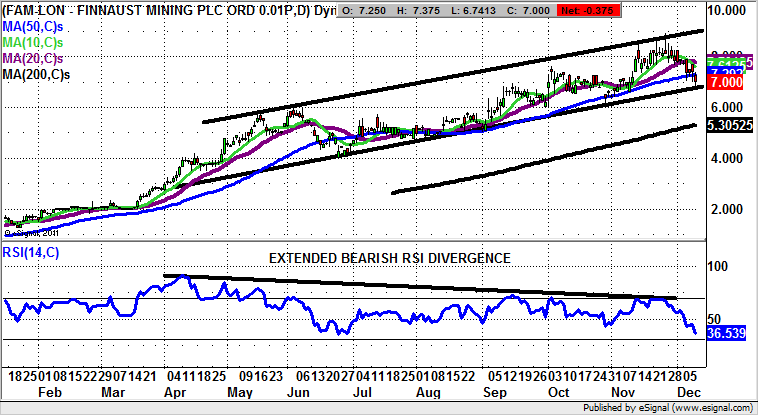

Finnaust Mining: Extended bearish divergence in place

Finnaust Mining (LON:FAM) has been a bit of a head scratcher this year. The reason being that the company has clearly been helped by the massive rebound in the sector to which it belongs, but with siren voices suggesting it may be overvalued.

I have to say that there is some entertainment value associated with companies which deeply divide the market. I am reliably informed by “smart money” that Finnaust Mining shares are somewhat overcooked.

But from a technical analysis perspective we have a situation where the trend has been one’s friend. This is in spite of the latest fundraise by the company, which took in £8.5m at 7p. The fact that the stock is still trading around this point has to be regarded as a plus point, but there is more.

The technical bear argument stems from the way that the stock has been making higher highs this year, but with lower RSI trace highs. All of this bearish divergence implies that at some time soon we could suffer a retracement.

Indeed, aggressive bears would be looking to a decline for the stock back to the 200 day moving average, now at 5.3p, even if the uptrend resumes after that. At this stage only a break back above the initial October resistance at 7.62p would really question the idea of near-term weakness here.

Comments (0)