Zak’s Daily Round-Up: AHT, CPI, SKY, APH, ENQ and PMO

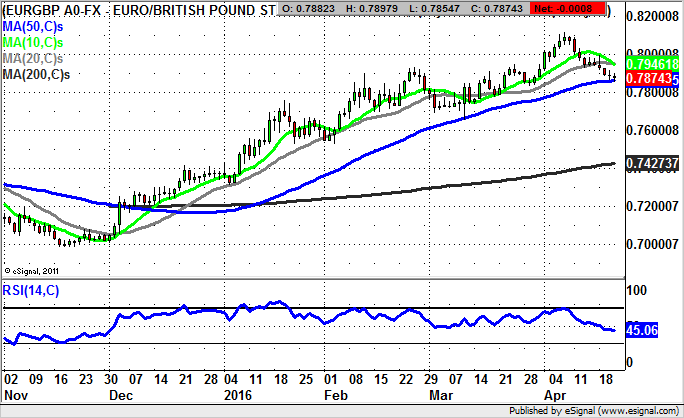

Market Direction: Euro / Sterling Key 50 Day Line Support

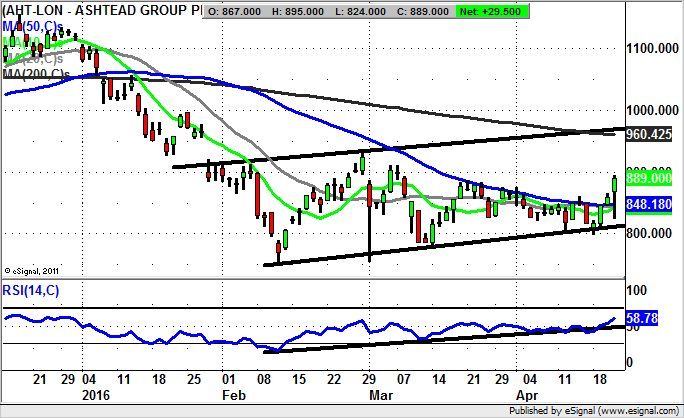

Ashtead (AHT): Risk Of 2015

Although one could perhaps suggest that almost any time could be crunch time for a stock or market these days, for Ashtead at the moment we are waiting to see whether the latest price action is merely a continuation of the downside break from the beginning of the year, or perhaps less likely, the start of a revival. What will be key near term is whether we shall see an end of day close back above the initial April resistance at 874.5p. So far the failure to sustain the 50 day line, at 846p today, implies that this could be a big ask. Of just as much interest is the threat of a break down below the February uptrend line at 810p, which is made more likely by the way that the RSI, now at 46, has declined below the neutral 50 level. The risk is that a weekly close below 810p tomorrow could lead to a retest of the 2015 support zone towards 750p over the course of May.

Capita (CPI): 910p Price Channel Target

Perhaps one of the things to remember about the “second line” FTSE 100 stocks is that while they may not always be first in our thoughts as far as trading opportunities, they can be worth investigating when a strong technical setup is on tap. This is what currently appears to be available at Capita in terms of the descent within a falling trend channel from November. What is apparent in recent months is both the way that the shares have tended to top out towards or just above the 50 day moving average at 1,049p, and of course the way that they have almost entirely missed out on the rebound for the FTSE 100 from 5,500 to 6,400 plus in the past couple of months. All of this goes to suggest that the bulls are very much on the back foot. The reason for saying this is the way we are trading in the aftermath of an unfilled gap to the downside below the 50 day moving average. The message is therefore that while there is no end of day close back above the 50 day line, the downside here could be towards the 2015 support line projection, currently pointing as low as 910p. This could be delivered as soon as the end of next month, especially on any swift loss of the former February support just below 1,000p before the end of April.

Sky (SKY): Risk of 920p Technical Target

Rather surprisingly, given the way that the subscriber numbers and sheer popularity of the platform of pay TV group Sky seem to be going from strength to strength, it is somewhat strange that the shares appear to be on the back foot. This is said in the wake of the latest failure of the stock at the top of a falling trend channel which has been in place since the beginning of November. Indeed, the message at the moment is that while there is no end of day close back above the 2015 resistance line / 50 day moving average at 1,014p, there is the risk of further downside. This could stretch as low as the floor of the channel from the autumn at 920p. The timeframe on such a move is seen as being the next 2-4 weeks.

Small Caps Focus

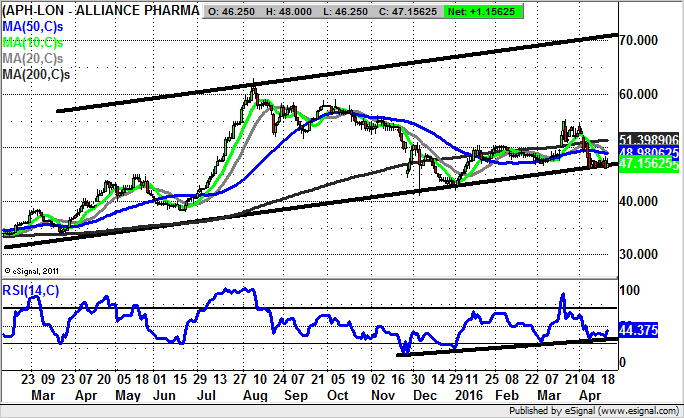

Alliance Pharma (APH): 70p Price Channel Destination

What is noteworthy as far as the daily chart of Alliance Pharma is concerned, is the way that we have seen a decent progression within a rising trend channel which can be drawn in from as long ago as this time last year. The key in the near term is the support we are seeing at the floor of the channel towards 45p, with the hope being that given the extended base for April, and the uptrend line in the RSI oscillator for November, there should be a rebound from around current levels. Indeed, it could very well be the case that as little as an end of day close back above the 50 day moving average, at 48.98p, might kick-start a new significant leg to the upside. Just how significant is suggested by the 2015 resistance line projection, which caps the channel at 70p. This is seen as the 2-3 months target, especially if the shares can clear the 50 day line either this week, or by the end of next week.

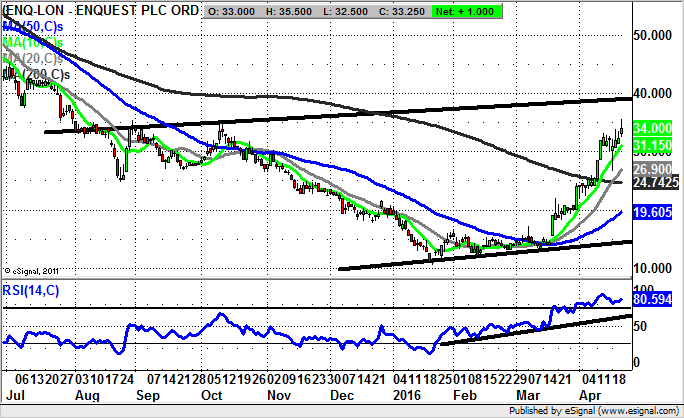

Enquest (ENQ): Up to a 40p Technical Target

Enquest may not immediately strike one as being the perfect contender as a bull candidate on a technical basis, but a look at the daily chart over the past couple of months does show us how this situation has been not only very robust, but also a classic set up – at least on this occasion. The reasoning behind this view point is the way we are trading in the aftermath of a March gap higher through the 50 day moving average, followed by no less than three bull flag breakouts. By definition, this kind of technical arrangement is not the type of thing one sees every day. While it has to be admitted that for the near term the rally is somewhat long in the tooth, we could still see a little more upside before the bulls have to step back. Indeed, the chances are that there could be a push to the top of an August rising trend channel at 40p, especially while there is no end of day close back below the 10 day moving average, now at 31.15p.

Premier Oil (PMO): Best Case Scenario Target at 90p

It seems difficult to believe that there could be further upside after shares of Premier Oil have tripled since the lows of the year. However, it would appear the stock is in a rising trend channel in place since December. The floor of the channel currently runs at 47p / 20 day moving average. This should mean that at least while we remain above this combination of support the top of the late 2015 price channel at 90p could be on its way over the next 1-2 months.

Comments (0)