A Wunch of Bankers and TV Winners

Two profit announcements today that are quite interesting…

First off: Barclays (BARC). I wrote about banks in my blog of July 16th. Barclays did reasonably well out of the collapse of Lehman Brothers. They picked up Lehman assets for a song and sold them in the last reporting period, making almost £500 million profit. The dividend is held at the same level as last year, and they have been hit by setting aside large reserves for things like mis-selling PPI. They’ve even set aside £250m for possible claims against their own bank account package. That sounds very sloppy.

On the bright side, 19,000 jobs are going, and Barclays didn’t take government hand-outs after the credit crisis, which I should imagine they’re very pleased they didn’t, as it means government has less chance to coerce them.

The concerning thing with Barclays is this: Have they really been doing well, or are they just selling some more of the family silver? The Lehman Brothers stuff, for example. They’ve made reserves which if they don’t need to use them – and they amount to over £1 billion – will be released into profit at some point. Maybe that’s the job. Keep the profits trickling in and create a story around them to make it look like they’re controlling things, rather than market conditions controlling them.

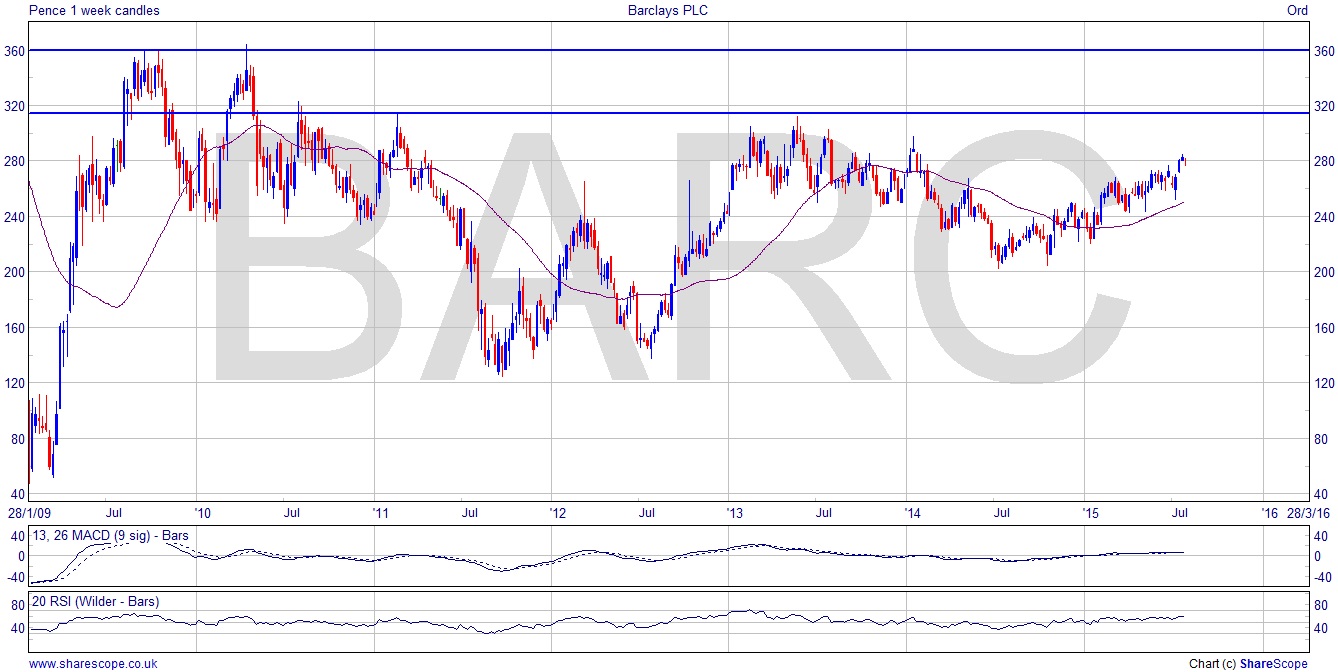

The verdict: As I said on July 16th, I don’t find the Barclays chart remarkable. Not much has changed since then. There are two resistance levels which I’ve marked. They are the biggest stumbling block initially, if they were to rise. Not a risk I like the look of. Out-of-the-money option job, for anyone who might want a punt, I would have thought.

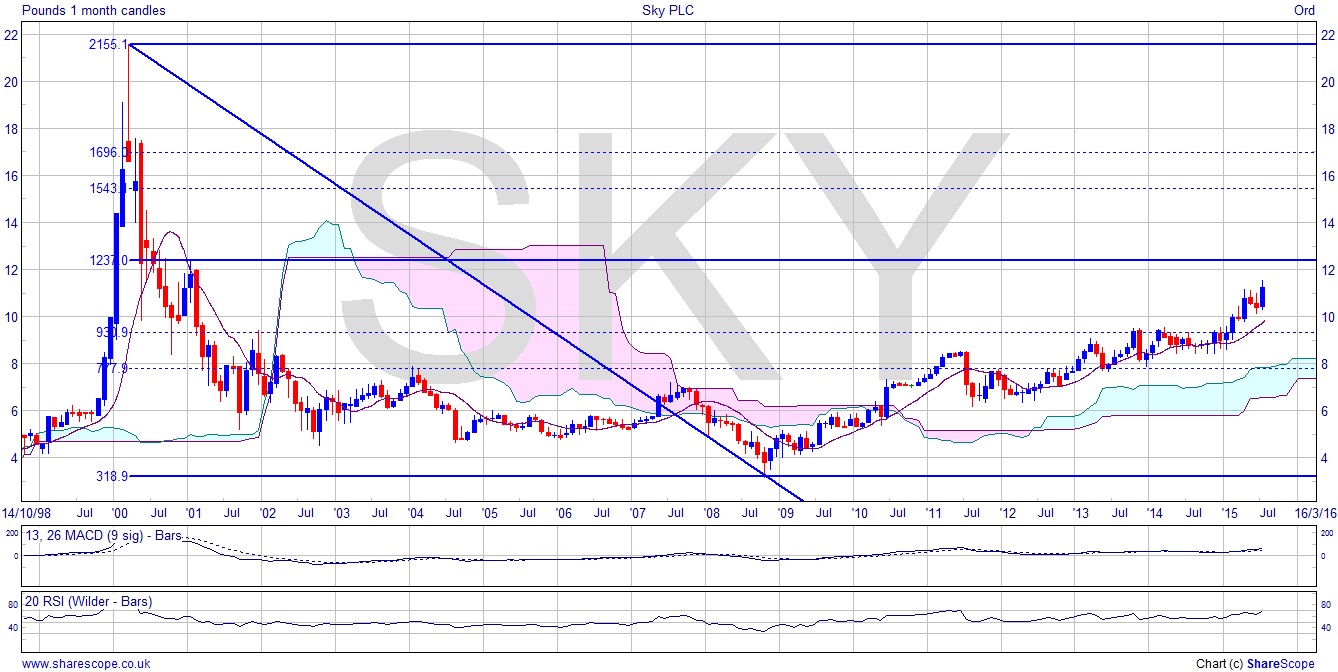

The other news is Sky (SKY). This is a decent looking chart. Heading towards the 50% retracement from the high in 2000 to the low in 2008. Looks like 1,250p is a goer. And there is resistance from way back, but then you have to wonder who would be eager to sell at an emotional price level from 15 years ago.

Sky have attracted more subscribers, and that has to be in part due to things like the excellent and exclusive Game of Thrones. They’ve also created quality original programming, like Fortitude, which I certainly enjoyed. BBC4 is the only other channel I watch and pay for (with the licence fee). So I’m actually happier with Sky’s output. And I don’t even like sport or watch movies. Well, American movies anyway. They always insist on a moral to the story, and that means you can guess the end pretty much just after they establish the protagonist. Stories don’t have moral endings in real life of course.

Actually, I think they should break up the Beeb and sell it. You might think I’ll miss it when it’s gone. I beg to differ. The BBC is where it deserves to be. It’s forgotten what it’s meant to be. Sell it, I say. I don’t think I will miss the biased news, the pro monarchy stance, walking on egg shells with all religions, the millions they spend competing with ITV (which they don’t need to do at all), the way they won’t let us into the archive of recordings we own, the censorship, the way they cut live music events in mid-song but play out every last breath of sport, the way they don’t make programmes as edgy as HBO and Showtime, nor the way it costs me a licence fee yet I only ever watch BBC4. No I don’t think I will miss the BBC.

I think the BBC has, in fact, helped Sky grow, and so too Virgin, as they don’t offer the range of packages and channels. They are basically the market leader now with 1 million new subscribers. Also they’re pretty recession proof. Watching TV is next to going on holiday when you’re short of cash.

The verdict: My approach to buying Sky would be to take an early entry half position now, and move the stop to breakeven as soon as it gets to the 50% retracement, and then look for a signal for the other half, like a higher low on the 50% level giving it a spring board for a good move up. Raising the stop then to cover the aggregate position to breakeven, then trail the stop up as it rises. Could be a good one. Entry timing needs consideration.

Comments (0)