A June Rate Hike at the FED?

Over the last week much ink has been spent in trying to pinpoint the Fed’s next policy moves from a meticulous analysis of April’s FOMC Minutes. But such a precision exercise seems redundant now because, only one week after the Minutes were released, the FED has already cast doubt over everything. Policymakers have been tweaking and moulding expectations over and over again through speeches and public interventions. At one point, a June hike was considered a certainty by analysts, only to later be replaced by a July hike.

Predicting what’s coming next from the FED is a tough exercise because, in my view, they really don’t yet know yet what they’re going to do next. The FED has been using communication strategies as a policy tool to change expectations because the public has been too extreme in its predictions when trying to guess the exact path of action. My view, based on what I have observed and read so far, is that the FED wants to hike rates but it is still very concerned with a few points that may not be remedied before the summer.

The FED considers the possibility of a rate hike in its June meeting but provides several clues that make it unlikely. Let me point out a few things from the Minutes that I believe are important and have not been given sufficient coverage in the press or by analysts.

Allow me to start at the end. The specific statement that heavily influenced a change in rate expectations just after the release of the FOMC Minutes on May 18 is the following:

“Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee’s 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June”

I really don’t understand the rush to sell equities just after the release. The sell-off was probably due to the many computer algos quickly seeking out keywords in the release to unfold a trading strategy. For these, the mix of “increase” and “June” in the same sentence certainly made the alarm bells ring. But us humans that need time to read and to digest, many other qualifying statements can also be found which still make a potential hike data dependent. The committee seems to be waiting for an improvement in economic activity, a strengthening of the labour market and progress in inflation. But since the FOMC meeting in April, apart from some improving housing market data, I have not seen any other data to validate the committee checks found in the above statement.

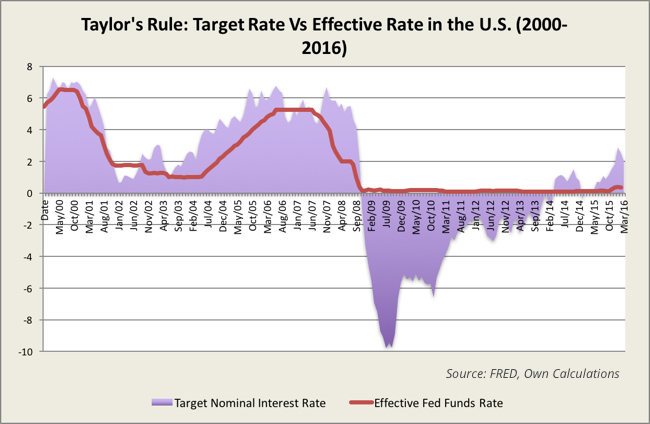

If the FED was following a rule to set its target rate, the first rate hike would have occurred in 2014. Ben Bernanke put an end to QE in 2013 and Janet Yellen should have hiked the funds rate at the beginning of 2014. Given the most recent data on inflation, employment potential and the unemployment rate, the advised nominal rate would be above 2.0%.

But we have long known that the FED doesn’t follow the Taylor rule. The central bank has been too concerned with the implications of its actions on financial markets and with the knock on effects a bearish market may have on the real economy. They clearly don’t want to hike the nominal rate as dictated by a Taylor rule, but instead they wish to wait until the economy is at full employment and inflation is near its target before hiking the rate by any sensible amount. Many claim that the job market is already at full capacity, which justifies a rate hike; but the central bank still insists in inflation being below target, in order to underline its opposition to premature action. Notwithstanding this, all those reading the Minutes became convinced of a rate hike in June.

St. Louis Fed President James Bullard further confounded investors by telling them that a June or July hike “wasn’t set in stone”, but was suggested by the labour data available. He even added that investors should not put too much weight in June, because that meeting is followed by a press conference while the July meeting isn’t. So, the FED may just hike rates whenever it intends to without any need to comment on it. Additionally, Bullard commented on GDP data, recognising that growth is below trend. That may be a thorn in the side of those FOMC members willing to hike rates sooner rather than later.

In contrast to previous minutes, this time the committee put a lot less weight on global financial conditions. The committee believes that the outlook is now balanced, but there is a clear concern about the domestic economy. The committee projects GDP to grow slightly above trend in the near future but expressed concern about the first-quarter data being so weak. They mentioned the fact that this is not the first time a first-quarter reading is weak, which may be due to measurement problems. But, still, they’re not sure about it, and thus may prefer to wait for additional data corroborating such a claim. In my view, the only piece of data that is capable of demystifying the issue is the second-quarter GDP figure, which is scheduled to be released on July 29. On May 27 and June 28, second and third estimates for first-quarter GDP will be released, but provided they come in more or less in line with the advance estimate of +0.5%, they won’t be of much use for setting monetary policy.

In addition to GDP data, the latest consumer spending and business investment data have also been weaker than expected. Some inside the committee fear there is a risk of a more persistent slowdown in both.

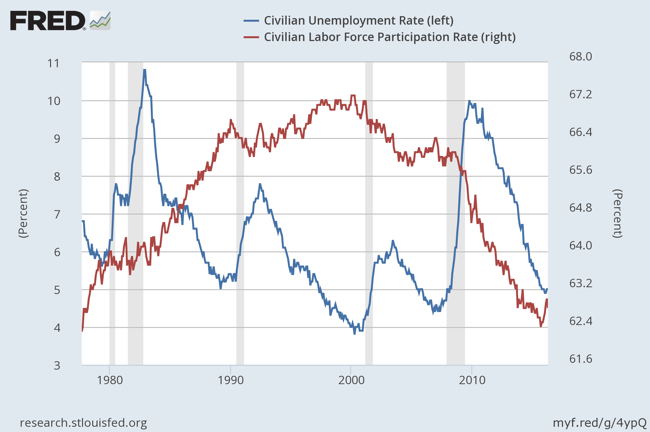

As mentioned by Bullard, the stronger part of the economy is the jobs market. With the unemployment rate now at 5.0%, there seems to be a good reason to hike interest rates. But even this thesis is easily challenged. The committee believes that the current unemployment rate is consistent with its view of full employment, but they recognise that a tighter labour market has helped to attract more people into the workforce rather than leading to inflationary pressures. This is a key point that may prevent the FED from acting now.

Before the financial crisis the labour force participation rate was around 66.5, but declined to 62.4 as people found it difficult to get a job during the crisis. Recently, as the jobs market has been improving, some people that abandoned the workforce are now being attracted to the market again. But the country has a participation rate that is near the levels of the late 1970s. Only by allowing the unemployment rate to persist at full employment levels for some time is it possible to induce a recovery in the participation rate.

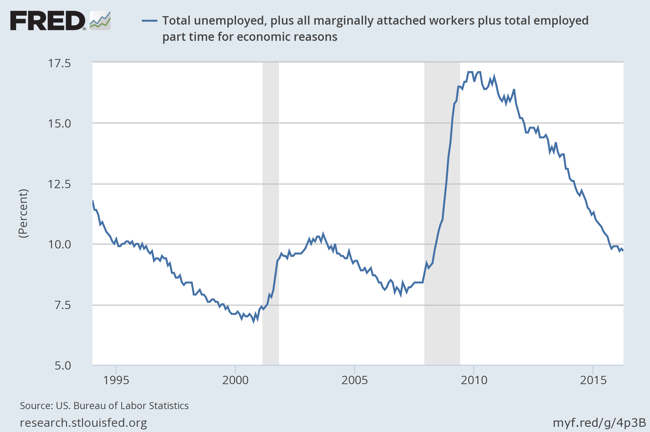

The FED knows this very well and may wish to wait until wage pressures are felt before embarking on any significant tightening. The economy seems to be operating at full employment, but the story changes dramatically when factoring in those who left the workforce during the last few years and those who are marginally attached to it (by working involuntarily on part-time jobs). The U6 measure, which attempts to account for those that are marginally attached to the workforce, still points to a 9.7% unemployment rate, while it was around 7.9% before the crisis began. Furthermore, that figure still misses the decline in the participation rate, which, if accounted for, would further increase the unemployment rate.

With all this in mind, my view is that investors should prepare for rate hikes this year, but should concentrate on the essentials instead of changing their view every day as the press digests the info and attempts to front run the FED. In just one week investors have already changed their minds several times, as policymakers play cat and mouse, and some market participants attempt to generate market volatility in their favour. The essence of the Minutes comprises the following concerns: first-quarter GDP data being so weak; the domestic energy sector having been decimated; the effect a rising dollar may have on exports; and the sluggish consumer spending and business investment. While there are no wage pressures and no broad inflation signs, the FED has no urge to embark on further rate hikes, particularly not before solving the puzzle of the aforementioned weaknesses. Until its June meeting it is very unlikely that the FED can collect enough material information to help. My long shot would be for rate hikes to not happen before September. Nevertheless a hike in July would be possible, because by then the FED will have a preliminary figure for second-quarter GDP. A June hike is unlikely.

Comments (0)