FT30 as a Leading Indicator

There is some madness around in the market place these days. HSBC looks like it might perform a bit better because it may not have any regulatory fines in the next accounting period! It’s a pretty bad show if a company is marvelling in guidance that it won’t be fined by its own regulator during the coming quarters. It’s quite clear the regulator is useless at its job once all the major banks are being fined left right and centre for years on end. It shows a complete failure in regulation, and as I’ve said before, the regulator should be made to answer as to how each of these regulatory failures occurred in a public tribunal with consequences.

It’s not ‘one of those things’, or a ‘bad week’. If there is structural rule-breaking in financial institutions, then there is structural incompetence in regulation. They are two sides of the same coin. But this is the problem you get when you send a vicar after a thief: the attitude of dealing with problems as they arise is fatally flawed, and we’ve already seen that. As we will see, so is pandering to public opinion and the will of politicians when creating new regulation. If the regulatory bodies are claiming it’s a hard job to do then they have employed under-qualified people to work there. Up the salary and get some people who will let finance breathe whilst keeping the genie in the bottle!

They’re reviewing CFDs, and by extension spread betting, soon. They’re concerned about risk for the ‘non-professional’ investor. Suggestion: stop protecting us from ourselves and start protecting us from bad practises. Make spread bet pricing more transparent. I remember being at an event put on by a bank to showcase their products. There was a chap there from the LSE pointing out that spreads are regulated on CFDs and spread bets. I asked if that included some rules on how quickly they updated prices and it had seemingly never crossed his mind that there could be an issue there. Vicars after thieves. Meanwhile the regulator will protect us from ourselves again, create more red tape, exclude some of us from markets they have no business excluding us from etc.

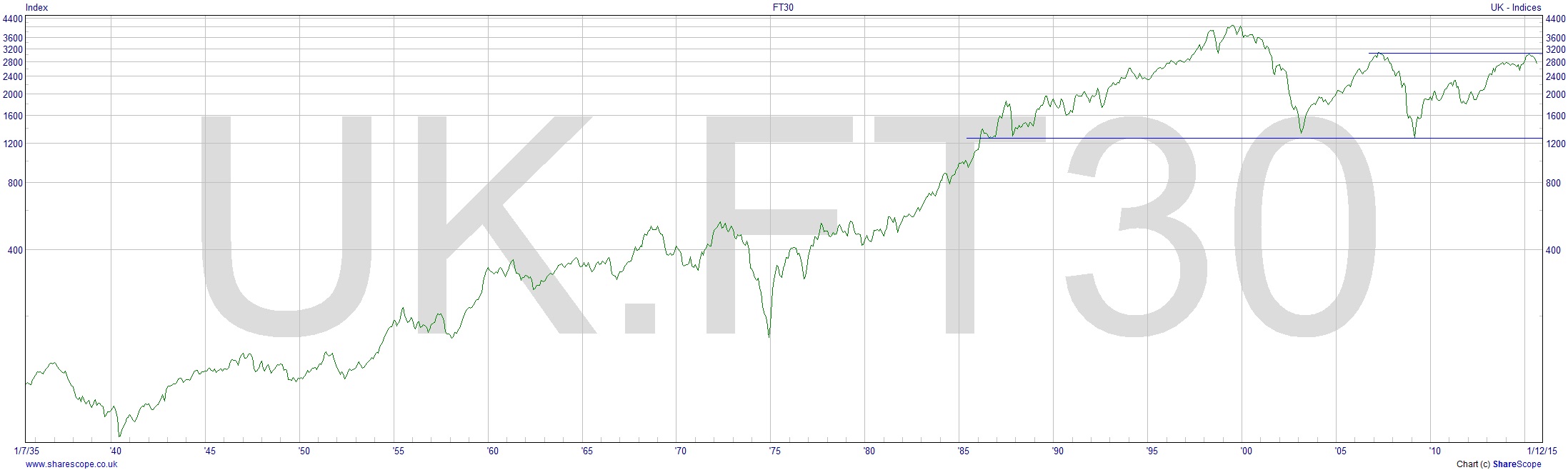

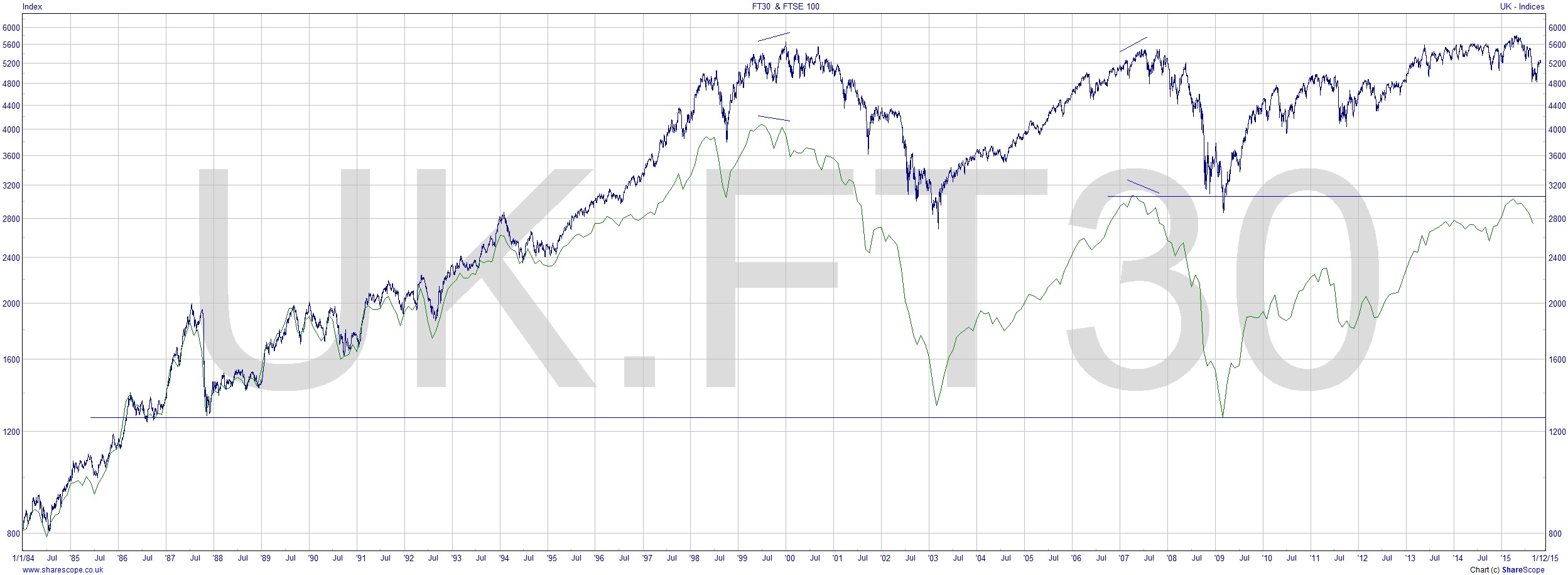

I was going to write about the FT30 as a leading indicator so let’s forget about regulators (if only) and look at the FT30. It differs from the other FTSE indices (100, 250, 350, etc) in that it is not based on market cap once a stock enters the indices. The only way out is take-over, merger or death. As a result it’s not full of bright shiny stocks. This means that it tends to fail before the FTSE100 and can be a useful tool in predicting a bear market.

I’ve shown the FT30 since 1935 on a log scale to illustrate how its high was reached 15 years ago and that we are now at the resistance level of the 2007 peak. We’ve also got a strong support level which has been tested three times at around 1,300. What we see is that the last two bear markets have been pre-empted by the FT30 versus the FTSE100. I’ve shown both on the second chart. I’ve marked on the divergence where the FT30 makes a lower high as the FTSE100 makes a higher high. That’s it. As simple as that. Wanna buy an app for it? No. You don’t need one. You can see it really easily by looking. FT30 is on Sharescope. Set up an alert.

Comments (0)