Themed Watchlist 5: Insurance Starts Failing

Last October the Met Office issued a report that said the next two years will be the hottest on record. They also said this winter would be cold here in UK, which I dismissed by using TA. I was right. But their major claim, a generally warmer planet, is quite plausible, and that means one thing for sure: more rain. So I looked at various industries for our watchlist, which now includes Insurance and Utilities. We’re now starting to see some interesting developments.

The winter is still very mild here but, most importantly, wet. Storm damage in the US south west is in the news today. All this has to be paid for so we might imagine it’s starting to affect insurers. To some extent they are all in it together, especially if they do re-insurance.

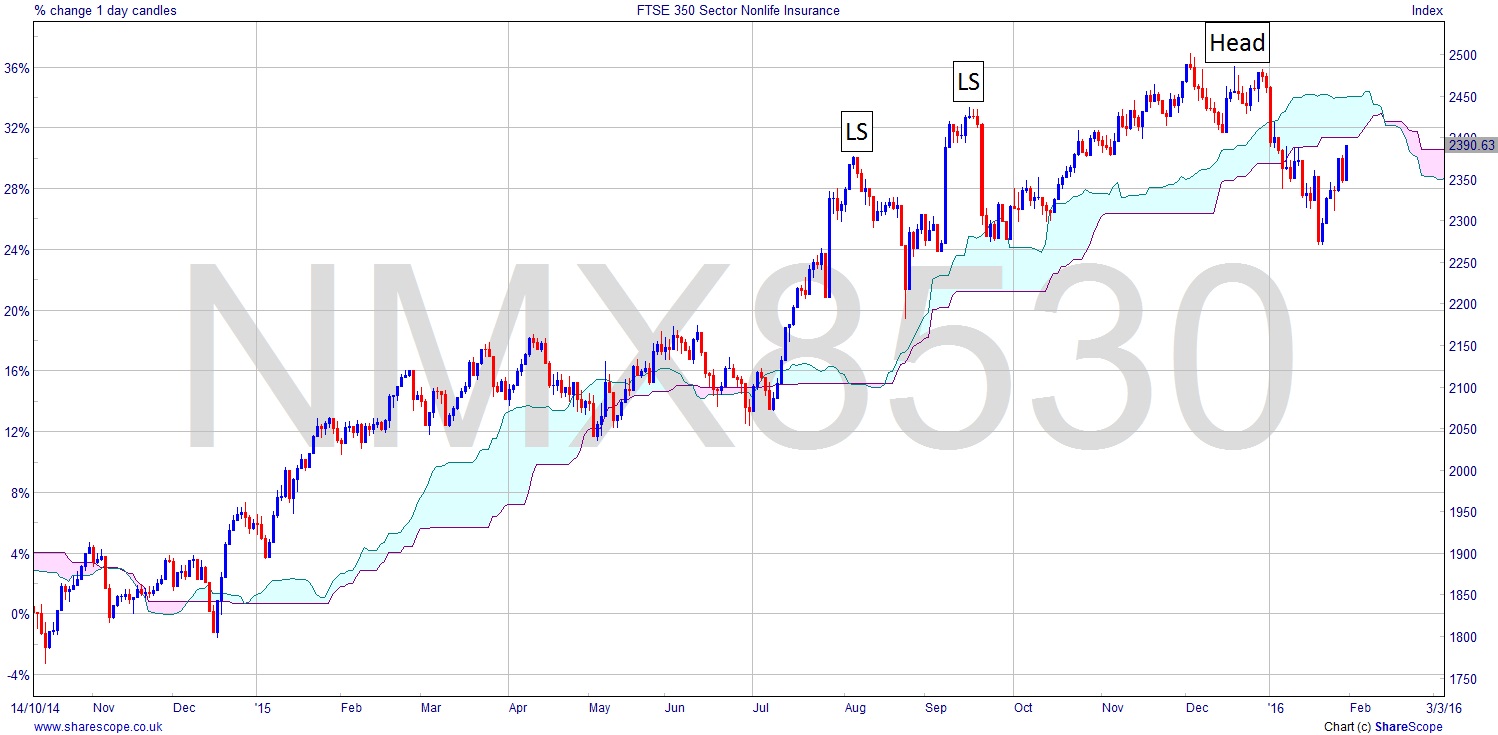

A month ago I was waiting for the FTSE 350 Insurance Sector (NMX8530) to start failing. It is. What we’ve seen is a nice fall below the Ichimoku cloud, and we’re now bearish. There could be a H+S set up here if we get another shoulder, which would be a very nice entry – especially if it can be taken early (i.e. with less risk). What I’d really like to see here is a bounce down off the bottom of the cloud. It would, in turn, make a lower right shoulder, which is a great sign of weakness. This is the daily chart – obviously we expect that to be the first to fail in technical terms, ahead of the weekly or monthly chart.

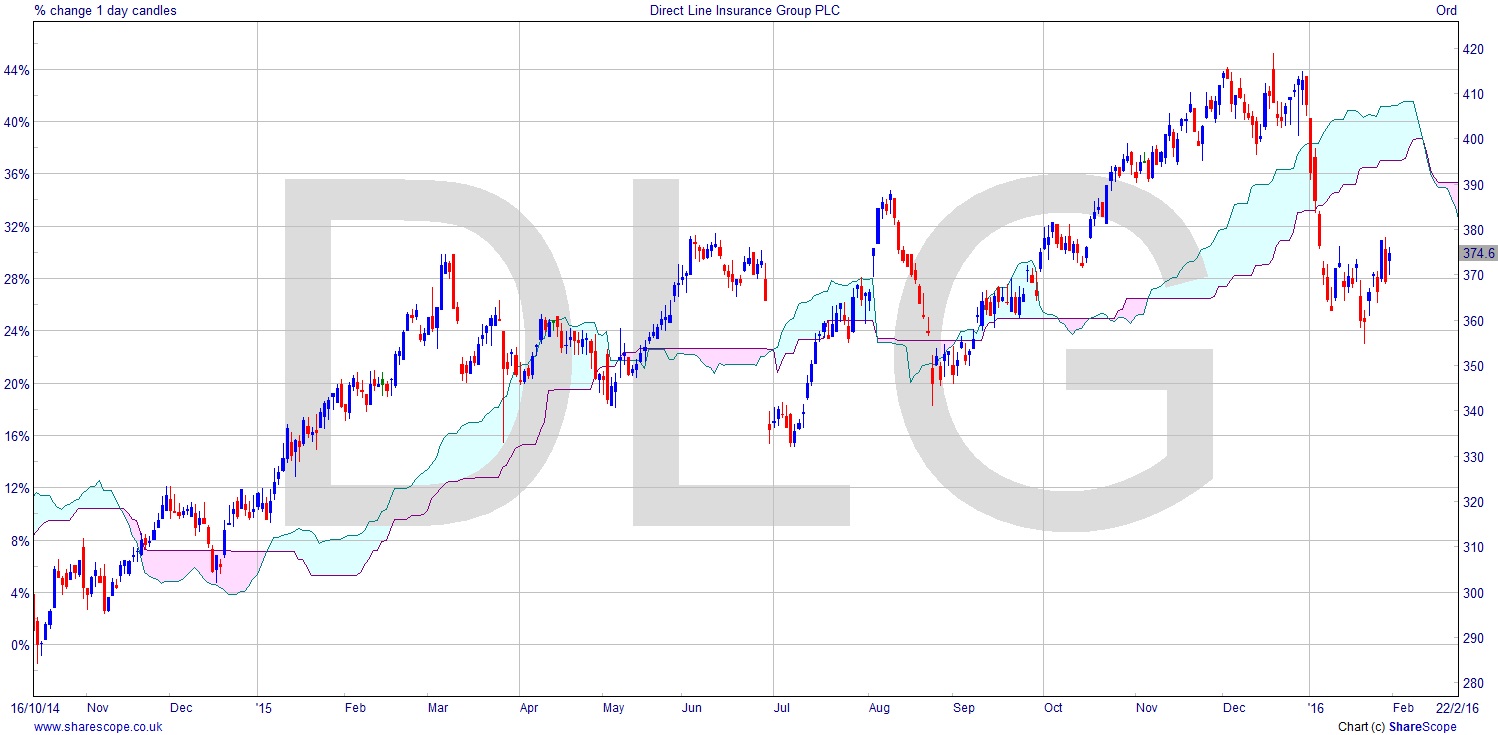

Direct Line (DLG) is still mimicking the index, and is actually a bit on the weak side. Again, looking at the daily chart we see a spectacular drop through the cloud, and something like a 15% price drop since the high. A lower high again would make a H+S here and also confirm the change in trend to bearish.

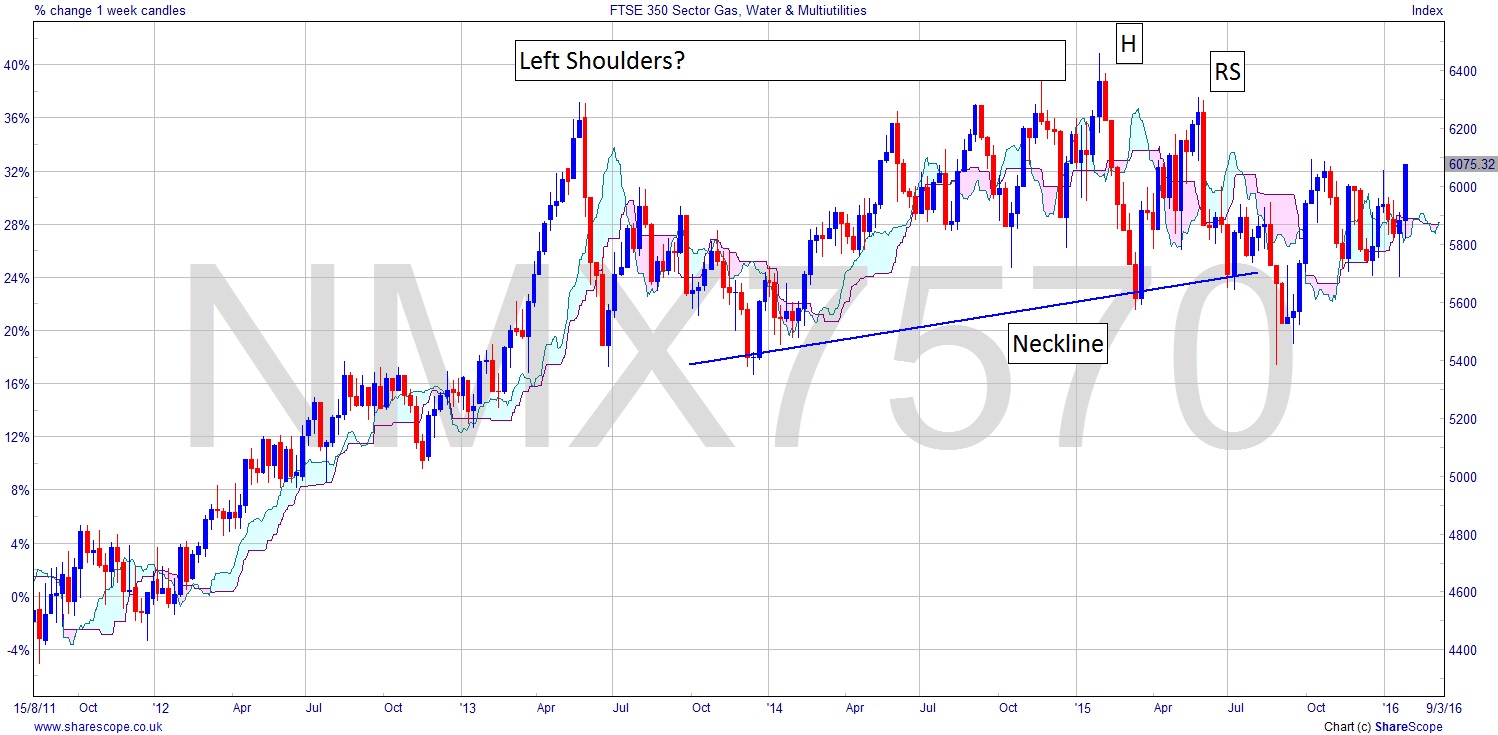

I looked at Utilities, too. If it’s mild, they probably won’t be doing too well in terms of profits from the usual winter increase in gas consumption, for instance. The FTSE 350 Sector Gas, Water & Multiutilities (NMX7570) chart has a very messy congestion area. We’ve seen a stylised H+S but now it’s seemingly range bound again. An early entry once that right shoulder is formed, using a shorter time frame (this chart is weekly), would probably still be within stop limits. I suppose it’s reasonable for a H+S with four left shoulders to have more than one right shoulder!

So the more exciting of the two is the Insurance (non-life) sector, for sure. They must be feeling the pain by now. Lots of claims will be coming in from the North of England and Scotland at the very least. El Niño battered the south-western US with 115mph winds and left 150,000 without electricity, according to today’s news story. That’s gotta hurt. I will look at the US insurers as there may be some nice opportunities there. With a spread bet it wouldn’t matter where the stock is, or what it’s denominated in currency-wise, as you’re trading per point. This is the advantage of spread betting/CFDs: you have access to different markets in different currencies without any of the worries you’d have buying the underlying yourself, or the decisions you’d have to make about splitting your capital in order to do so.

Comments (0)