Something for the Weekend – Coffee Sucks

I remember a joke from the ‘80s that went along the lines of: “Why don’t pixies get pregnant? Because they only go to goblin parties.” I mention that now as there is going to be a goblin coffee shop in Paddington. The Fellatio Café will open in Praed St it seems, and will be using a legal loophole, as prostitution is not illegal here but decriminalised. The first Fellatio Café is to open in Geneva, and dare I say, will open come December. Meanwhile when the London one does open, that’ll save people a walk to Sussex Gardens where all the streetwalkers are. I’m not sure what the café’s tag line is. “We spit, you swallow”, perhaps? If the idea catches on maybe they’ll open a restaurant too. The tag line for that should be “Get nosh and get noshed off”. Either way, you may be short-changed if you use contactless payment (if they offer it).

This is the first idea I’ve heard that actually might make the streets of London safer from people-traffickers and gangsters. Take prostitution mainstream and put the bad guys out of business. On the other hand I guess the public phone boxes in town will all disappear as they only serve as a shelter for prostitutes’ cards. But then who hasn’t got a mobile by now? I’m amazed there are any phone boxes left.

These cafés should bring on the public debate about prostitution which – like so many other important issues – has been avoided by the politically correct. As for the future, what other franchises might appear? Get messy messing about on the river on the “Cleveland Steamer Steamer”? It’s a free country and high time we swept away the last vestiges of Victorian puritanical tyranny. Incidentally, the Victorians may have called this café “Stiff Upper Lip”. I’m here all week.

Starbucks (NYSE:SBUX) is really the only listed coffee shop where you can target risk to coffee shops. Most of the big names here are part of larger, more diverse concerns. For example, Whitbread plc (LON:WTB) owns Costa Coffee. The principal business of Whitbread is not coffee, so therefore not much help. Starbucks on the other hand is a global brand so you’re not targeting risk to a particular region or even currency. Well them’s the breaks.

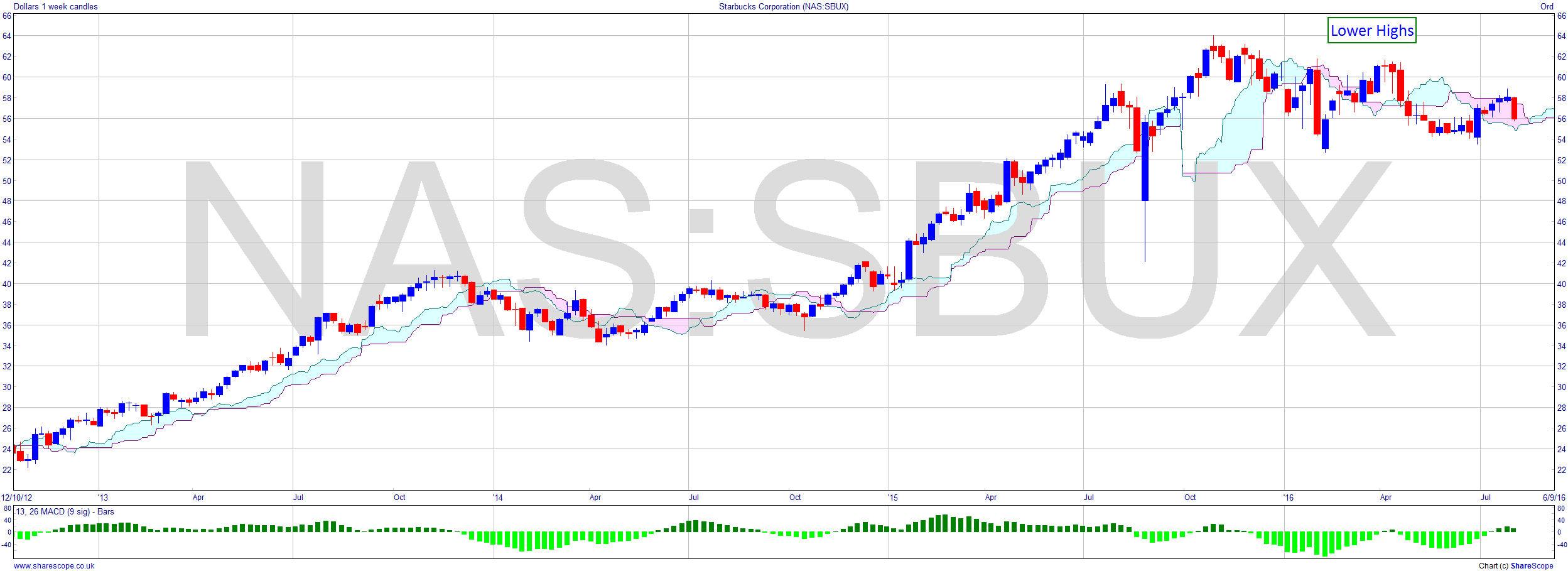

The US market has been motoring on to new highs and apparently not taking Starbucks with it. In fact Starbucks looks decidedly toppy. Does this mean coffee is going out of fashion? In the US they compete with so called energy drinks, which are basically a tin of caffeine that smells like sweet vomit. There’s even a product they’ll deliver happily to offices called 5 Hour Energy, which basically contains 4 calories and as much caffeine as a cup of “leading premium 12oz coffee”. Bizarrely they make a decaf product. Go figure, as they would say. It’s quite possible that this kind of product is taking business away from Starbucks.

Something is definitely not right though. You can hear in the Q2 guidance call Howard S. Schulz say “In Q2, Starbucks’ powerful 24,000-store global retail operation again drove record financial and operating performance, including record revenues, record profits”. So why are the shares lacklustre in a rising market? They also had “record-breaking unit sales, unit economics and return on investment”. It doesn’t add up to an overvalued stock, so there must be something we don’t know.

The weekly chart shows clearly that we’re seeing lower highs. I’d like to see lower lows to consider it in the bag, but this looks like a stock about to fail quite dramatically. The point + figure chart is much more convincing. Complete with lower lows. It points to a reversal perhaps as low as $40 from the present level of upper $50s.

If Starbucks have to add value and include sex to encourage business growth and invent a name for the brand, well that joke just writes itself.

Comments (0)