Don’t Panic Mr Mainwaring

There are lots of things that have no bearing on the stock market right now, and Corbyn is one of them. En passant, he poses an interesting question for the Labour party. They now have a leader voted for by a clear majority of party members, but whose politics do not broadly agree with a majority of Labour MPs, and, by extension, a majority of Labour voters in the last election. A lot of those MPs must wish they’d joined the Tory party now. After all they are mainly career politicians who believe it’s more important that they get elected than anything else (like sticking to the ideology of the party they represent, or anything they may do once they actually get elected). I’d have a two term limit on political office so we could have real people as politicians, rather than what we get: odious, professional liars who are, almost immediately after election to office, basically celebritised spokes-models for the re-election campaign. I’d also make it law that election promises have to be kept, with penalties for not doing so if adequate justification could not be provided to a tribunal in the event.

What stock markets are moved by is continued good results and economic success, while any kind of fear makes them fragile and ripe for a crash. To be fair, market crashes happen because assets are over-priced. A lot of quarters tried to blame the market failure after the sub-prime debacle on people shorting the market. Doh! It was quite the opposite. It was people paying far too much for assets that caused them to crash.

Newspapers and politicians thrive on bad news. Newspapers thrive because bad news sells more copies than good news. Politicians thrive because they get to fiddle with things to make it look like we need them more than we do (if indeed we need them at all).

So, given all the ‘bad’ news that’s floating around, or at least perceived bad news, don’t forget it’s people, i.e. morons, that provide the sentiment to move markets. So are the main markets on a precipice? Well yes. It’s a rather an odd state of affairs though. We have low commodity prices, including gold, and that could be seen as a leading indicator of deep-rooted problems. We certainly have a property bubble here in the UK and we’re not the only ones.

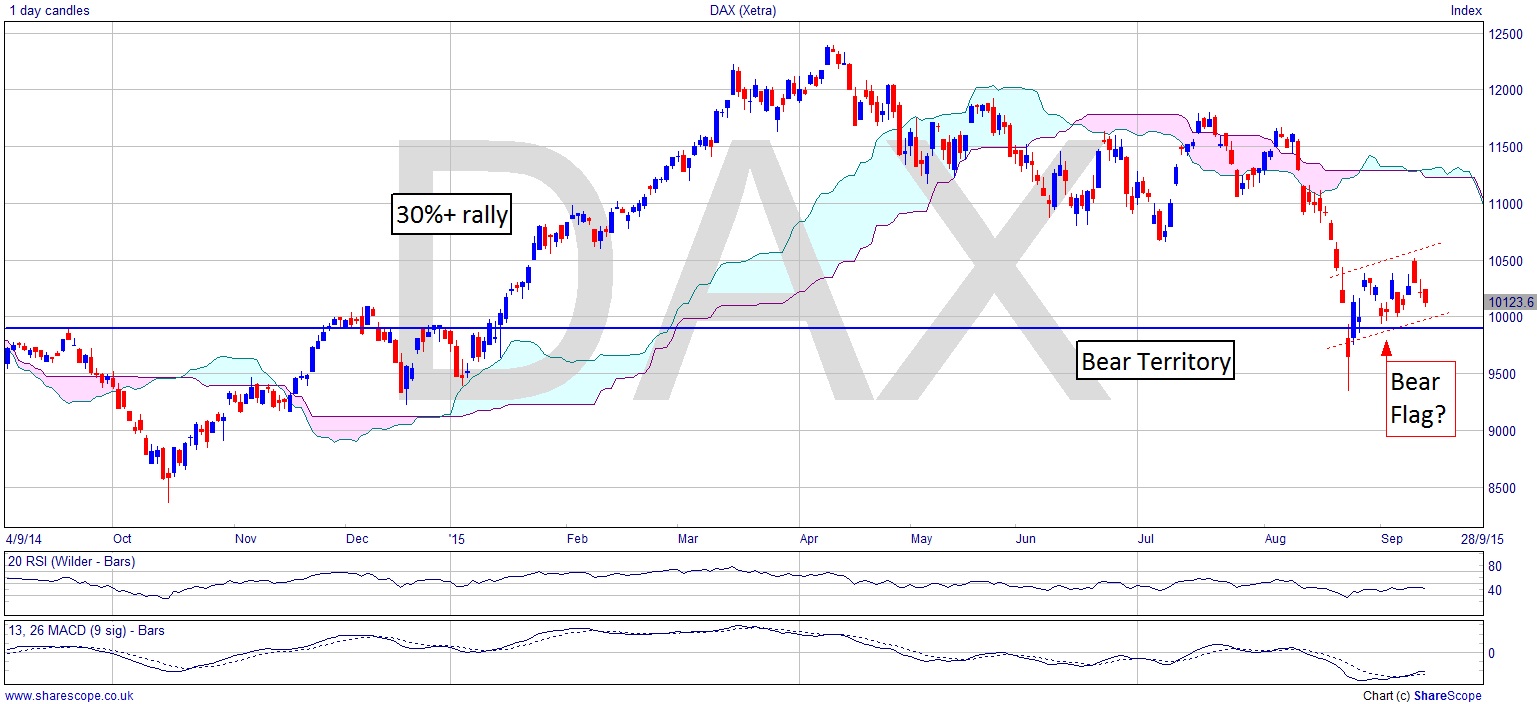

And where are the market signs? Well the DAX, which don’t forget actually hit bear territory last month, looks like it’s making a Bear Flag. I’ve marked it on the chart for clarity. If it plays out then we can expect big falls this autumn, as in another 20% from this point. This would put the DAX down to 8,500 and the FTSE below 5,000 and after that maybe 3,500 again. That really would be a big deal. Happy days!

Comments (0)