Hotel Chocolat (HOTC): The next Fevertree?

It would appear that everyone is looking for the next Fevertree (LON:FEVR) or Patisserie Valerie (LON:CAKE). It may be that premium chocolate is actually the way forward in this respect.

I have covered shares of Hotel Chocolat here before, and noted the way that the founders decided to cash in soon after the IPO – something which I suppose was understandable given the sums of money involved.

It now seems appropriate to look at the shares again in the wake of the 91% rise in pre-tax profits. The key to the business model seems to be the idea of getting Glasgow born Zak Mir to part with £3.85 for a bar of “Supermilk” 65% chocolate. This is no mean feat.

But given the upmarket customer experience one’s heart melts and the purchase is made – perhaps a couple of times a month. The key here is that margins are 66%, something which does not make me feel very clever when paying nearly four quid for a modest sized bar of chocolate. However, this is great news for shareholders, and is something which leads up to the daily chart.

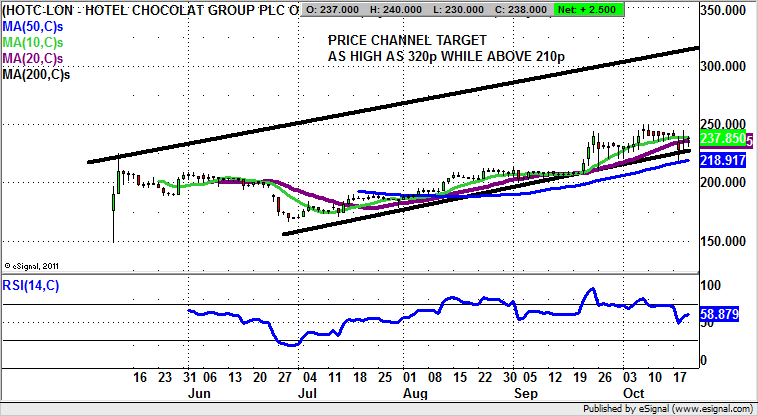

Here we can see a rising trend channel which can be drawn in from as long ago as May. The resistance line projection of the channel is heading as high as 320p. This is three-month share price target while there is no break back below the former August/September resistance zone at 210p.

Comments (0)