Can the Markets Be Terrorised?

As seen in the January edition of Master Investor Magazine.

One of the unfortunate things about 24 hour news is it goes on for 24 hours and has to be filled with something. The news tends to come from places where the news networks have a crew, and that are emotive to the viewing public they ‘serve’. This gives rise to the phenomenon of patriotic reporting. The notion that a story is more or less interesting because there are people you don’t know from some part of the country you happen to live in is nonsense. But people are programmed to think it does.

You may remember the Channel 4 comedy series Drop the Dead Donkey. Originally it was to have been called ‘Dead Belgians Don’t Count’, but political correctness put paid to that. Once a story does get onto the headlines, if it’s dramatic and ‘breaking’, then it’ll be on heavy rotation, maybe even ‘live coverage’. I’ll bet nothing ramps up the viewing figures more than a terrorist incident somewhere you may have been, if not on your doorstep.

Statistically, you’re still more likely to die from being crushed by a large piece of furniture than by a terrorist, but for some reason the terror seems more immediate and takes the top spot for fear. People aren’t generally cowering at the thought of an amorous Anwar jumping their bones. Given that, it would seem logical that since financial markets are based on sentiment, they would be particularly affected by domestic terror attacks.

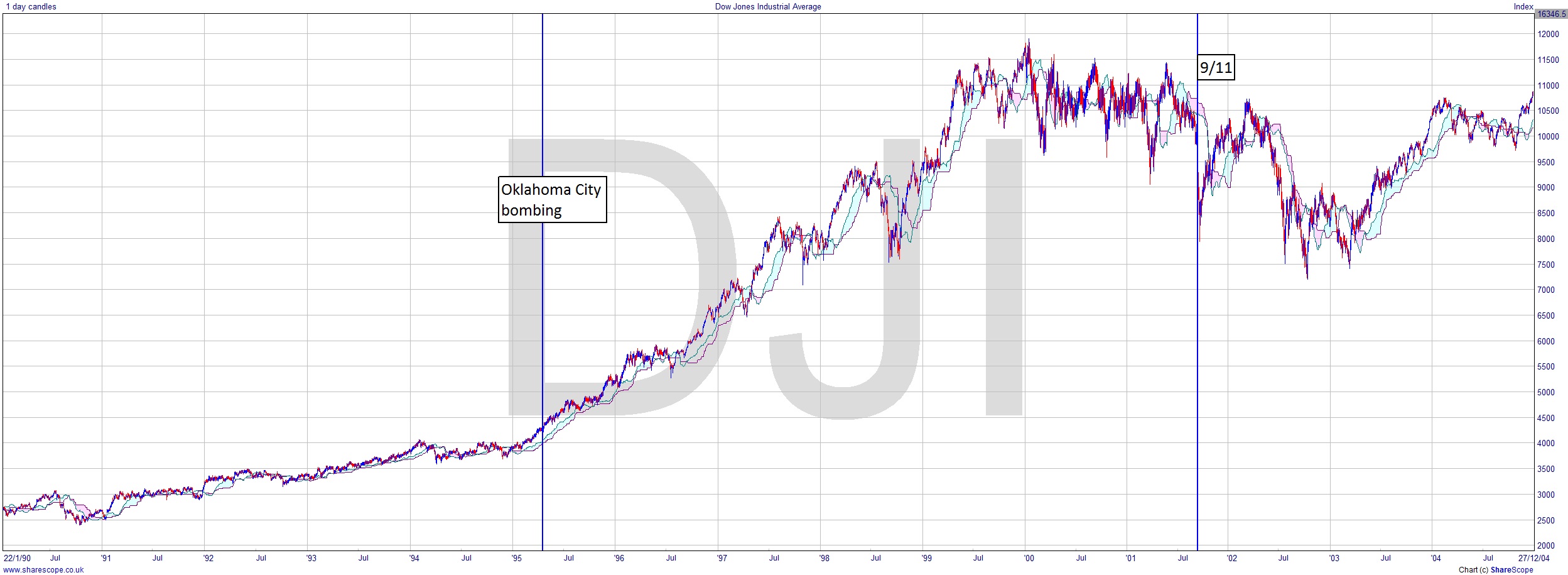

I often describe Americans using a Douglas Adams reference from Hitchhiker’s Guide: Paranoid Androids. They’re worried, if not neurotic, about everything. Thus, one might reasonably expect that the terror attacks in Oklahoma back in ’95, and more recently 9/11, would have had a dramatic effect on the markets. Particularly since public participation in US markets is high.

I’ve annotated a Dow Jones chart with the dates of the attacks clearly marked. Starting with Oklahoma, it made absolutely no difference at all. The trend remained almost embarrassingly intact. Granted it was a maverick act, and not part of some bigger threat, but it did represent the first occasion in modern times that the US stopped feeling quite so untouchable and beyond harm.

9/11 is a little more dramatic, but let’s examine what happened in the market around that time. We can see the markets fell after the attack, but it’s not any more significant than some of the other falls during the months either side of the attack. In fact the reversal signal was highly visible months before September. The market behaves fairly predictably, and eventually bounces off previous lows to start the new bull market in ’03. During the weeks after the attack the Dow even had a decent rally, so the markets weren’t really that spooked.

We see a similar situation in the UK. Most of us will remember the IRA. They’ve gone into pharmaceuticals and training now, but throughout the ‘70s and ‘80s they were far more prolific than their Brit-hating successors. Did you know the IRA even threatened to kill comedian Dave Allen for his religious jokes and sketches? Terrorists have no sense of humour! And that sounds an awful lot like a fatwa. I’ve marked two big IRA bombs and 7/7. Again we see a quite minimal effect for both of the IRA bombs, if any. But even 7/7 doesn’t make a dent in the rally that started back 2003. Perhaps it’s the Great British resolve. Foreign friends of mine here in London were amazed how matter of fact we Brits are in these kinds of situations – on discovering a road or a station closed we just calmly set off in a different direction. Perhaps this kind of stoicism stems from the Blitz spirit collective memory.

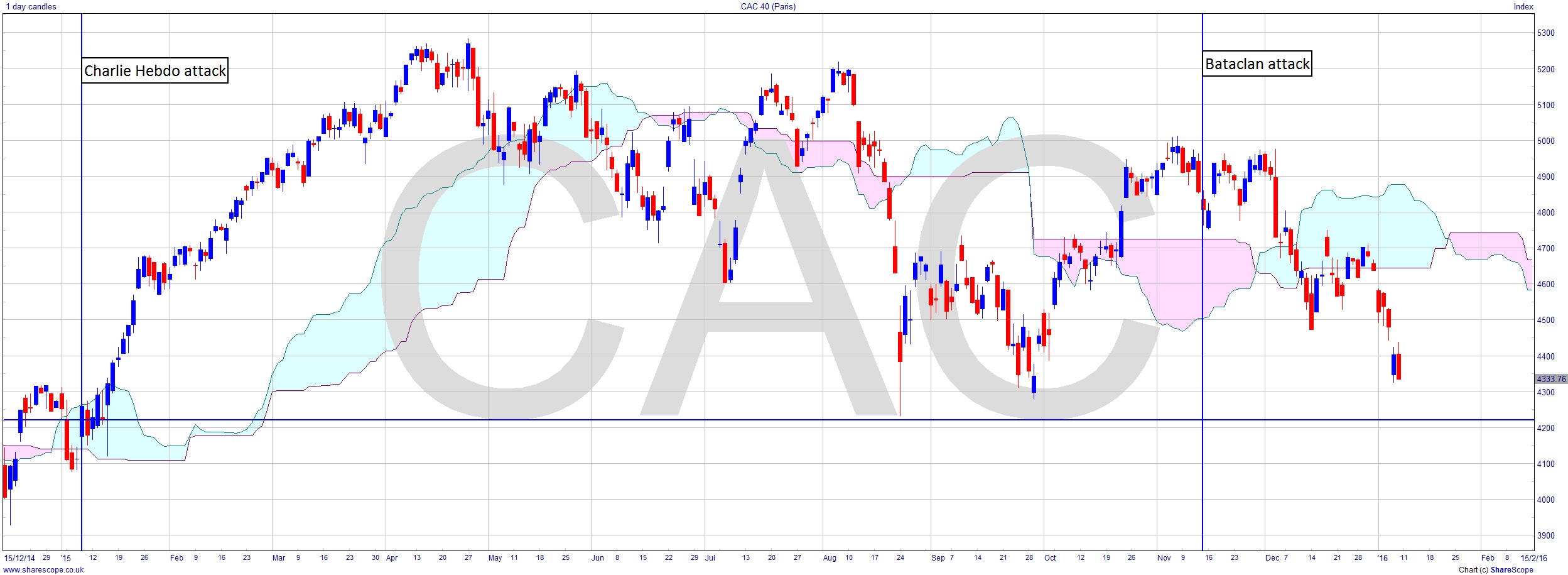

I’ve also looked at the CAC40 and the recent attacks in France. The Charlie Hebdo attack had no effect on the market. Neither did the Bataclan attack. The market stays true to the developing chart patterns.

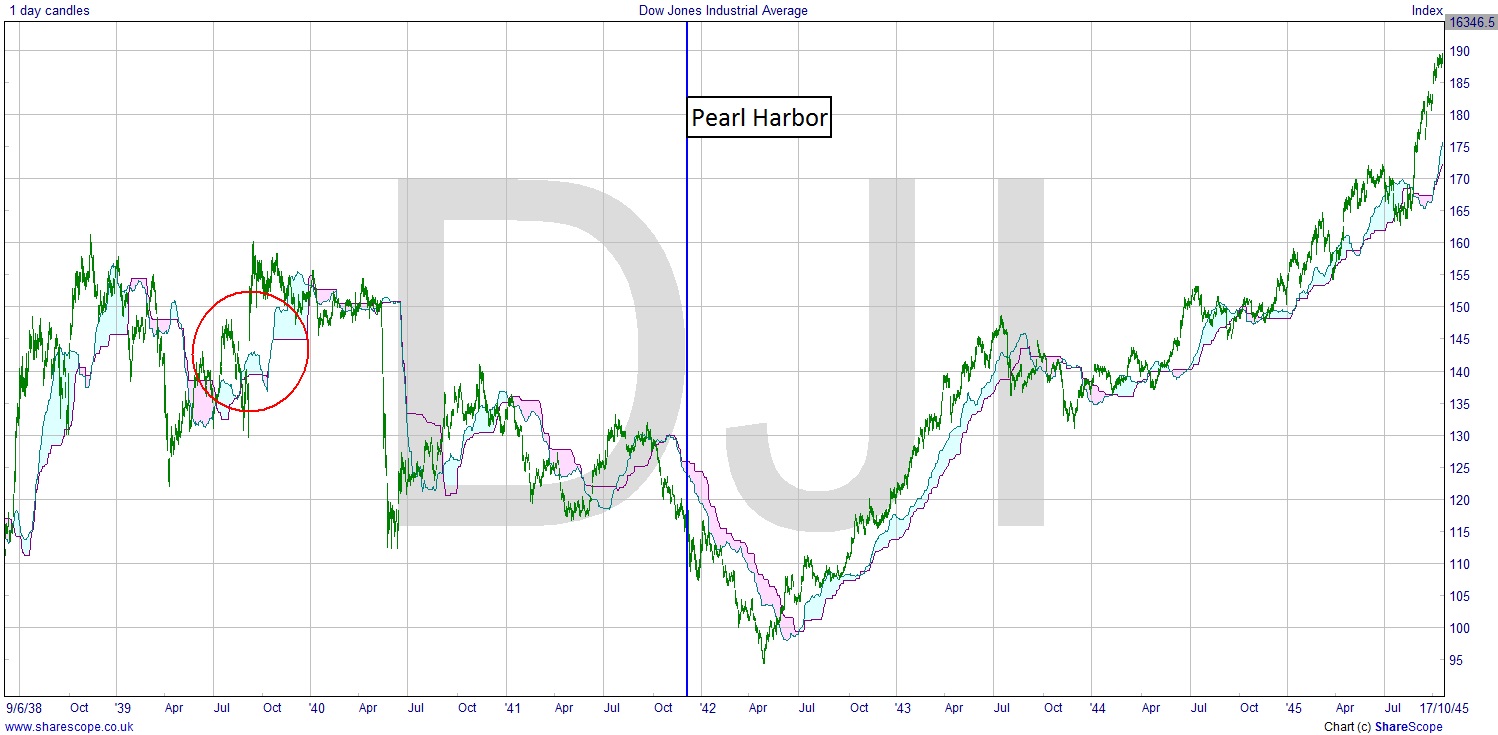

These are just attacks though. Surely there would be more of a reaction if a war broke out. I looked at the Dow during WW2. Pearl Harbor happened when the market was in decline anyway, but it didn’t buck the steady downward trend very much. The interesting thing is what happened when Britain declared war on Germany in 1939. I’ve circled it so it’s easy to see. That gap up, that’s the first trading day after the declaration of war! A few months after Pearl Harbor and the US involvement in the war the Dow had rallied to recover the value lost since 1938/9.

So is there anything we can gain from this? Yes. Firstly, markets are often counter-intuitive. But the main point to pick up on is that the markets exist outside of the political world to a greater degree. We’re in the business of seeking opportunities for price corrections and new normals. Since we don’t mind which direction markets are moving, it doesn’t really matter what’s going on. And certainly markets are no observers of political correctness. They don’t go down as a mark of respect for the dead!

As it’s a new year, one thing I can say is that I expect there to be much more civil unrest in Europe in the coming year. The pressure cooker of the former Yugoslavia could blow at any time – probably around Kosovo. Greece is still in disarray after the financial crisis. Turkey’s President Erdogan said he wants to model Turkey more on his all time fave regime: their erstwhile ally, Hitler’s Germany. Turkey has the bargaining chip by taking refugees and heading them off on their way here. Perhaps the subtext is if we don’t let them join the EU, then they’ll march into Greece, Hitler style, just like they did with Northern Cyprus. Erdogan’s storm troopers are presently gaining experience in the East against ISIS, or Douche Bag, or whatever they’re called this week. I expect any elections to swing to the right. And of course we’ve a US presidential this year. There could even be some action in the Orient as China seeks to lay claim to all the disputed islands within its reach. Not to mention some they’ve made themselves. All of that says roller coaster to me. A year of opportunity awaits…

Just stick to the Technical Analysis and everything else will take care of itself. News is noise. There’s that great quote by American newspaper publisher, William Randolph Hearst: “News is something somebody doesn’t want printed; all else is advertising.” From company results to new alcohol limits, something else to remember when you’re next lying to your doctor about your lifestyle, it’s all noise. The only real news is natural disasters and genuine surprises. But they’ve got to be pretty big surprises, as we now know that even declarations of war don’t have much influence over stock prices in the big scheme of things.

In a future article I shall look at how to make profits in times of natural and other disasters. (It’s only morally wrong if you actually caused the disaster, by the way.) There was a couple taking a selfie with that Dubai hotel inferno way in the background. Bit of a hoo-ha about it being the “most inappropriate selfie ever”. Incidentally, I always hate statements with the word “ever” in them. Seriously though, it’s a photo. Rubber-necking is a recognised career path in the US, from ambulance chasing lawyers to news choppers. Our desire for news ruins lives, not the odd selfie in arguably poor taste.

Comments (0)