Whitbread and Rolls Royce

Lyrics that are now too close to the bone for some are good fun in my book. One classic is the line in the Small Faces’ song ‘Itchycoo Park’: “we can miss out school (won’t that be cool), why go to learn the words of fools?” And another from Mungo Jerry’s ‘In The Summertime’: “Have a drink, have a drive, go out and see what you can find”. So, in that order…

Whitbread (WTB) has responded exactly as I said companies would to the so called Living Wage debacle: passing it on to the consumer. They own Costa Coffee and Premier Inns, as well as pubs and restaurants, so they’ll have plenty of low paid workers, as is the case in hospitality, with quite a lot of costs to pass on. And so begins the cost-push inflation I predicted in my Master Investor Magazine ‘The Final Word’ article this month “Why a minimum wage is a bad idea”. I also predicted that this will lead to wage inflation, as people who now earn closer to the lowest paid will wish to restore their wage differential with a pay rise, and so we have a spiral of inflation.

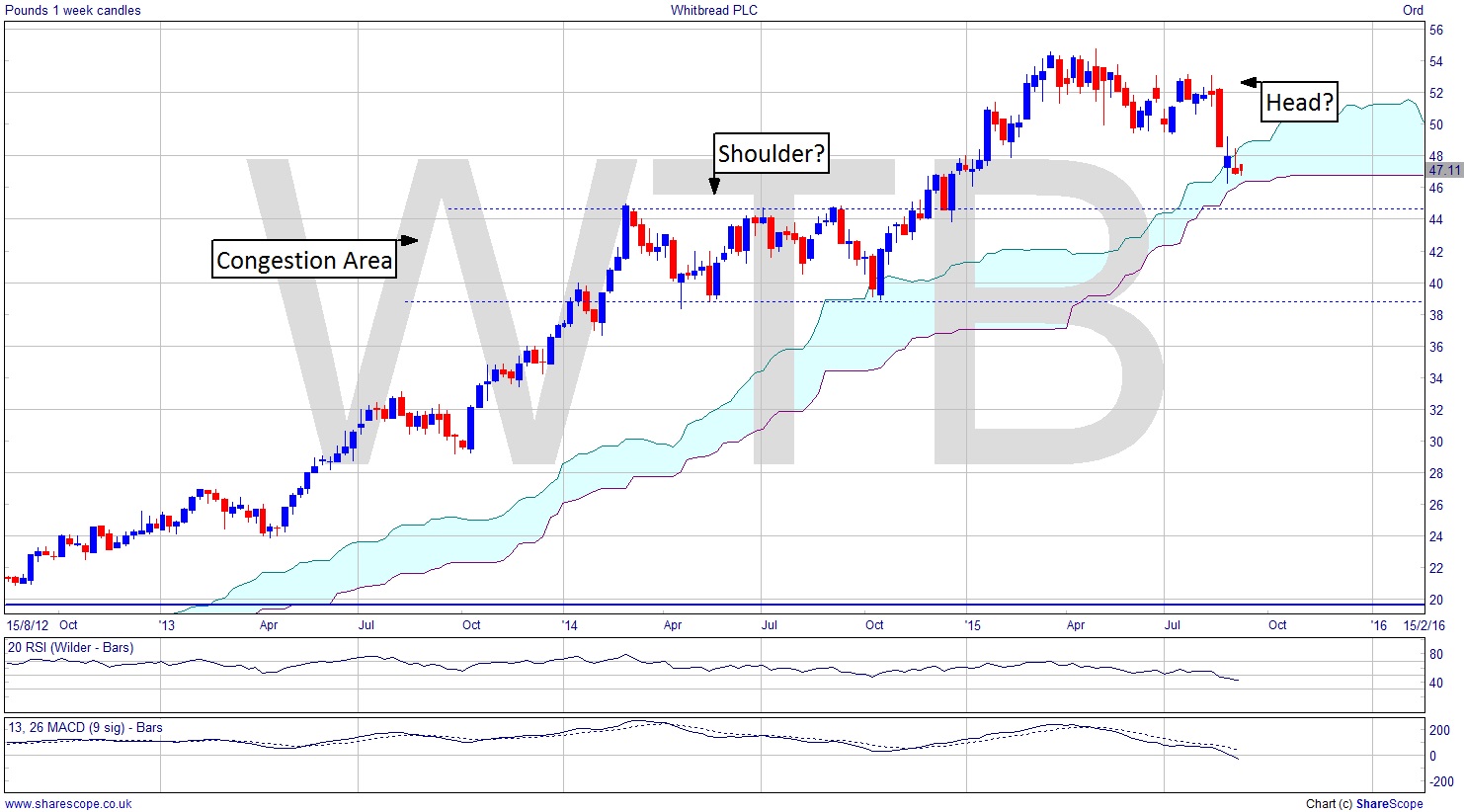

The chart reveals a cross-roads for Whitbread. Not a really good looking chart like some of the less diversified brewers, but instead one which, if it’s not careful, will make a head and shoulders and become one of the FTSE failures. There’s a congestion area below which should provide a safety net in the short term, but only makes it more likely that any prolonged period of subdued prices will make that right shoulder, and then we’re looking at a 50% fall from the ATH back in the spring. The MACD is looking pretty weak just now too, so no support there, and with the cloud still rising, following the several year rally, it’s going to struggle to get above it, and falling out of the cloud won’t take much at all.

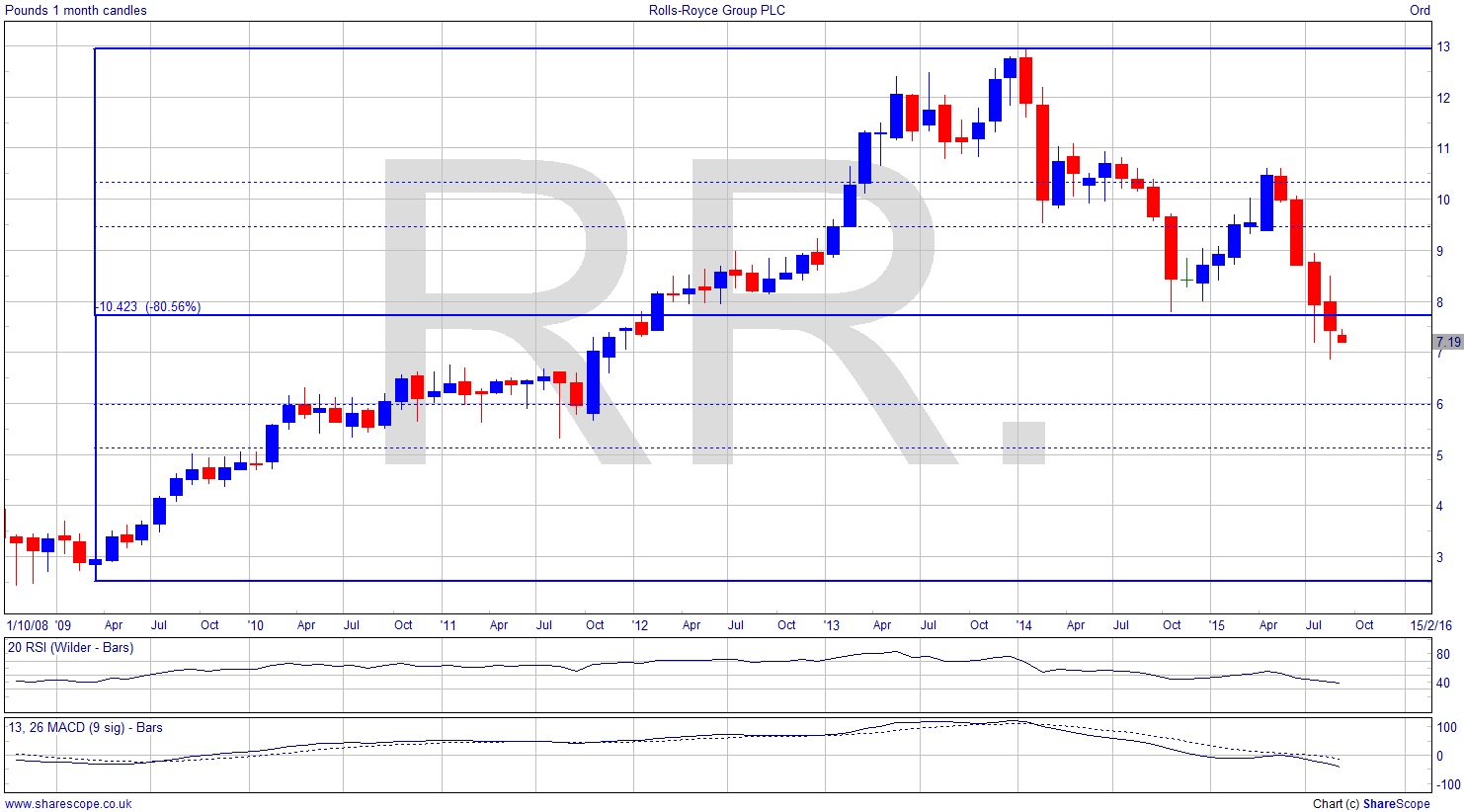

Rolls Royce (RR.) I wrote about back in mid-July after they’d issued another profit warning. It’s hard to imagine how the passenger jet business could be going much better; aircraft manufacturers seemingly have orders coming out of their ears, and war being in a growth phase economically speaking, the military aircraft business can’t be too sloppy either. That said, their chart looks poor. They did fail at the 50% retracement and have fallen 10% since that time. Again poor MACD and it’s already fallen out of the cloud, the Ichimoku Cloud not a Silver Cloud. If Rolls Royce were relying on the Chinese market it will be very sobering for them that Chinese August imports fell over 14%.

Comments (0)