European Metals: Extended bull run towards 50p

One of the highlights of the past year on the stock market has been the rise and rise of mining stocks. But the problem has tended to be the embarrassment of riches in terms of the choice of companies to go for. Nevertheless, European Metals (LON:EMH) has offered a smoother ride than most.

European Metals may be a relatively obscure mining play, but it has to be said that in it really has delivered for the bulls of late. Moreover, its performance has been strong on a fundamental basis as well as a technical one.

For instance, it is difficult to ignore the way this Lithium play has outperformed so many others on the stock market. This includes those plays who are mainly focused on this “hot” commodity, and those who were precious metals miners getting on the bandwagon.

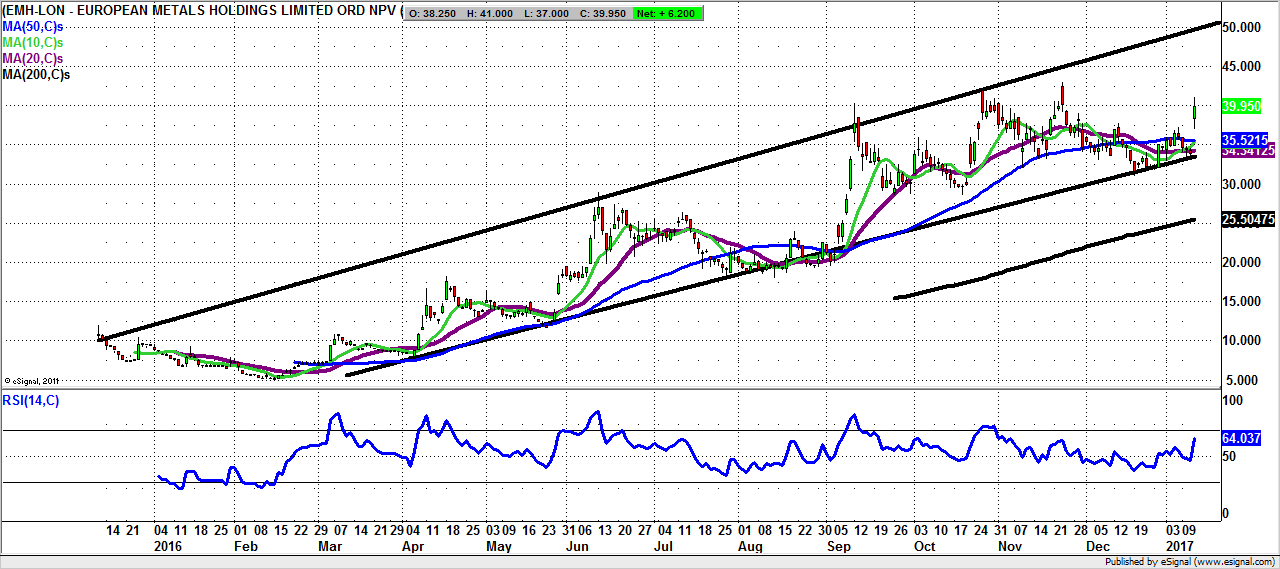

The problem for Lithium is of course the notion that it is arguably trading post bubble, and pre any big electric car revolution. However, none of these doubts are apparent on the daily chart of European Metals, where we can see a solid-looking rising trend channel over the past year. Even better, there have been sporadic gaps to the upside for the price action.

The present position is that we have been treated to an unfilled gap to the upside through the 50 day moving average at 35.5p. The message currently is that provided there is no end of day close back below the 50 day line, we should be looking to a 2016 resistance line projection target as high as 50p over the next 4-6 weeks.

Comments (0)