Zak’s Daily Round-Up: BA., GSK, TSCO, GWMO, MTPH, MXO and SAV

Market Direction: Gold Back near $1,220 Support

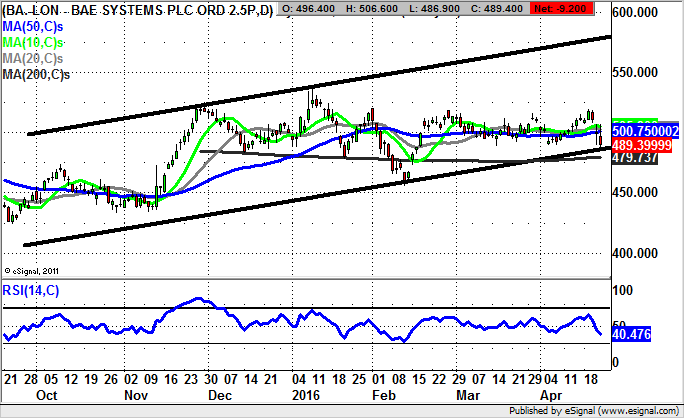

BAE Systems (BA.): Range Considerations

What can be seen on the daily chart of BAE Systems currently is the way that it is possible to draw a mildly rising trend channel from as long ago as September last year. However, even without the extra annotation it is relatively easy to see that the shares are in a range between 460p to 520p. All of this would go to suggest that with the RSI back below the neutral 50 level at 40.47, and the latest ball trap retreat for April from 500p plus, even fans of the stock would probably be looking to buy the shares at lower levels. Indeed the earliest that one would be happy to press the buy button is likely to be the 200 day moving average at 479.73p.

At least while this major charting feature remains in place, one would be taking the buy tack and be reasonably confident of an overall decline for shares of BAE over the next 1 to 2 months. At this stage outright bearishness would only be suggested by a break of the September uptrend line currently running at the 465p level. This is currently regarded as the end of day close stop loss trigger for the aerospace & defence group.

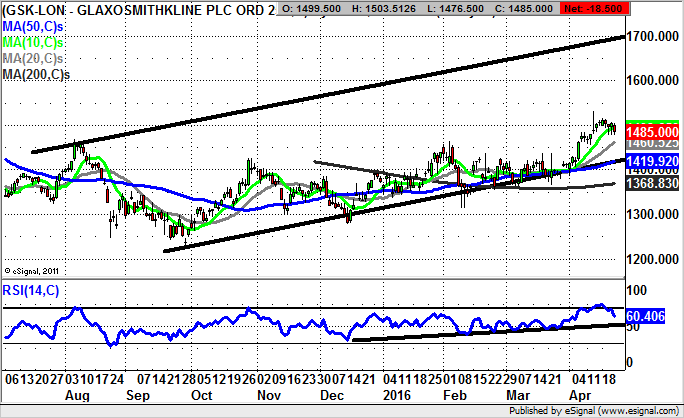

GlaxoSmithKline (GSK): 1,700p Technical Target

Depending on your fundamental perspective it can be said that over the recent past shares of GlaxoSmithKline have either been a gentle giant, or a sleeping one. But at least it can be seen on the daily chart that over the recent past, and possibly as a nod to the forthcoming departure of the long-standing CEO, we have been treated to a recovery in the share price.

This recovery has taken place within a rising trend channel which can be drawn in from as long ago as August last year. As far as the price action so far this year has been concerned, it can be seen how since the end of January the shares have been largely above the 50 day moving average currently at 1,419p. This is helpful given the way that the 50 day line ties in with the notional floor of last year’s rising trend channel, thus providing double support in this area.

On this basis from a technical perspective one would be keen to target as high as 1,700p for shares of the drugs giant .In the meantime any dips towards the 20 day moving average of 1,460p to improve the risk reward ratio of going long can be regarded as buying opportunities.

Tesco (TSCO): 200 Day Line Support

Tesco shares have been surprisingly difficult to get a handle on over the past couple of months, with this situation underlined by the way that for March the stock topped out towards the 200p level. But at least for this month it would appear that the 200 day line currently at 181p is providing decent support.

The view at this stage is that providing there is no end of day close back above the 200 day line, we should at least see a return to the top of a rising trend channel from December as high as 215p over the next 1 to 2 months.

Small Caps Focus

Great Western Mining (GWMO): 200 Day Line Clearance Targets 0.8p

It is only really been over the past couple of months that the mining sector as a whole has really got on the front foot. That said, at least what we see at the moment for this stock is the way that there has been a rebound off the area of the 200 day moving average at 0.42p at the end of last week, which is something that suggests a lasting turnaround could be on its way.

It also helps that the latest support zone was former early 2016 resistance. Therefore progress within a wide rising trend channel looks to be on tap, with the favoured destination over the 1 to 2 months being as high as an August resistance line projection at 0.8p. At this stage only sustained price action back below the floor of the 2015 price channel/50 day moving average at 0.37p would really upset the recovery argument.

Midatech Pharma (MTPH): 225p on Technical Radar

Midatech Pharma shares have been on the radar for a potential recovery for much of the past month. This was initially the case given the bear trap rebound from below the former December support at 150p. Since then there has been a December resistance line break just above the 150p zone, followed by tests for support in the past week at this level.

The view at the moment is that enough work has been done by the Bulls to get Midatech moving on a sustained recovery. At this stage only an end of day close back below the 50 day moving average of 162.6p would really even begin to delay the prospect of a 1 to 2 month timeframe target as high as 225p, the present position of the 200 day moving average.

MX Oil (MXO): Basing Continues

MX Oil is a stock situation which has fascinated investors over the past year, and looks as though it will continue to do so. At least from the perspective of the Bull camp it would appear to be the case that the latest recovery for the shares from the 0.6p level has been as persistent as it has been welcome. This is because at current levels the stock has snapped a falling wedge on the daily chart from December, with the message at the moment being that providing we remain above the wedge resistance line at 0.8p, a journey towards former February resistance at 1.3p plus could be on the cards over the next 2 to 4 weeks.

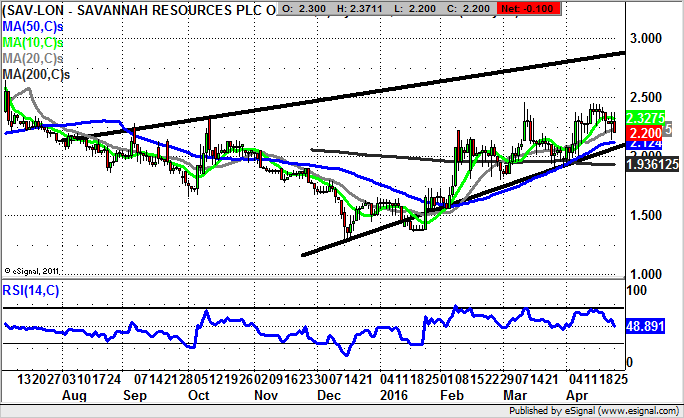

Savannah Resources (SAV): 2.9p August Resistance Line

It would appear that shares of Savannah Resources are another example of a former private investor favourite which is finally starting to come good in 2016, given the overall recovery in the mining sector. The position currently is that we see support coming in towards the 50 day moving average at 2.12p, with this regarded as the buying zone for the stock. Indeed, the view is that while there is no break back below the 20 day moving average at 1.93p, the upside here over the next month could be as great as an August resistance line projection at 2.9p.

Comments (0)