Should You Still Sell In May?

One of the more consistent stock market adages has been the advice to ‘Sell in May’. The general idea is that stock markets perform badly during the summer months and that you’d be better off staying away until the winter. The effect is linked to the ‘Halloween’ effect which proposes that stock markets perform best after Halloween.

So is the ‘Sell in May’ really worthy of consideration, or like Halloween is it more likely to be superstition?

Sell in May v Buy in May

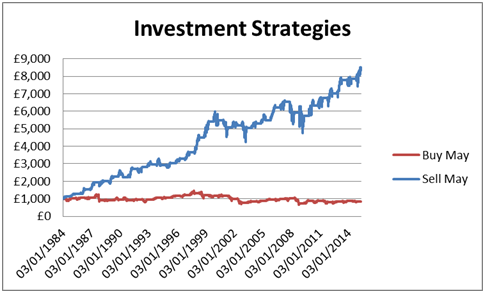

The chart below shows the returns of a strategy that A) bought the FTSE 100 on November 1st and sold April 30th compared to B) one that bought on May 1st and sold on October 31st.

FTSE 100 Sell In May

The strategy assumes you had £1,000 at the start in each case going back to 1984 with dividends ignored. No return on cash is accounted for when out of the market.

The ‘Sell in May’ strategy has massively outperformed the ‘Buy in May’ strategy, with a total investment pot of over £8,300 compared to just £831.

You might wonder if this is down to number of big crashes taking place in the summer months that skew results, and to a certain extent this is true, but it doesn’t have any significant impact on the underlying results.

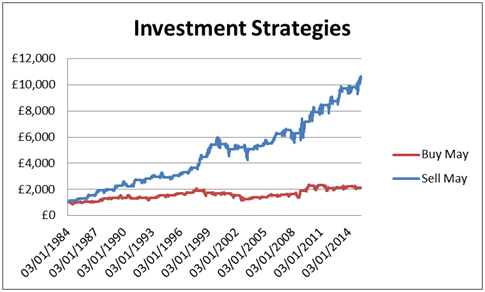

FTSE 100 Sell In May With Outliers Removed

Removing any days with a drop of more than 5% slightly improves the performance of summer months, but not anywhere near enough to bring it in line with the winter months – even with the worst days of 1987 taken out of the equation.

Is the effect still valid?

We might wonder whether the effect of this trading rule is diminishing over time, especially with markets generally rallying since 2009.

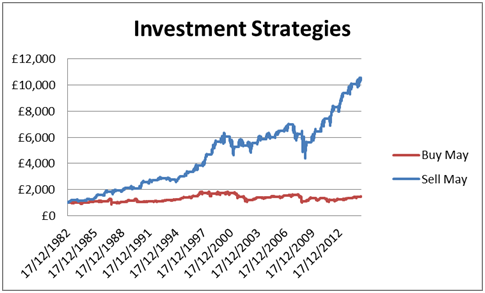

FTSE 100 Sell In May Since 2005

We can see that the winter months have continued to outperform the summer months in the last decade. A large proportion of this difference can be explained by the market volatility of 2008, but even if we were to remove any days with 5% drops during this period, the ‘Buy in May’ strategy has still outperformed over the last decade.

Why might this be? One theory is that the summer months are a time when the senior traders are away on holiday, meaning the junior traders are left to run the show. The junior traders may be less willing to make large bets in either direction and may be happier to take quicker profits rather than let a bull market run on.

It’s almost impossible to verify this theory and you might argue that investment firms should have more sophisticated risk procedures that preclude the need for senior traders for big decisions.

Is it just a UK thing?

The ‘Sell in May’ effect isn’t just constrained to UK markets either; it seems to apply just as well to other markets such as the S&P 500. This makes sense as global markets are so intertwined at the moment that anything happening in US markets will almost certainly happen in European ones unless there are any crisis events such as Greece.

Sell in May on the S&P 500

So should you sell in May?

Although the ‘Sell in May’ effect appears to be very real and still offering potential for outperformance, as an investment strategy it leaves a lot to be desired. The advent of May isn’t a particularly brilliant sell signal, as it’s not as though markets will immediately sink over the summer. It’s more the case that markets just don’t seem to go anywhere between May and November.

It’s true that the summer months have historically been more volatile and avoiding this period could avoid a fair amount of stress, but in reality time out of the market is time that you are not accruing dividends.

A better bet for sell in May

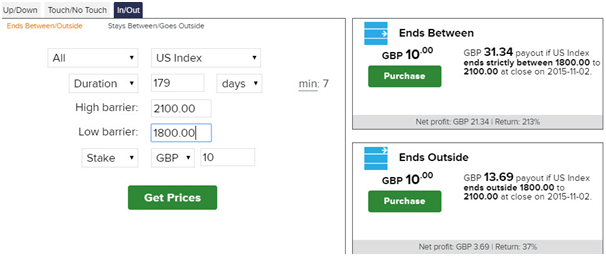

Thankfully we don’t just have to consider this effect from an investment perspective, as binary betting opens up a world of possibilities. One such possibility is that the FTSE stays within a tight trading range for the next six months, thus fitting with the historical pattern of poor returns during the summer. Markets are flirting with record highs and Fed chair Yellen is warning about how current levels may be unsustainable. Therefore a period of backing and filling may be what we see over the summer, whether this is down to the calendar or economic fundamentals.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)