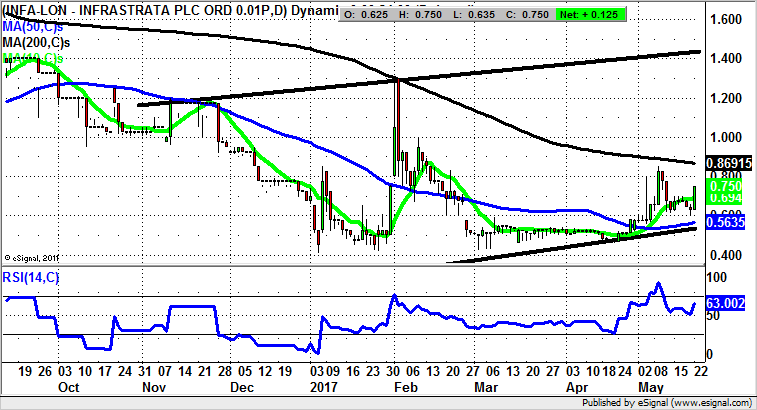

Infrastrata: Clearance of 200 day line targets 1.4p

Although it may be said that Infrastrata (LON:INFA) has been something of a Cinderella stock in the recent past, it would appear that the latest developments at the group could signal the start of a lasting turnaround.

Apart from the share price drift, there have been a couple of problems associated with the Infrastrata story on a technical basis. The first has been the obviously illiquid nature of the shares, and related to this, several false dawns where the hopes of the bulls will have been dashed. However, this occasion with an initial lunge towards the 200 day moving average at 0.86p today, does appear to be more credible than most.

This is said on the basis that the positive price action coincides with the announcement that the company has been “in discussions with interested parties to provide the remaining £2.2m funding required to complete the entire Front End Engineering Design (“FEED”) and a commercialisation work programme for the Islandmagee gas storage project. This is all very encouraging, particularly if Infrastrata can actually seal the deal. Of course, there is an element of wait and see here, something which brings in the technicals.

On this basis one would say that given the decent basing for the shares towards 0.5p, and the lasting recovery of the 50 day moving average at 0.56p one would be confident of a clearance of the 200 day line. Above the key moving average points to 1.4p at the top of a rising trend channel from October. Cautious traders can wait on an end of day close above the 200 day line before pressing the buy button.

Comments (0)