A Peaceful Summer for Equities?

The inability of the FED to hike rates is turning into a chronic disease. Each time the central bank becomes more hawkish in anticipation of a hike, something happens to erode the prospects for even the smallest hike. Since the time of Ben Bernanke, the FED has been putting too much stock in the market’s reaction to a change in interest rates. The momentum for a hike has been lost, as the latest economic data is unfavourable, as is a series of political developments. In my view, we won’t see any rate hikes at least until September and we are poised for a quiet summer, during which there is some upside potential for equities.

A central bank must always be prepared to face some fierce opposition to its actions, as it will always be unable to satisfy on all fronts. When asking a saver about what he thinks about the interest rate level, the saver would always ask for more; if asking a shareholder about the same, the shareholder would urge for a move in the exact opposite direction. The central bank must be able to manage these conflicts and, in particular, never spend too much ammunition unnecessarily. Just prior to the end of quantitative easing (version 3), Ben Bernanke had a chance to hike interest rates by 25bps and open the road for subsequent increases. By then, the economy was enjoying momentum, and rate hikes of about 50 bps per year were possible. At the end of this year, rates could have been between 2% to 3%, which would be more than enough for now and would have provided some cushion for the FED to deal with future crises.

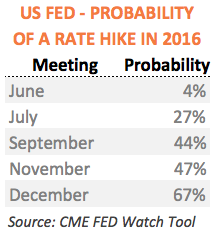

But, unfortunately, one way or another, the FED delayed the rate hike for too long, and created such a stigma around it that when it finally hiked its key rate by just 25bps in December, it was enough to send commodities prices spiralling downward while the dollar shot in the opposite direction. By then the FED was busy convincing everyone that four rate hikes were on the cards; but six months later, the FED hasn’t been able to hike even once. Investors have been downplaying the probability of a rate hike occurring this year from an almost certainty to a 67% probability. One month ago everyone was expecting a June hike; today, the odds for that happening are just 4%. And, in my view, investors are quite right. The atmosphere is such that it would be suicidal to hike rates in June just prior to the Brexit vote and after a sluggish GDP growth figure has been reported.

The Minutes released by the FOMC in May 18 (relating to its April meeting) showed a hawkish and determined central bank poised to hike its key rate as early as June. But credibility was quickly lost as soon as the first estimate for first-quarter GDP pointed towards sluggish 0.5% growth. In the meantime this number has been improved to 0.8% through a second estimate, but the pace is still well below what would be considered healthy. With the final numbers coming in at the end of July, the FED would never press the hike button before its July meeting. Even in July, and keeping in mind these numbers aren’t likely to be revised significantly higher, the final reading would still be insufficient to convince the FED. With the low-liquidity month of August and a Presidential election in the horizon, the FED would rather avoid generating a turbulent summer similar to that of 2011, when the S&P ratings agency downgraded US debt.

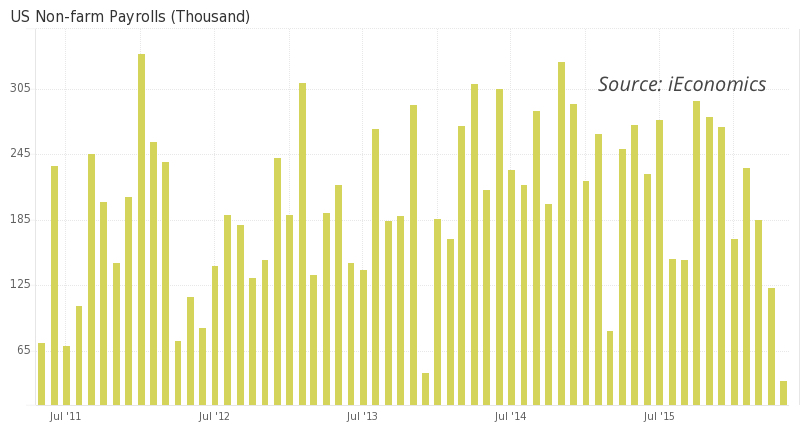

Also contributing to Yellen’s headache is the latest non-farm payrolls report. The US economy added 38,000 jobs in May, which is a miserable figure and significantly below an expected 160,000. While many may consider this number as an outlier, we can’t ignore the fact that payrolls have been declining for the last three months in a row. From 233,000 in February, payrolls decreased to 186,000 in March, to 123,000 in April and finally to 38,000 in May. It may not be reason for panic but it certainly is a thorn in Yellen’s side.

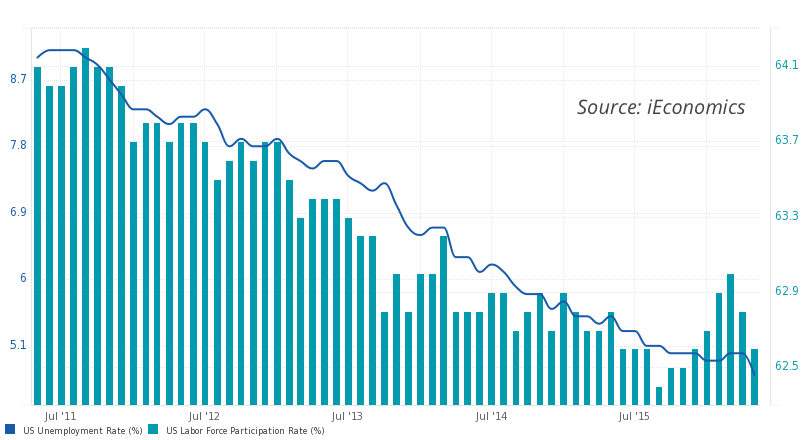

The payrolls report last Friday also came with the positive news that the jobless rate decreased to 4.7%. But, unfortunately, the drop in the jobless rate has been more a consequence of a long-term decline in the labour force participation rate than the result of job creation, as I explain in my recent blog “A June Rate Hike at the FED?”.

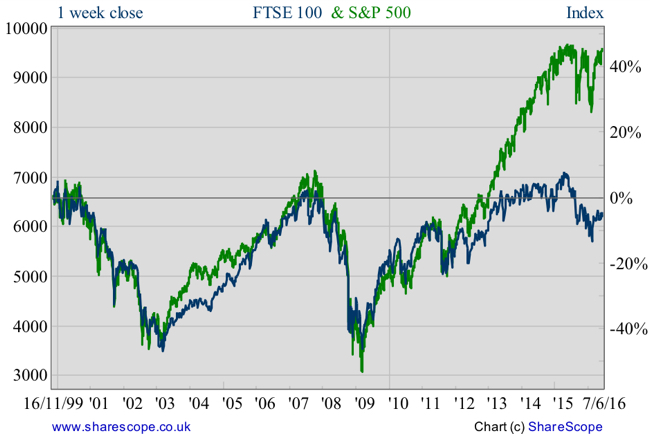

But bad news is good news. The decreasing likelihood of a rate hike means that gold, commodities, emerging markets, and some equities elsewhere may do rather well, at least through the summer. In recent blogs I have been advocating long positions in energy and gold (pg. 58-63); a position in favour of the yen and the AUD; a short against the USD in general; and a short (or close of existing positions) against the S&P 500 and the GBP, as a way of obtaining protection against existing risk factors. I still believe in the downside of the dollar (in particular against the AUD as the Australian economy accelerates, but also against other currencies); I still believe in gold and energy; and I believe the FTSE has some upside potential right now. The uncertainty around the Brexit and rate hikes led the FTSE lower from above 7,000 points one year ago to the current 6,295. But, as the odds for rate hikes decrease and the Brexit referendum date is fast approaching, the volatility impact on the index is declining. The basic materials industry is due a recovery and will help boost the FTSE towards 7,000 again. While I now believe the S&P 500 may positively benefit from the same, I see this index as being way overvalued and thus prefer to be out. The following chart says a lot about it…

Regarding Europe, well… it’s a hell of a mess out there so it seems very unclear to me how stocks are benefitting from the ECB. The FTSE still seems the best candidate for me.

Comments (0)