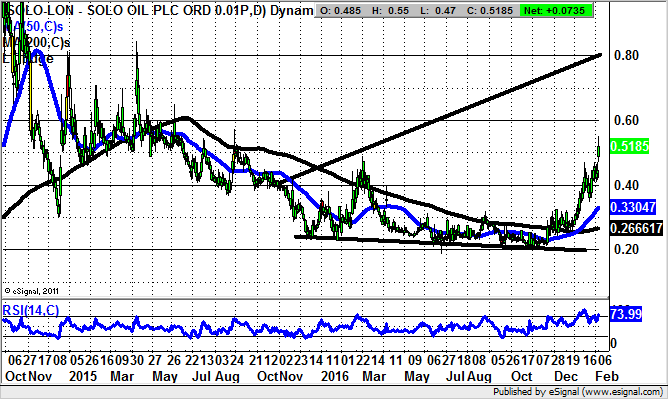

Solo Oil: Golden cross aftermath targets 0.8p zone

It has not exactly been a pleasant journey for shareholders of Solo Oil (LON:SOLO) in the recent past. However, the general stock market revival, as well as improved sentiment towards minnow explorers, looks to be helping out the company’s share price.

There are perhaps a couple of key factors helping the Solo Oil cause which exist separately from the company itself. The first is the relative stabilisation of the Crude Oil price over the past year, and the way that OPEC/non-OPEC seems to have got its act together. The second plus point is that traders and investors do seem to be coming back to the small caps/minnows space, pushing up even the most speculative of situations.

As far as how all of this affects Solo Oil, one could be forgiven for thinking the extended weakness for the stock would have finished by now, after a two-and-a-half-year pullback from the best levels of 2014 around 1.2p. But it would appear that 2017 to date has been the starting gun on a decent move to the upside, with the technicals helping out.

This point is underlined by the way there has been a golden cross buy signal, something which was perhaps rather surprising in terms of being such a vigorous signal, given that the big near-term driver for the company – better than expected initial appraisal results from Ntorya-2 – was only announced today.

All of this should be enough to allow the shares to head up to an October 2015 resistance line projection heading for 0.8p. The timeframe on such a move could be as soon as the next 1-2 months.

Comments (0)