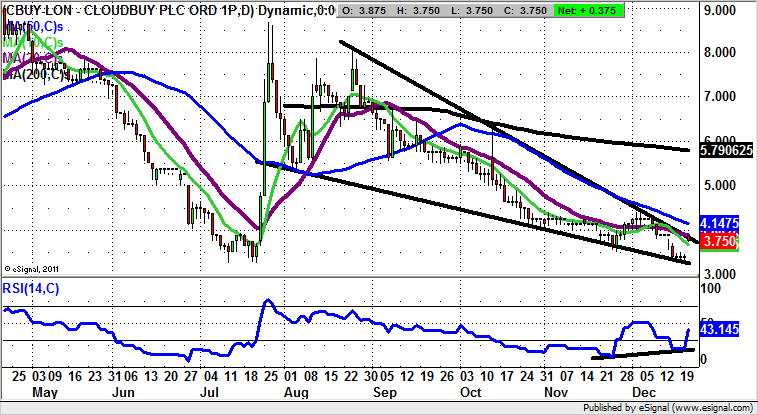

Cloudbuy: Rare triple bottom reversal

One of the New Year resolutions I am going for is to look for reversals in stocks and markets as early as possible. This is especially pertinent in the context of Cloudbuy (LON:CBUY).

On a fundamental basis I have the slight issue that I am not entirely convinced of what the company does, or whether there is any money in it. The other slight problem is that it would appear that everyone and their mother is engaged in the type of business that this company engages in. Competition kills in a time when you can find a better deal at the click of a mouse.

Therefore it is probably just as well that the main thrust of this coverage of Cloudbuy stems from the technical position, where the daily chart is sending a clear message. This comes in the wake of the triple bottom gap reversal from the former July floor at 3.25p. Added technical excitement has been provided by the way that the turnaround was accompanied with bullish divergence in the RSI window.

All of this would most likely suggest enough momentum to deliver a 1-2 months timeframe target back towards the 200 day moving average at 5.79p. Only cautious traders should wait on a clearance of the 50 day moving average at 4.14p before taking the plunge on the upside. The most obvious stop loss is an end of day close back below the 3.25p level.

Comments (0)