Amur Minerals: ‘Golden cross’ buy signal approaching

Amur Minerals (LON:AMC) was a hero stock for private investors in the first half of last year, moving from below 10p to over 40p in ultra quick time. They will be hoping that history repeats itself going into 2017.

I interviewed Robin Young, the CEO of Amur Minerals, a month ago, and he stated that the Siberia focused mining company is at an inflection point. On a fundamental perspective this was a correct call in the sense that just a few days prior, the company had signed a memorandum of understanding with major Chinese Nickel player Jinchuan.

This seemed to be enough in its own right to put a lasting floor under Amur’s share price, after the sharp losses from over 40p seen at best last year. If you factor in the recent progress towards definitive feasibility, and the sign-up of a Russian advisory service for financing, Amur Minerals certainly appears to be set fair from a fundamentals perspective.

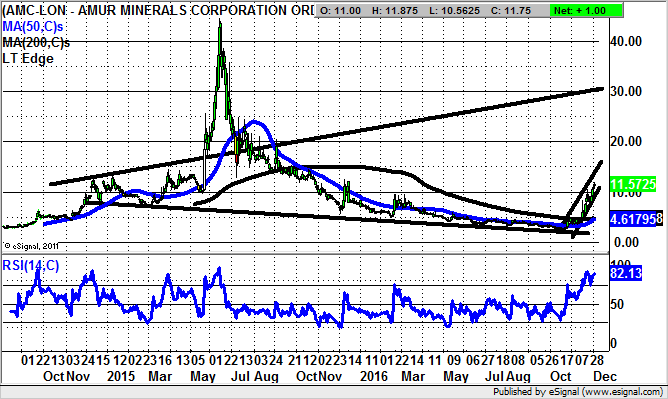

Indeed, things are looking quite chirpy from a charting view as well. After recent sharp share price gains we see the stock in the run-up to a likely golden cross buy signal between the 50 day and 200 day moving averages. They currently lie at just above 4.6p and should continue to guide the stock higher.

Just how high is suggested by the top of a wide triangle formation in place since the start of 2015. The implied technical target on this would be as high as the one year resistance line projection at 30p, a destination expected to be hit as soon as the beginning of February.

Comments (0)