How to Play the Bounce in the Aussie

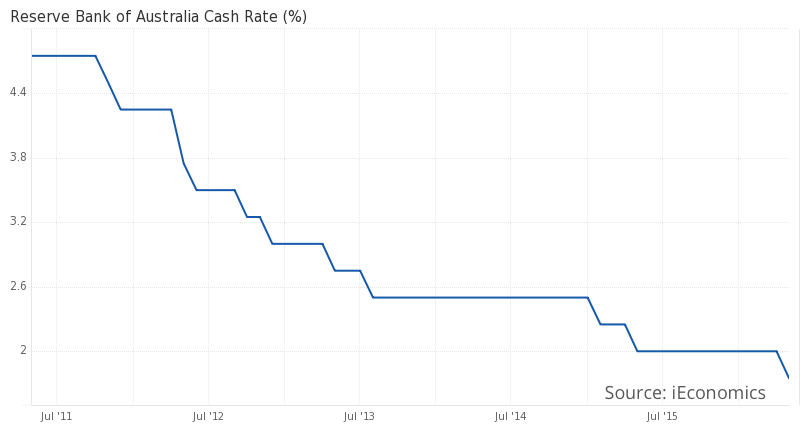

The Australian economy has been hit hard by a global decline in the demand for commodities, a fierce currency war between major central banks, and the false prospects of interest rate hikes in the US. Reflecting these deteriorating conditions, the Aussie declined from 1.10 against the US dollar in 2011 to 0.70 in 2015. But, this year, the trend seems to be inverting again, in particular because the FED has retreated from rate hikes and commodities have started recovering at an accelerating pace. On 3 May, the Reserve Bank of Australia (RBA) decided to cut is cash rate by 25 bps to a record low of 1.75% in an attempt to restore the Aussie downtrend. But, on the contrary to investors’ first impressions, such a rate cut may be the first and the last, as the latest Minutes from the RBA show disagreement between policymakers. With the likelihood of an additional rate cut in the July meeting now looking low, the Aussie uptrend may be restored for the next two months.

On 3 May, when the RBA announced a cut in its cash rate from 2% to 1.75%, it expressed some concern about the Australian economy. In its press release, the central bank pointed out that inflation pressures are lower than previously expected and that there are no significant wage pressures. Additionally, the central bank commented that the “global economy is continuing to grow, though at a slightly lower pace than earlier expected” and that “China’s growth rate moderated further in the first part of the year”.

Concern about global growth is well expressed in the RBA’s press release. For a commodity-driven economy that depends on its exports of raw materials, a global recovery is essential. During the last few years, the appetite for commodities has declined, in particular as China has been trying to transition from an infrastructure-driven economy to a consumer-oriented one, which has severely punished the commodities market, throwing almost every commodity into a bearish trend. Exports of oil, ores, precious metals, aluminum and copper, which are key to the Australian economy, were all impacted, leading to a quick deterioration of the Australian trade balance and pushing the value of the Aussie down. The bold monetary policy conducted in the US by Ben Bernanke boosted the value of the Aussie from 0.60 to 1.10 between 2008 and 2011. But as expectations for further aggressive quantitative easing were trimmed, global demand for commodities started declining, exposing past excesses in terms of investment in the sector. The necessary adjustments pushed commodities into a bear market and led the Aussie downwards.

The impact of developments in commodities markets on the Australian economy is substantial and will certainly dictate the next steps followed by the RBA. In its 3 May statement, the RBA recognises that “commodity prices have firmed noticeably from recent lows”, but, at the same time, it adds that the recent trend “follows very substantial declines over the past couple of years”. The commodities market is turning more favourable, but the rebound still seems insufficient to drive an acceleration of the economic recovery. Australia is still rebalancing following the explosive mining investment of the past and the RBA seems to be prepared to cut its cash rate further if necessary to accommodate the adjustment.

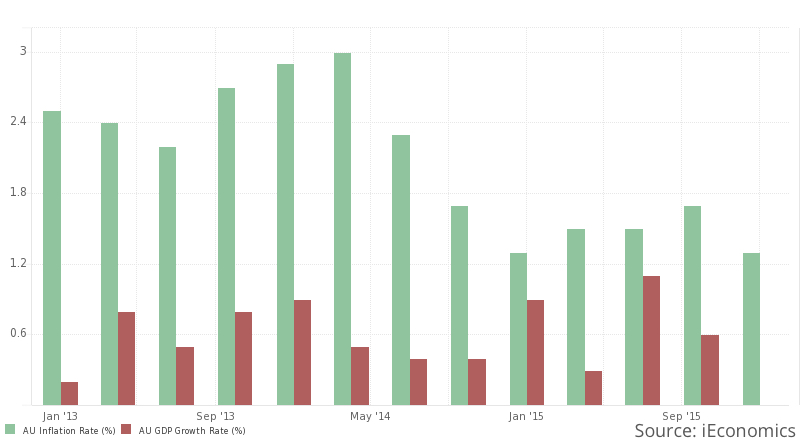

After hitting a low of 0.68 in February, the Aussie entered a new uptrend. It must be mentioned here that on 3 May the Aussie recorded one of its highest daily losses, when it tumbled 2.4% following the rate cut, but that hasn’t inverted the uptrend. The rate cut delayed the uptrend for a few days but will not be enough to reverse it, as the fundamentals keep improving. Of more importance than the cut itself is the continuing uptrend experienced by commodities which continues to press the Aussie higher. Year-to-date, oil and iron ore are up 30%, silver is up 24% and gold is up 20%. If there is a bullish asset class so far this year, it is certainly commodities, to the great benefit of any commodity-driven economy, like Australia. GDP growth and inflation have been subdued so far but still much healthier than in many developed economies. With the effect of rising commodities prices still to be reflected in GDP growth over the next few quarters, I would say the RBA will act very carefully, as there is no urge to spend ammunition at a point when the fundamentals are improving.

Today the RBA published the Minutes from its May interest rate decision. Against expectations, the rate cut was a close call. The RBA’s board considered “waiting for further information before acting”, as an alternative to cutting rates at the meeting. This observation trimmed expectations for a second rate cut in July’s meeting. Investors still expect the RBA to cut its key rate further, but have pushed back their expectations for such a cut to the August meeting.

The next important update on inflation figures will occur on 27 July, when second-quarter inflation data will be released. Until that point, nothing major will be released for the RBA to justify another rate cut. With the last rate cut having been such a close call, and with no important data to be released until the July meeting, it is unlikely that the RBA will cut rates. In my view, with more than two months until the August meeting and with commodities prices still on the recovery tack, there’s a high likelihood of the RBA further delaying any rate cut. The Australian trade balance is improving and most of the mining adjustments regarding past excesses have already been conducted. I believe that upcoming economic data will weigh on the positive side and will thus help to push the AUD/USD higher. Currently the pair trades around 0.7335 and a recovery to at least 0.7800 (a figure last seen in April) is not unlikely.

One way of playing this trend is by purchasing the AUD/USD through spread betting. An alternative way of getting leverage is by purchasing the ETFS 3x Long AUD Short USD (LAU3:LN), which is an exchange-traded currency (ETC) traded in the London Stock Exchange. This ETC tracks the MSFX Triple Long Australian Dollar Index, which aims to reflect three times the performance of a position in forward contracts rolled on a daily basis. In other words, this ETC is expected to expose you to three times the performance of the AUD/USD on a daily basis.

Comments (0)