Taptica: Notional 400p technical target

Taptica (LON:TAP) came to my attention following a stock screen on VectorVest, something I keep an eye on for the best fundamental situations on the stock market. Then my charting kicks in!

Taptica has an air of 1984 about it (in a good way) in that its technology allows companies to be able track internet user behaviour, with the data sold on to the likes of Amazon, Disney, Facebook, Twitter, OpenTable and Expedia.

It is refreshing that in the case of Taptica we clearly are looking at a tech company which is not only able to monetise its business, but unlike the likes of Snap Inc, is able to do it in the here and now, and not months or even years into the future.

This point is underlined by the full-year results which showed that adjusted EBITDA grew to $25.7m ($7.4m), on revenues 66% higher at $125.9m. Followers of this column will note that this is the second company in recent days where sharp EBITDA gains have been highlighted. The last one was Venture Life (LON:VLG).

For those concerned about the balance sheet, the latest cash and bank deposits stood at $21.5m, up from $9.5m on June 30 2016 last year. There has also been a share buyback and a dividend payout, something which is rare in the growth tech space.

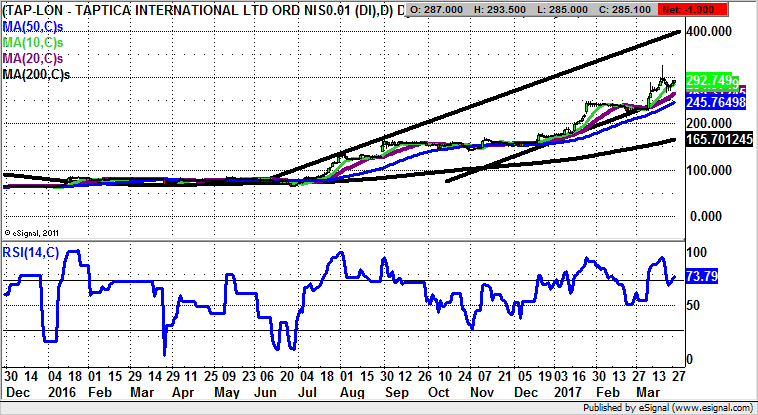

What can be seen on the daily chart is that there has been a rising trend channel in place since June last year, with the floor of the channel running level with the 50 day moving average at 242p. At least while this notional support holds the upside here could be as great as the 2016 resistance line projection at 400p over the next 3-4 months.

Comments (0)