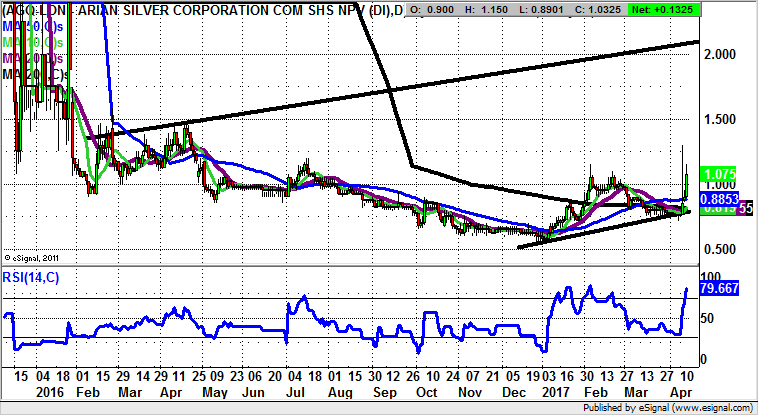

Arian Silver: 2016 price channel target at 2p

As I have been reliably informed that Silver plays are a better play on precious metals than Gold, it seems correct to take a look at the recent recovery in a leading mining minnow.

For me, the case for Lithium has always been based on how many of us are driving electric cars. This may be deliberately ignoring the other uses for the metal in batteries, but the first Lithium “Gold Rush” a couple of years back was definitely based on the idea of electric cars ruling the world. Instead, what we have seen so far is shares of Tesla (TSLA) taking over Ford (F).

However, we do seem to be in Lithium 2.0 where it has once again become the buzzword. Companies like Arian Silver Corporation (AGQ) who announce they are entering this space are amply rewarded in share price terms, which can be seen on the daily chart where there has been a bear trap rebound from below the 200 day moving average at 0.8p this week.

The implication is that, provided there is no weekly close back below the 200 day line, we could be treated to significant further upside here. The favoured destination at this point over the next 2-3 months is regarded as being the top of a rising trend channel from the beginning of last year which is currently pointing to 2p.

Comments (0)