Foxtons – FOXT? They Might Be

I got on the property ladder by buying houses that needed an awful lot of work doing on them and then doing it mostly myself. I used to punch people who would tell me how lucky I was to have a house. I remember that when it came to selling, one of the agents asked to do some internal photographs. Well, open-minded as I am I do draw the line there, especially after he produced an endoscope.

Foxtons (FOXT) is a business that typifies style over substance. They charge more to add value where it produces no perceptible difference. I mean, hats off to them for the genius of pulling it off. But essentially they have created a pair of three legged trousers. Trousers with 50% more legs for just 25% more. No use to anyone with the possible exception of Rolf Harris.

If you’re not familiar with Foxtons, they’re an estate agency that made a splash by having Mini Coopers for their agents and being very glossy indeed. In turn they would charge a fortune to sell your gaff. Sole agency at 3% (including VAT) is still pretty steep, although if memory serves they used to charge more. They also do lettings. Lettings agencies are a licence to print money anyway. They’re highly under-regulated (previous attempts at regulation having had no noticeable effect), so tenants and landlords are still being fleeced across the board. For me the biggest conflict of interests with agency costs comes under the management part. The agent’s commission for arranging works is based on the cost of the works carried out. That’s an obvious encouragement to avoid a cheap solution, or to look for preventative solutions. Another scam is to charge for renewing a tenancy when in fact, where a tenancy agreement exists but the fixed term has expired, no new contract is required and you simply become a periodic tenant instead of a fixed term tenant. £96 + VAT for absolutely nothing.

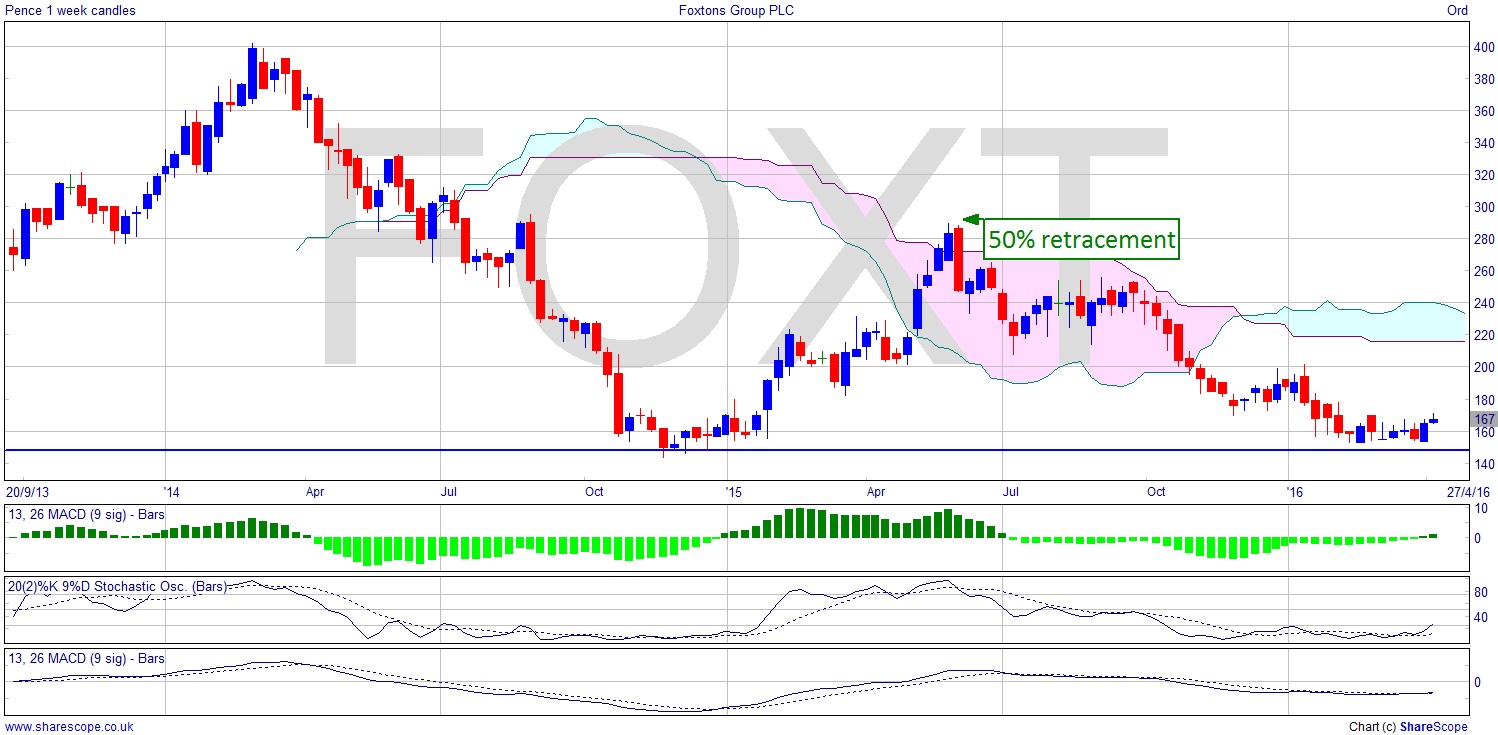

Foxtons came to market in 2013 and the IPO was over-subscribed. A cursory glance at the chart will show that over-enthusiasm has not persisted. We see a significant support level at around 150p, bearing in mind that the starting price was around 280p, and the ATH a shade over 400p. Dow Theory is a big factor here. Lower Highs to die for. There’s a classic 50% retracement, which I’ve marked, last June. I wouldn’t be at all surprised to see another after this more-prolonged second attempt on the support at 150p, so that would be up to a little over 200p, which is coincidentally the cloud bottom at the moment. That would certainly be a suitable point of failure, and a possible early entry point.

A stock for the short list, then. In a period of rising house prices, rising rents and low interest rates it’s hard to imagine how this isn’t the time to make hay for Foxtons. Or is there something toxic in the accounts which will see them dead and buried quite soon? A quick look at the financials since flotation doesn’t offer much. Steadily increasing revenue and decent profits. They’re paying dividends. But they’re not falling off a cliff for no reason at all. FOXT?

Comments (0)