Christmas is cancelled

One of the things I really like about Sweden is there are fewer people there than there are here in London. About 1 for every 14 because the place is huge and has a smaller population. Their idea of a busy bar is actually reasonably comfortable compared to the crowd densities you see here. And even though beer is incredibly expensive there, I’ve never felt like I’m on some sort of profit driven conveyor belt like I do in so many London bars.

For the Festive Season though, it’s felt a lot more like Sweden, at least in terms of numbers. I don’t perceive bars and pubs (or restaurants, for that matter) to be as busy as they have been in years gone by. Town centres aren’t buzzing quite as much with shoppers. And apparently mini-cabs and taxis haven’t had the usual Big Weekend before Xmas. Friday was quite busy, but Saturday not so much. It’s generally been a quiet party season for them – certainly round here in not very deep, and certainly not darkest, Surrey.

What’s happening? Well some of that business will be going online. This is the unknown for analytical purposes right now, as we can’t see very easily how busy online sites are very easily. Are people tightening their belts and going online for savings, or tightening their belts full stop? Most people spend their time in denial, and we are not a nation of savers, so it’s unlikely to be a pre-emptive strike to save money pending interest rate increases.

Pending data I would suggest that online retailers will be beneficiaries come what may. So I’m going to examine real-world retailers.

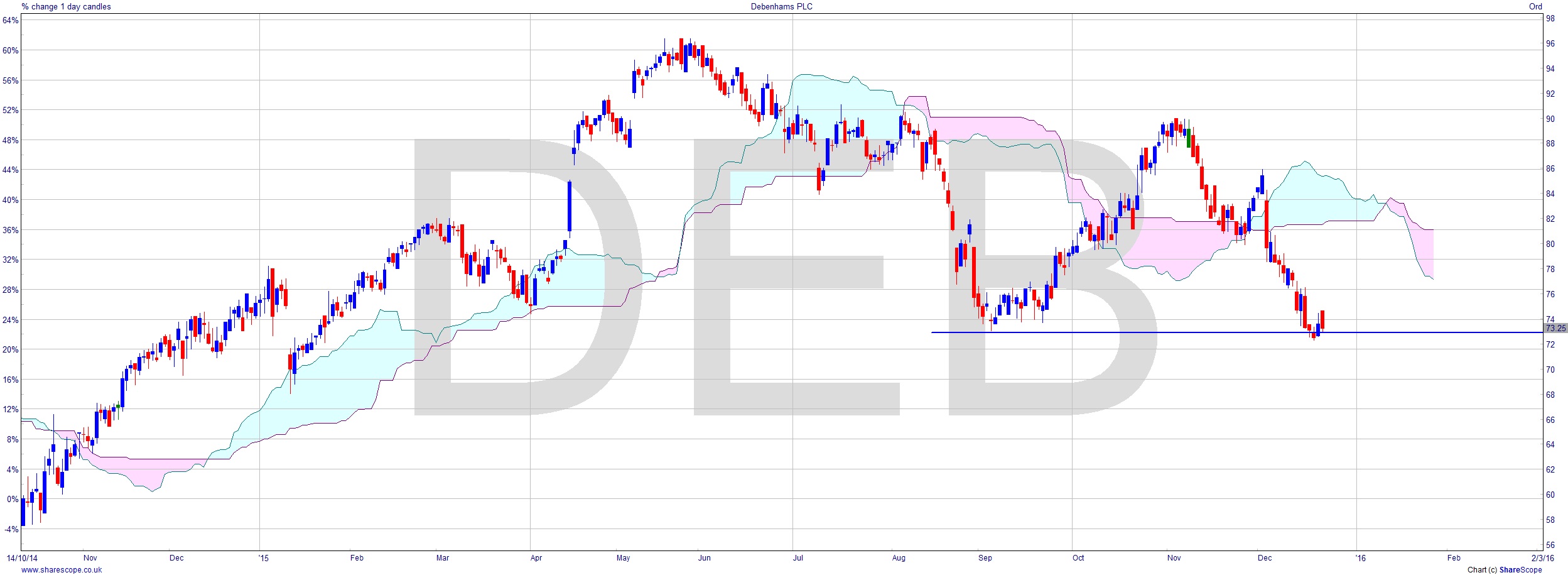

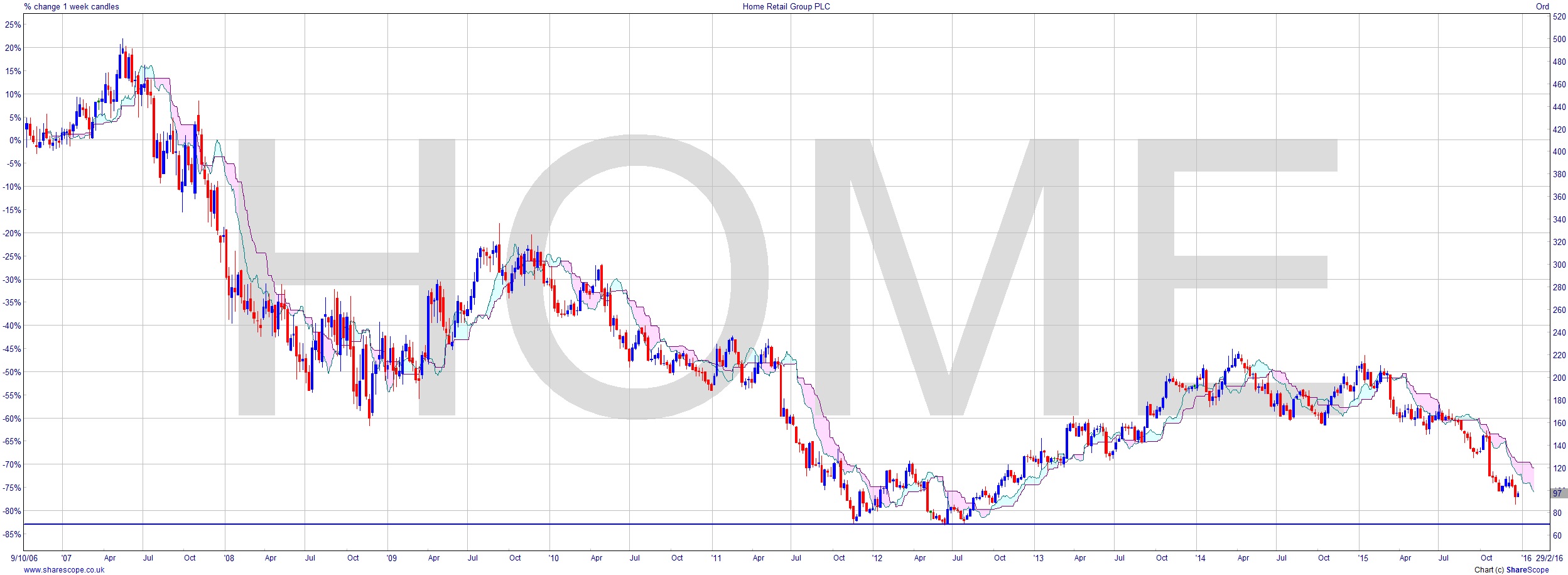

Debenhams (DEB) look pretty ripe for a fall. A decent entry signal here, like a break below that Support level and a failure at it on a rally, making it a Resistance level, would be an attractive proposition. Home Retail Group (HOME), which owns Argos and Homebase, seems to be dying on its arse. If you look further back in time it looks even starker. These guys want to watch out for prowling takeover jackals while interest rates are still low.

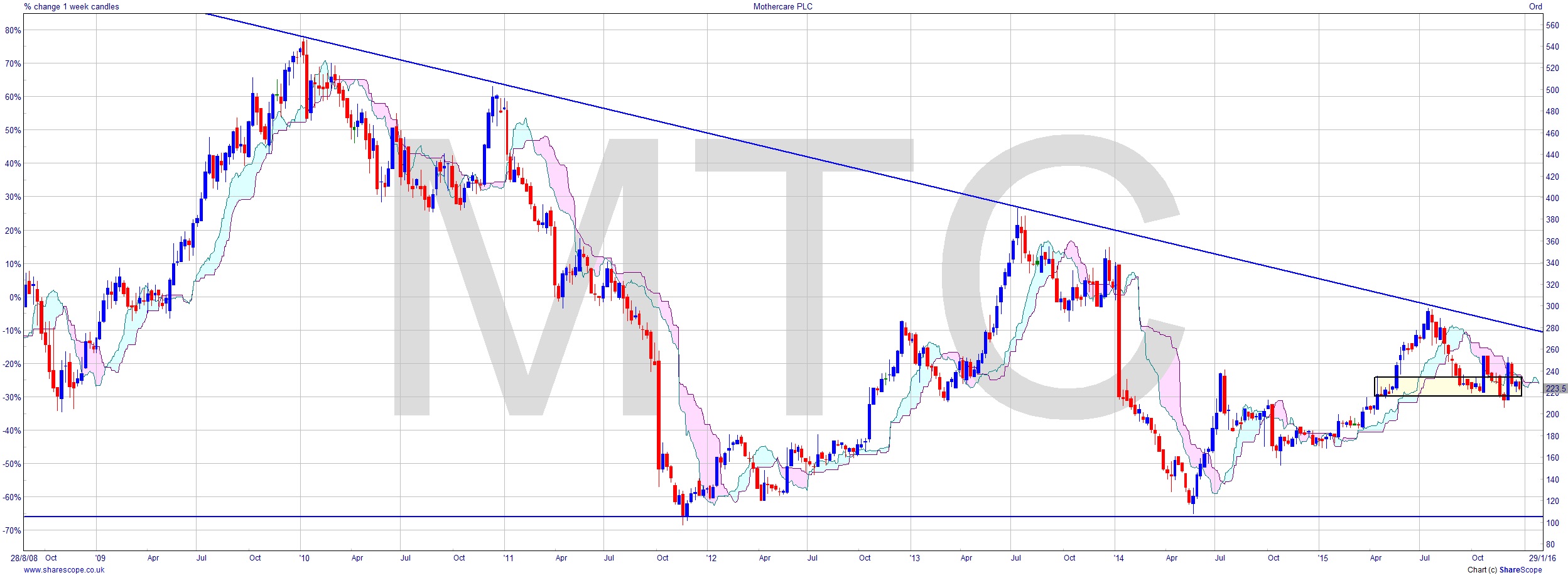

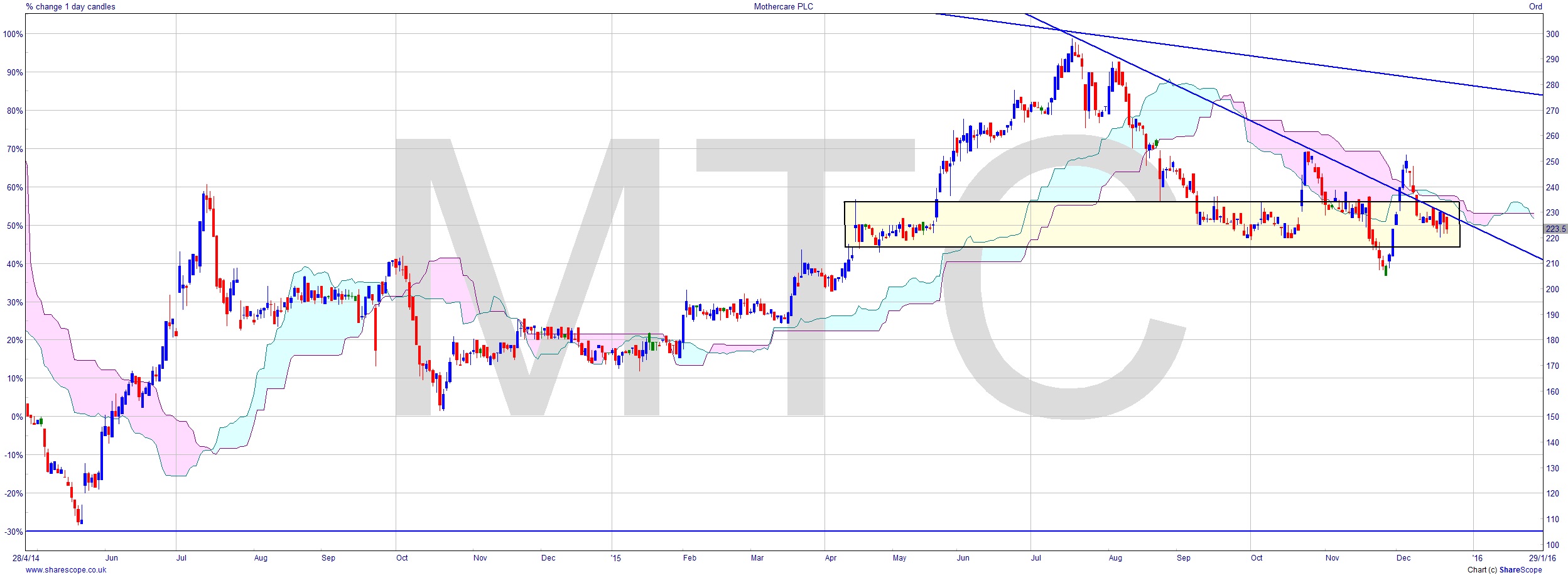

Mothercare (MTC) is an interesting chart. There’s something of a baby boom on apparently, so you’d expect to see jolly old Mothercare coining it. Apparently not. I guess charity shops and eBay have put paid to that. We see a trend line holding down the price action for the last five years now. There’s major Support around the 100p level and an interesting Congestion Area around the 220-235p level, to which the price keeps coming back. The Congestion Area is clearer on the daily chart where you can really see how it’s acted as a price magnet. Weakness from here could easily seal its fate to head towards 100p. A really good entry signal would be a result.

One unusual point here is we’ve seen two upwards fake outs and one downwards in the last quarter. We also see a broken trend line from the top in July, which has also faked out, and the price seems to be finding resistance at the trend line once again. Trend lines are probably the iffiest of indicators. I imagine for the most part they’re easy to draw on, so people do and then they think “oh, there’s a trend line”, and it seems to work, but really only because they’ve all drawn it on. We can’t ignore the sheep mentality of market participants, but we should be aware that trend lines are superstitious in

their nature much of the time. Mothercare is a challenging chart, but getting it right when and if a short signal does present itself could be well rewarded.

Comments (0)