Central Asia Metals (CAML): Small-cap copper play of choice?

Rather like the stock market analogy of profits warnings coming in threes, there is the situation where one capitulates on a stock or market just before the great turnaround arrives. This may ring true with copper – and hence miners in this area.

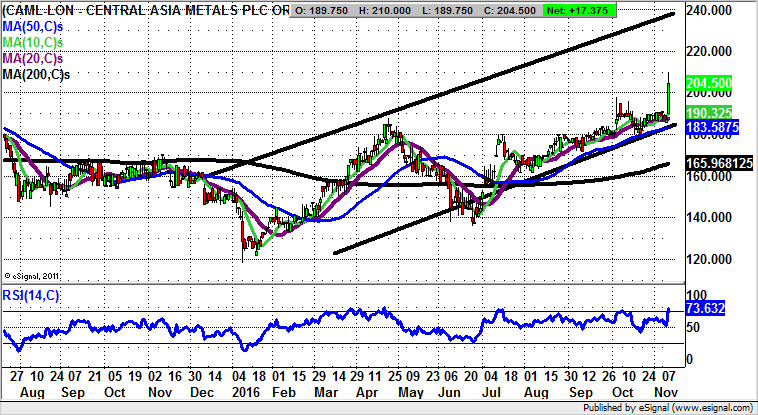

The price of copper and the share price of Central Asia Metals (LON:CAML) have been in a very positive divergence relationship, even as the price of the underlying metal was probing the lows at the beginning of this year. What helped drive confidence since then as the base building process progressed was the way that shares of Central Asia Metals started to stabilise towards February support in the 140p zone.

But perhaps the real clincher for the bulls in recent months, to remind us that this is a decent recovery stock, was the gap through the 200 day moving average at the beginning of July. Helpfully enough, the stock has not fallen below this feature now at 165p since, and there has not even been the need for a test of support towards this line.

Such breakouts are normally only seen in the most bullish of situations, and given the good news on the soaring price of copper this week one would consider the shares are very much on their way. Just how high they could stretch is suggested by the top of a rising trend channel from the turn of the year with its resistance line projection at 240p. This is a technical target which could be hit as soon as the next 1-2 months, provided the 50 day moving average, now at 183p, remains in place as support on an end of day close stop loss basis.

Comments (0)