AIM Stocks Winners: Avanti Communications, Blinkx, Optimal Payments

I have to confess that it is difficult for me to resist taking a look at the best of the recent bunch of AIM stocks on a weekly basis for Master Investor Magazine, if only to prove that while this part of the market may have some Wild West characteristics, this makes it all the more compelling. In terms of the stocks we are looking at today, it can be said that for traders and investors alike it is probable that they would have to force themselves not to get on the momentum bandwagon of the price action. At the same time, all three of the plays have made headlines in this section of the market as bloggers and analysts fight over the correct valuations/stance.

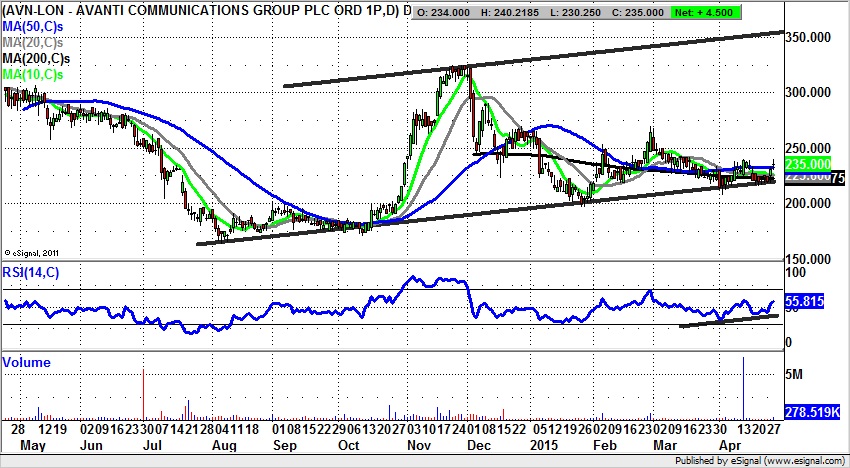

A good example of a company which has divided the market right down the middle is satellite communications group Avanti (AVN). This seems to be a situation where although I am biased to the upside, the issue of cash burn seems to be a concern for some. Looking at the daily chart it can be seen how it is possible to draw a wide rising trend channel in place since September. The best description of the price action in the recent past, especially the past month, is that the stock has been bumping along the bottom of the channel. This has its floor currently running level with the 200 day moving average at 222p, a feature which can be said to provide “double” notional support for the stock. The view at this point is that as little as an end of day close back above the April intraday resistance at 240p should be enough to trigger a significant new leg to the upside. This is especially the case considering the way that the RSI now at 55 is above neutral 50 and hence a leading indicator on a new leg to the upside. The favoured initial target during May is regarded as being the former February peak at 269.65p.

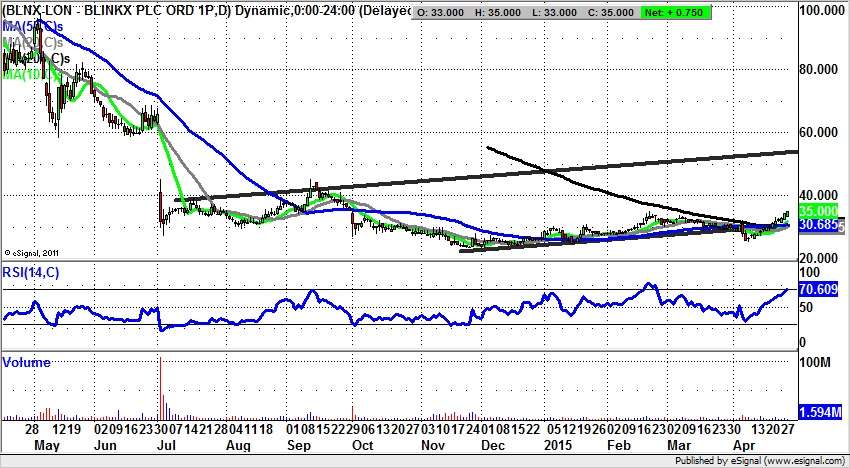

Next up is one of the more controversial stocks on AIM, largely due to the intervention of Associate Harvard Professor Ben Edelman. It cannot be denied that our high achieving friend did the business for the bear here, but the issue now is whether the stock remains in terminal decline, or is actually going to be able to stage a lasting recovery. What can be said currently for blinkx (BLNX) is that as little as a weekly close back above the neckline resistance of 35p from February on the daily chart could deliver a follow on move within a rising trend channel from July last year. Indeed, it could be that the implied 50p plus target is hit anyway over the next 1-2 months, especially while there is no break back below the 200 day moving average now at 30p.

As far as the present position of Optimal Payments (OPAY) is concerned it can be seen how we are trading in the aftermath of an unfilled gap to the upside through the 200 day moving average, one of the classic bullish configurations. The fact that the gap remains unfilled suggests that there could still be further significant upside. The expectation now is that especially while the 20 day moving average at 287p remains in place as the end of day close stop loss, a journey to the top of the June 2014 rising trend channel at 390p looks likely. The timeframe on such a move is likely to be the next 4-6 weeks, helped by the recent 50 day / 200 day moving average golden cross buy signal.

Comments (0)