Greece Heads For Solution Nobody Wants

At the time of writing, the latest round of Greek negotiations appears to be going to the wire once again, yet the euro continues to stand relatively firm. The bond market has borne the brunt of volatility while the euro is seemingly inoculated thanks in part to the effect of the ECB’s quantitative easing programme.

There was further evidence of the ECB’s role on Thursday as the latest LTRO (Long Term Refinancing Option) had more take-up than expected, with the 73.8bn topping analysts expectations. Despite the LTRO now being of less importance in the context of the QE programme, the numbers were at least supportive of markets and peripheral markets in particular.

Quite what will happen on the political front is anyone’s guess, though Thomson-Reuters’ Michael Cartine continues to draw parallels with the First World War: “No one wanted WWI, yet it happened anyway. No one wants Greece to default and/or leave the euro…”

Thursday saw much excitement over a supposed leak from German paper Zeit which claimed that a major concession had been given to Greece with a further extension (possibly excluding the IMF). This was in turn denied by EU diplomats, but the euro still held up well considering the context.

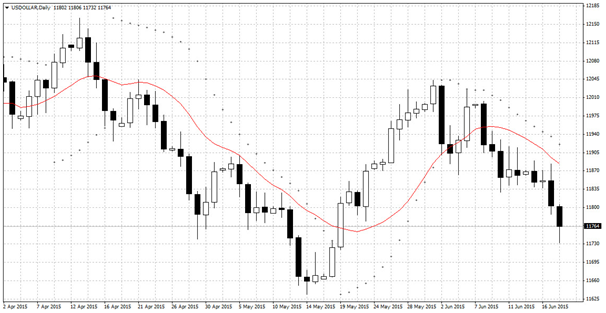

Dovish Fed Hurts Dollar

Wednesday’s FOMC meeting was generally perceived as dovish, with an apparent downward reversion to rate projections. Markets still imply two 0.25% rate hikes before the end of 2015, but from here the rate curve appears to be slowing compared to previous expectations.

Dollar Index

Added to this, Thursday saw an almost perfect storm of US data, with lower than expected CPI coming in with better than expected unemployment claims and Philly Fed manufacturing index.

The dollar bears are back out in force, a move that will only add further support to the EUR/USD.

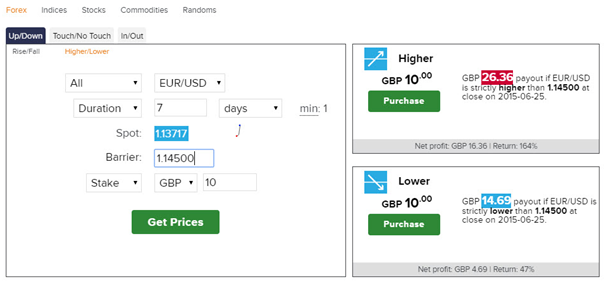

Betting On Euro Survival

Current peripheral bond yields imply a sense of alarm surrounding the Greek situation, but these fears are far from plumbing the depths of the 2011/12 crisis. The question may not now be whether Greece will default and exit the euro, but how bad the result will be for wider markets. Judging by current market activity, the prognosis appears to be that any default or exit may be painful, but far from catastrophic. There may even be a scenario where Greece pays private creditors while reneging on larger organisations such as the IMF.

EUR/USD daily chart

There may even be another compromise agreement reached at the fourth deadline beyond the deadline.

Markets may be wrong – they often are – but while the dollar weakens, there could be further upside for the EUR/USD.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)