Uru Metals: Broadening triangle targets as high as 3p

It may just be me, but it does appear that there are several saucer formation stocks around in the small caps space currently. One of the flavours of the month is Uru Metals (LON:URU).

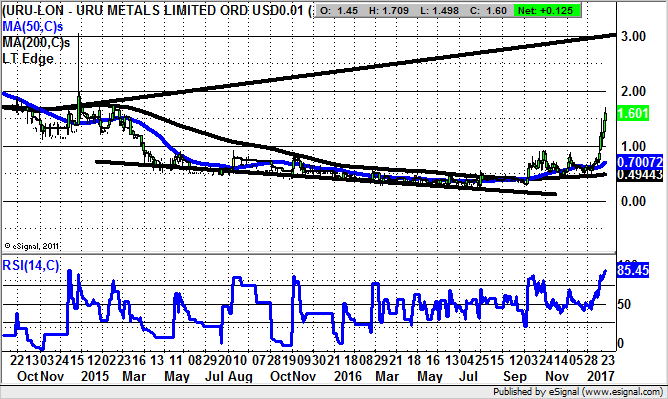

What can be seen on the daily chart of Uru Metals amounts to a classic extended share price turnaround situation. This comes on top of the fact that on a fundamental basis the market has been rather more friendly towards mining stocks as a whole since the beginning of last year.

It can be seen here that the big breakthrough in terms of price action did not occur until September last year, when there was a break back above the 50 day and 200 day moving averages, coinciding with a golden cross buy signal. Clearly, this was a signal which worked well, and arguably more smoothly in this instance than we normally see.

The newsflow which accompanied this centred on the company’s Zebediela Project and the better outlook for Nickel prices since the Trump infrastructure trade began in November. For the start of 2017 we have been treated to a £770,000 placing and director share buying at the same price as the placing – something which is rather refreshing, if nothing else.

As for what comes next, we are looking at an overbought situation, with the hope that support may come in well above the former 1p resistance. While this is the case, the top of the 2015 triangle target is the 3p zone, which could be achieved over the next 2-3 months.

Comments (0)