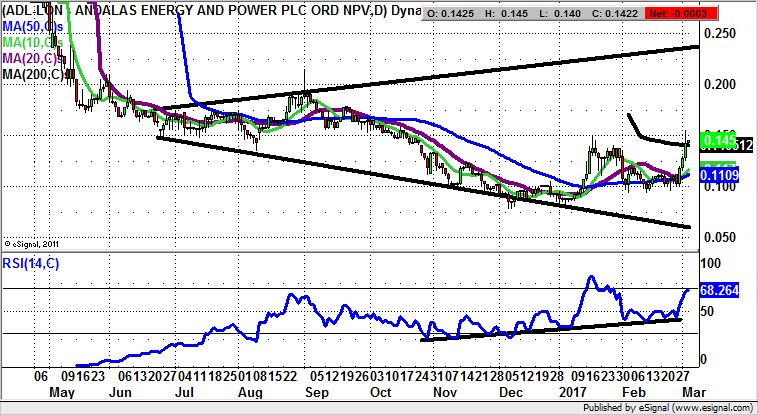

Andalas Energy: Winning the battle with the 200 day line

I am half thinking of starting a series with the title, “You know we are really in a mega bull market for stocks when… is rallying”.

There are green flags and red flags when it comes to whether a small cap company is one worth investing in or not. A frugal management, visibility of earnings and cashflow are the conventional plus points. Big cash burn and an executive lifestyle are clearly something to avoid.

However, I may have found a new issue – a CEO with an earring. This is what I saw a couple of years back with the company now known as Andalas Energy (LON:ADL). Call me old fashioned, but even well into the 21st century, a CEO with a suit and tie is still the norm, even if Mark Zuckerberg and the Silicon Valley brigade are trying to change things.

But getting back to the teaser for this article, many of us will have noticed that over the past couple of months almost any small cap worth its salt – and even some that are not – is on the up. In the case of Andalas Energy it can be seen how the great turnaround started in December with a deep probe below 0.10p.

Since then we have been treated to several narrow dips below this key level, but this week it would appear we are close to a trend changing clearance of the 200 day moving average. If this can be achieved this/next week, the long awaited promise of a 0.25p zone target could be on the cards over the next 1-2 months.

Comments (0)