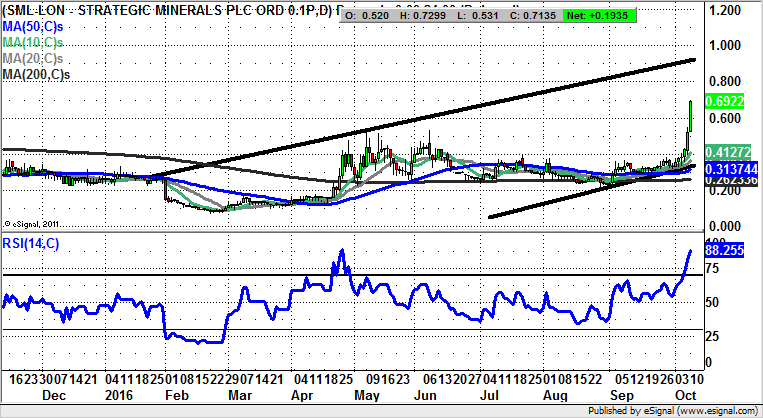

Strategic Minerals: Extended shuffle points towards 1p

There are a few stock-market clichés to be applied to the latest rise at Strategic Minerals, especially from a technical perspective…

Strategic Minerals (SML): Extended shuffle points towards 1p

One of the best aspect of the small-cap space is that it is genuinely one where you can double or treble your money in a matter of days or weeks, as well of course as losing it just as quickly. However, I will not dwell on the downside story, given the way that with technical analysis one should always know where your exit / stop loss point is before you enter the position. But the problem of how to have handled Strategic Minerals in the recent past has really been related to that of timing, and of patience being a virtue. Indeed, given the speed of the recent ascent one can always say “you had to be in it to win it.” The problem from my understanding – which may be incorrect – is that there was an overhang in the stock or a distressed seller, and only once that cleared could the shares finally break and sustain the 0.5p major resistance level. Now that this has been achieved, one would expect the latest nose bleed inducing rise to continue. The favoured destination is as high as the top of a rising trend channel which can be drawn in from as long ago as the beginning of the year. At this stage, at least while above the 0.5p former 2016 resistance zone, the upside here as soon as next month should be the 2016 price channel top at 1p.

Comments (0)