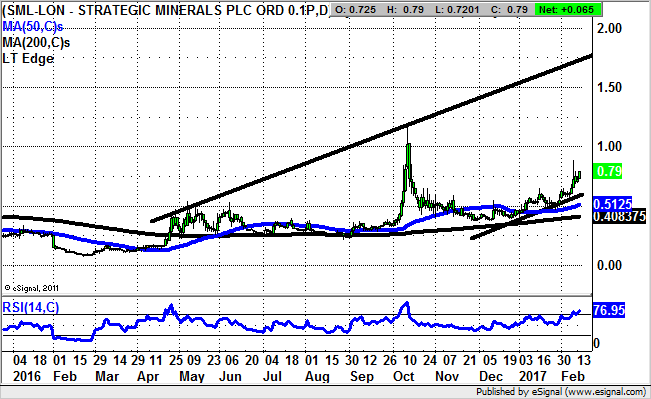

Strategic Minerals: 2016 price channel heading for 1.7p

It would appear that after quite a wait, the tipping point of profitability is set to be reached at Strategic Minerals (LON:SML).

It really has been a rather long journey for Strategic Minerals to get its act together both fundamentally and technically. This can be seen on the daily chart where one notices at least a couple of false dawns over the past year, ahead of what we are now hoping will be the definitive break to the upside. Clearly, given the abortive move to the upside in October, we would want to see that on this occasion the stock goes up and stays up.

Adding credence to this notion are the latest offerings on the fundamental front as released last month, with the promise of a flip to profitability for 2016 off the back of increased production at its Cobre Magnetite mine in New Mexico. All of this, along with the ongoing recovery in the mining sector, should mean that we see shares of Strategic Minerals go up and stay up this time.

The favoured scenario over the next couple of months is for a push towards the top of a rising trend channel from May last year at 1.7p, with an end of day close above this month’s 0.88p peak a decent buy trigger for cautious traders. The stop loss on the buy argument is currently any weekly close back below the 2016 uptrend line at 0.6p.

Comments (0)