AIM Stocks Momentum Plays: Clinigen, GW Pharma, Ithaca

While some may find that life on AIM can be a little rocky at times, my take on the best way to flourish in this particular space is to focus on situations where the market has already got the bit between its teeth – momentum plays. This may mean that one is focusing on the technical side, rather than the fundamentals, but going with the flow/trend is a form of investing which has historically proved to be effective, or at least simple. Of course, the trick here is not to be shy in terms of pulling the plug on a position if the money management parameters set when the stock was bought suddenly change.

We kick off with a solid looking contender which comes in the form of Clinigen (CLIN). Here it can be seen how the stock kick started an extended bull run with an as yet unfilled gap to the upside in August. Since then we have witnessed an as yet untested break of the key 200 day moving average now at 488p, something which suggests that we are looking at an exceptionally robust bull run, one for which the post November consolidation between 480p – 580p should break convincingly to the upside. The favoured scenario at this stage is that while there is no end of day close back below the 10 day moving average at 552p, the upside here could be as great as the August price channel top at 700p over the next 1-2 months. Any dips towards the 10 day line in the interim are regarded as a buy opportunity on a technical basis.

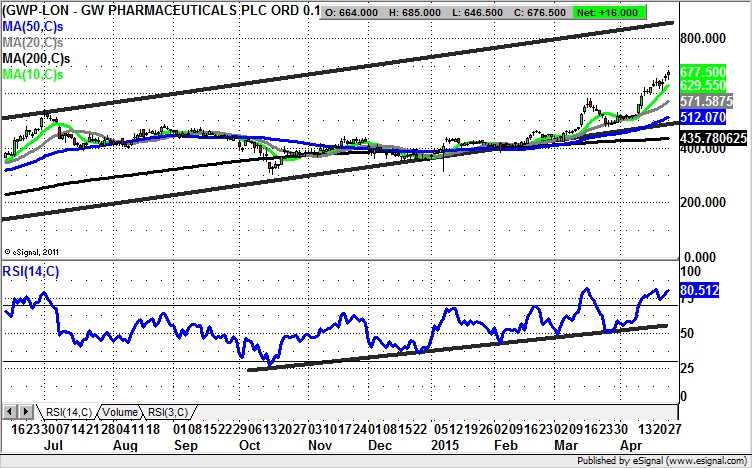

GW Pharma (GWP) was certainly one of last year’s big AIM winners, especially in the first half of the year. That said it can be seen how over H2 2014 and going into March this year the stock was clearly in consolidation mode. Luckily for the bulls it now appears some of the old bullish form is back in play. This is said in the wake of a decent break to the upside through the former initial 2015 resistance/March peak. The chances are now that while there is no end of day close back below the 10 day moving average – now at 629p – we shall be treated to further gains towards the top of a rising trend channel in place since March last year with its resistance line projection currently heading as high as 820p. This target could be hit as soon as the end of May, with the implied stop loss back below the 10 day line. Only cautious traders would wait on any dips towards the 10 day line so as to cool off the current overbought RSI through the 80 level.

Finally, Ithaca Energy (IAE) appears to have captured the imagination of private investors on a fundamental basis of late, although it has to be admitted that the real excitement here may be technically driven. This is because the recent recovery has been served up in the wake of an unfilled gap to the upside through the 40p level earlier this month. The presence of this feature as well as the way that we have notional support towards the 50 day moving average at 44.75p all goes to suggest that the present consolidation could be of the mid move variety. Indeed, while there is no end of day close back below the 50 day line, the implied best case scenario target is seen as being the top of a rising December price channel at 85p over the next 1-2 months.

Comments (0)