Big Trouble in Little China

The European crisis appears to have abated for now. Markets seem to be seeing the latest agreement for what it is – a very fragile compromise that could blow up at any step. As such, we have not seen a significant relief rally in the euro just yet.

One reason for this is the continued dominance of the US dollar. In part this is down to expectations for a US interest rate hike coming sooner than expected. There is another reason though, as highlighted in the small hours of this morning.

China.

The prospect of a Chinese slowdown has been a shadow cast over markets over recent years, but more recently an eastern slump has been fast approaching on the event horizon.

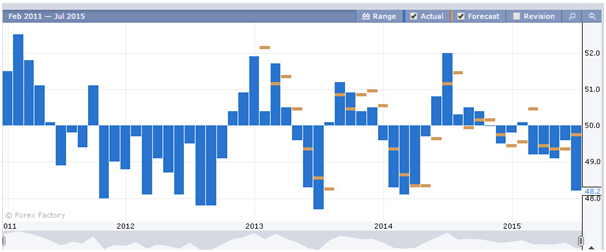

The chart below shows Markit Flash Manufacturing PMI data from 2011.

In recent months there has been a sustained slump in activity, with July data crashing well below estimates to post its biggest decline since March 2014. With lower Chinese activity comes a reduced demand for raw materials and commodities as the great building site in the East switches off.

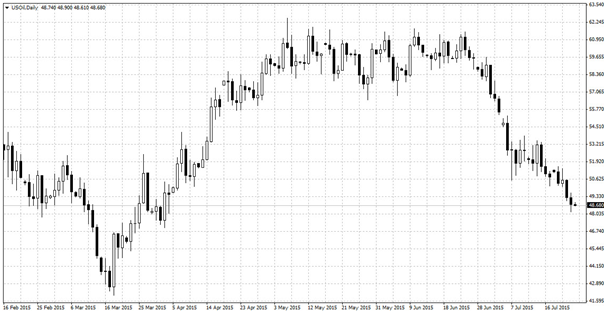

Oil Prices

It is no coincidence then, that oil prices are also slumping to levels not seen since March of this year. Lower Chinese output is just one of the reasons for the sustained slump in oil prices, but it certainly has been a driving factor through the summer.

Commodity-heavy currencies have had a rough time, particularly the Canadian dollar as the tar sands struggle to make economic sense in the low oil environment.

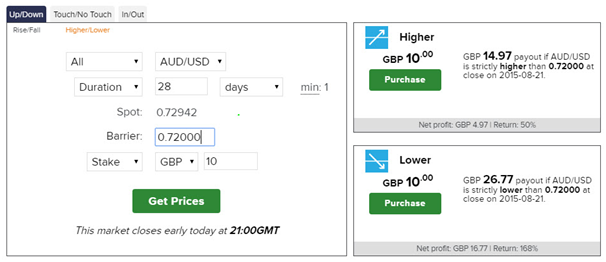

The Australian dollar has for some time been a proxy play on China, with its heavy reliance on commodity exports to fuel the previously booming economy. Recently, the Aussie has been hit hard by a double punch of lower general commodity prices and a waterfall plunge in gold prices this week.

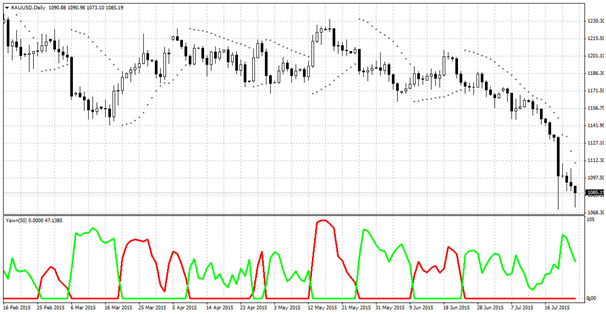

Gold prices

To highlight the strong correlation between the Australian dollar and commodities, the chart below shows the Goldman Sachs Commodity Index (orange) indexed with the Australian dollar (blue).

Even if commodity prices were to recovery in the short term, the longer term damage to the Australian dollar is already plain to see. Until we see a sustained recovery in oil prices, we’re unlikely to see any positive movement in the Aussie.

Added to this equation is the fact that the US dollar is once again dominating currency movements with a rate hike fast approaching. Even if the Australian economy found a stable footing, the strength of the US dollar could still ensure further downside for the AUD/USD pairing.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)