Moron Uncertainty

A sunny spring day today as I write, the 80-odd ladybirds that took refuge in my office last autumn are waking and flying around. It makes me think Wimbledon isn’t far off and then it’ll be winter again. Carpe diem! Here in the UK, one of the few luxuries afforded by the copious amounts of money we pay in TV licence fees is to watch some sporting events, like Wimbledon, without commercial breaks interrupting your enjoyment. Sports presenters have been a rich source of amusement over the years and there was a classic a few years ago when Henman was still playing. Actually it was a BBC London news article, and they showed some footage of him in the opening sequence then came out with the wonderful line “moron tennis player Time Henman later”. Well that’s what I heard. And that’s the problem with homophones, which at least I don’t have as a journalist! For the written word though, “potato, potato” is rather meaningless.

I wrote about uncertainty last week and it really is one of the best things that news media does for us as private investors: create volatility and trading opportunities. I like the cool Scandinavian detachment from sensationalism. There was an earthquake in Northern Sweden at the weekend. The statement from the Swedish National Seismic Network was that the quake zone “has relatively high seismic activity but has not experienced a quake of this size in the last 100 years.” So matter-of-fact. Either side of that you have the west, where we tend to sensationalise everything, or at least the media does, and orient, where they tend to understate dangerous things like Fukushima. Sensationalism to sell news versus denial to save face. Each is a reaction inappropriate to the facts.

Luckily for us market infrastructure makes income mainly through volume. Volume is created by uncertainty and most of that uncertainty is manufactured. Fears about oil prices, for example. $27 oil was obviously low, the trick is not to panic, but to identify opportunities and trade them. If we have fear as traders especially, but investors also, we will lose. There’s a great phrase to remember: “scared money never wins”. I’m going off absolutes because there are always exceptions (sic) but an asterisk and a qualifying statement aren’t really popular in your everyday adage.

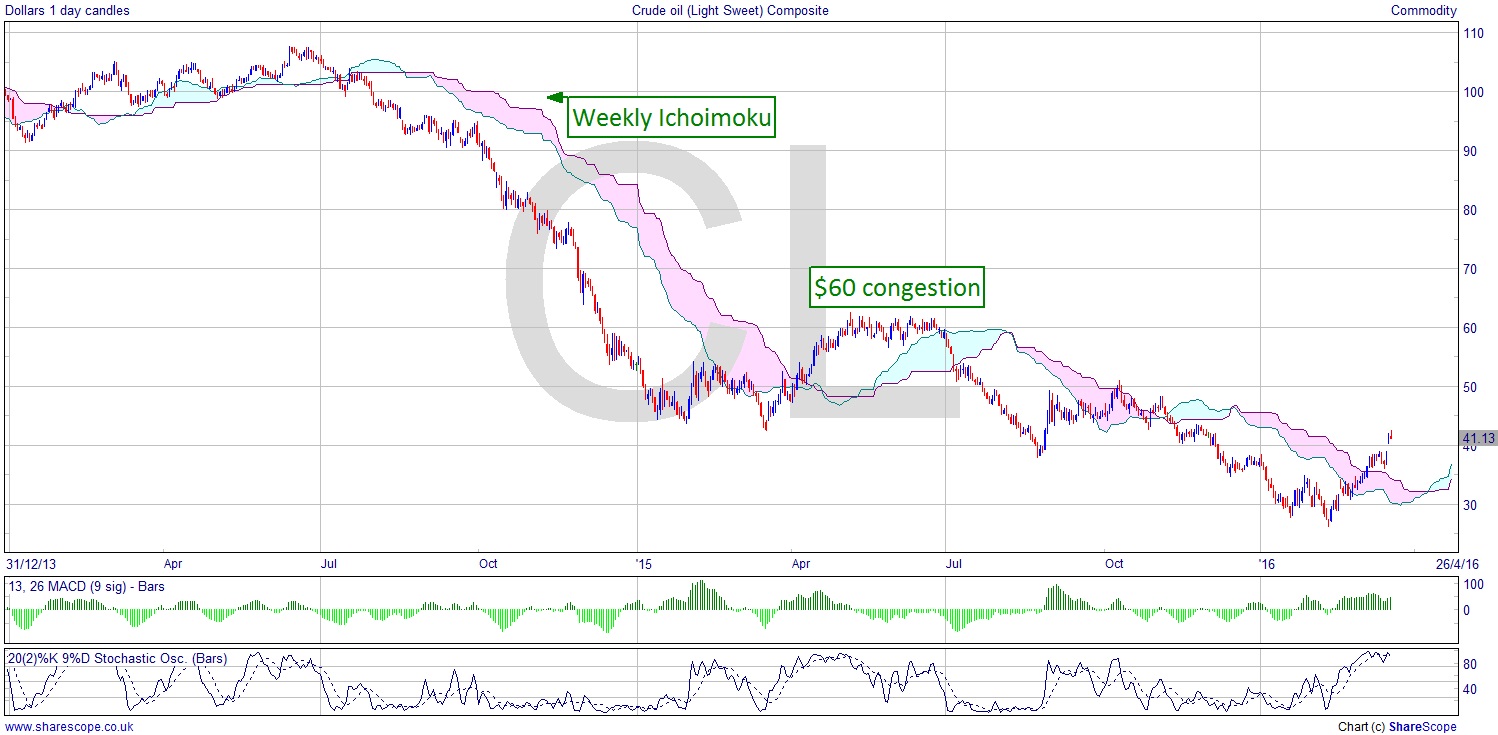

I’m just throwing out some old newspapers and one leads with a story the first week of February about banks falling because of fears over oil prices. What use is that to anyone? We cannot trade the past. It’s the one thing we can’t do. By the time oil prices were $27 you know most of the damage is done on the downside. There must be pressure on an upwards move, and of course here we are just a few weeks later with oil at $40 [NYMEX:CL]. The story shouldn’t have been about bank shares falling but some analysis of when they, and oil, might rise. That said, since we can ride the wave of media induced fear, we should be happy that they don’t tell people how to trade these opportunities, as if everyone knew there wouldn’t be any profits to speak of for any of us. And remember, once it’s in the paper, or on the telly, it’s common knowledge and your only carriage is likely to be a bandwagon.

So where are we with oil? Still waiting for a weekly higher low to reinforce a trend change, but the daily has produced a couple. What do we know about supply? Well the one thing we can say is the most likely scenario is that it will remain volatile in the next few years. If the price goes up and stays up, then more and more supplies will come back online. We’re moving into summer for most of the world (i.e. the northern hemisphere) now, so demand, being seasonal, will be falling – not a punch that suppliers are likely to lean into.

The daily chart shows a higher low above the weekly cloud, which is the first really bullish signal since the short-lived rally last April. There’s a huge amount of resistance at $60 on this chart so it’s a likely flash point as the price rises. There was congestion around $60 for around three months last spring, pointing to a rally perhaps in part stalled by the fall of demand in summer. A pullback on the daily could create the higher low on the weekly which would underpin that rally to $60. Incidentally it’s a useful thing to use the weekly Ichimoku cloud on the daily chart if you’re looking for weekly strength or weakness as it sort of kills two birds with one stone. You get a heads up before the weekly chart, but won’t miss one when and if it comes.

Comments (0)