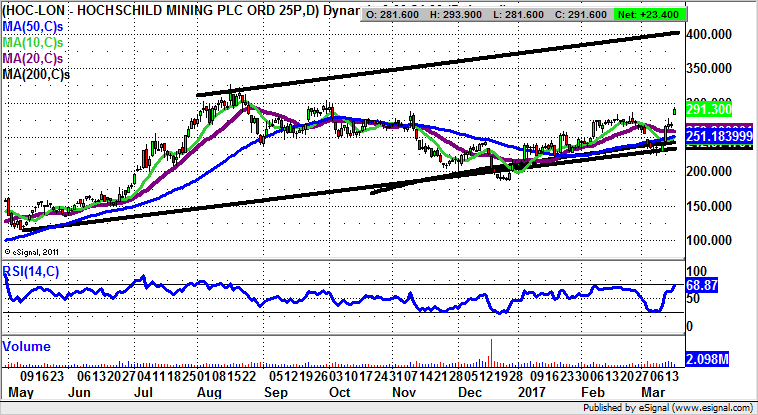

Hochschild Mining: Above 50 day line could lead to 400p

“Swing back to profit” is a favourite phrase as far as many a stock market company is concerned, and was applicable to Hochschild Mining (LON:HOC) earlier this month.

It would appear that as of 16 March most of the fundamental and technical stars relating to Hochschild Mining are very much aligned. This is said in the aftermath of the update earlier this month when the Peru focused gold and silver miner was able to boast a vastly improved year on falling costs and rising commodities prices. The big plus though, was the shift back to profitability, an event which is almost always significant, on a technical as well as a fundamental basis.

What can be seen on the daily chart is that the stock had already been anticipating the return of the good times from as long ago as this time last year when the price action cleared the 200 day moving average, then around the 70p zone. Indeed, there has only been a brief period since when the 200 day line was breached – on the December dip for the shares.

The view now in the wake of the latest gap to the upside through the February resistance zone is that while there is no end of day close back below the 50 day moving average at 251p – the trailing stop loss – we could be treated to a top of May 2016 price channel target as high as 400p over the next 3-4 months.

Comments (0)