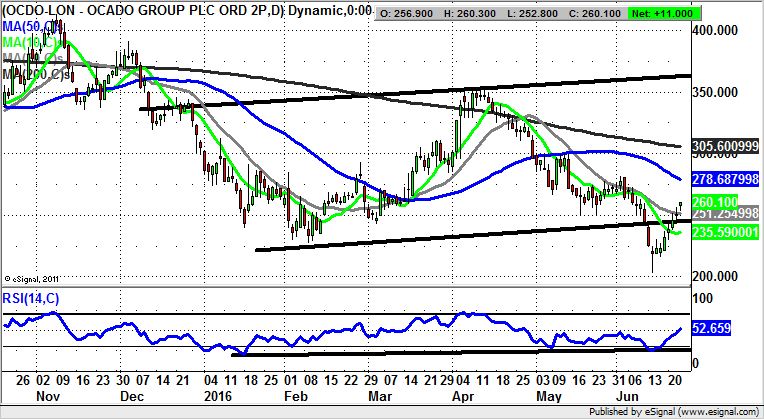

Chart of the Day: Ocado

It remains one of the stock market mysteries that while online grocer Ocado has struggled to turn over a profit over the past decade, the valuation and indeed the share price seem to defy gravity. This is apparently the case even though retail sector disruptor Amazon has just invaded its space.

Ocado (OCDO): Ultra Sharp Bear Trap Rebound

One can say without too much fear of contradiction that shares of Ocado have been rather more resilient on a technical basis than one might have feared from the fundamentals. This point is underlined by the way we have been treated to the sharpest of rebounds in the wake of news that Amazon is invading the UK grocery delivery space. That said, the smart money has always viewed Ocado as a logistics software specialist, rather than an internet supermarket, and this is arguably more than enough to explain the £1.5 billion share price and the apparent 139 P/E ratio. Therefore, while the bears continue to prowl, it could very well be that the share price continues to confound the doomsters. As far as where we are now on the daily chart, it can be seen that there has been a recovery of the May 250p intraday floor. While there is no end of day close back below this number the upside for Ocado on a charting basis should be back to the 200 day moving average zone at 305p over the next 4-6 weeks at the latest.

Comments (0)