Is The Dollar On The Turn?

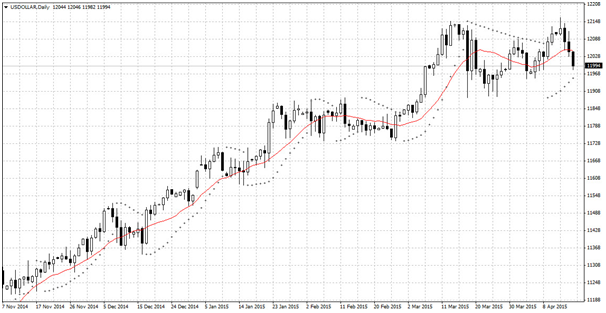

For the last nine months, there has really only been one way to bet in foreign exchange markets and that is to follow the dollar’s relentless push higher. Since the middle of June, the dollar has risen by 22% against a basket of currencies.

This week we’ve seen a reversal of this momentum with three consecutive down days of substantial size for the first time since early December. The dollar’s gains have been built on rising interest rate speculation, but this has cooled somewhat with the Fed taking a relatively dovish tone of late.

US Dollar Index

The US is still likely to become one of the first Western nations to raise interest rates since the financial crisis, but it may just take a little longer than previously expected. Adding to the dovish potential this week, we have had below expectation building permits, unemployment claims and housing starts. The futures market is now pricing in just a 50/50 chance of a rate hike before the end of 2015.

While the dollar has had its own inherent strength, its rise is also largely down to a collapse in confidence in the euro and the introduction of the ECB’s quantitative easing programme. The US dollar and the euro have had one of the strongest negative correlations of the last nine months.

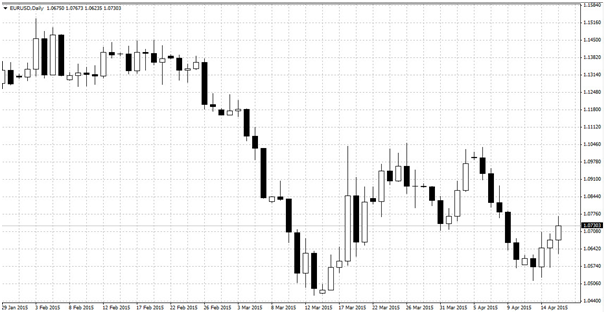

It’s no surprise therefore that the dollar’s pullback has come at a time when the EUR/USD is on the rise.

EUR/USD Daily Chart

The euro’s rise is curious given the ongoing problems in Greek debt negotiations. Greek Prime Minister Alexis Tsipras has stated that he is “firmly optimistic” that his government will be able to reach an agreement with foreign creditors by the end of April.

The problem is that these statements fly in the face of more pessimistic comments from creditor nations, notably Germany. German Finance Minister Wolfgang Schaeuble declared that “no one has a clue” how a deal could be reached by April 24th for a meeting of finance ministers in Riga.

So why hasn’t the euro been under more pressure?

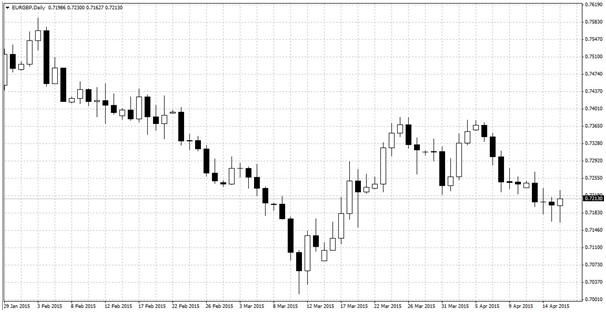

The first thing to recognise is that the euro has hardly been all conquering of late. Even with the UK’s forthcoming election uncertainties, the EUR/GBP has still lost ground in April and has just about stood still this week. Clearly the euro’s gains this week have largely been down to dollar weakness and not a sign of overwhelming confidence in the single currency.

EUR/GBP Daily Chart

Still, it could have been much worse for the euro this week as a Greece exit draws ever nearer. It reveals two distinct possibilities.

The first is that markets are being too complacent and are over confident on a deal being reached eventually. After all, the Eurozone has a history of muddling through and finding a compromise no matter how short sighted it is.

The second possibility is that Greece is no longer as significant for the euro. As the latest round of Greek problems broke, there was speculation that this time around, there would be no contagion to other regions. Paradoxically, a Greek exit could be positive for the euro.

Sceptics would correctly point out that similar arguments were made about the sub prime bubble before it burst. The fact is that we never know quite how a crisis might develop and what momentum will emerge.

That said, in the short term, the wind is blowing the euro’s way and it could pay to bet on a continuation of short term upside.

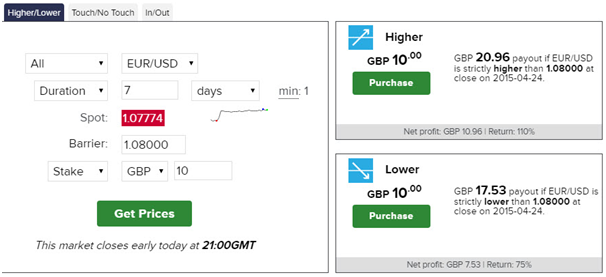

A good way to play this is a LOWER trade predicting that the EUR/USD will close above 1.0800 in 7 days time for a potential return of 110%. Put another way, betting that the EUR/USD will close above 1.0800 on April 24th could return £21.24 for every £10 put at risk.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)