Optibiotix: Broadening formation points towards 90p

Optibiotix (LON:OPTI) has been one of those rare beasts: a reliable small cap company prospect. Here the shares have gone up, and largely stayed up.

As luck would have it, today I bumped into the CEO of Optibiotix, Stephen O’Hara. The company is one I have followed from the word go, and its continued progress is most welcome. The particular areas this company is tackling are among the most difficult to address or indeed treat. I am of course referring to obesity, high cholesterol, diabetes and skin care.

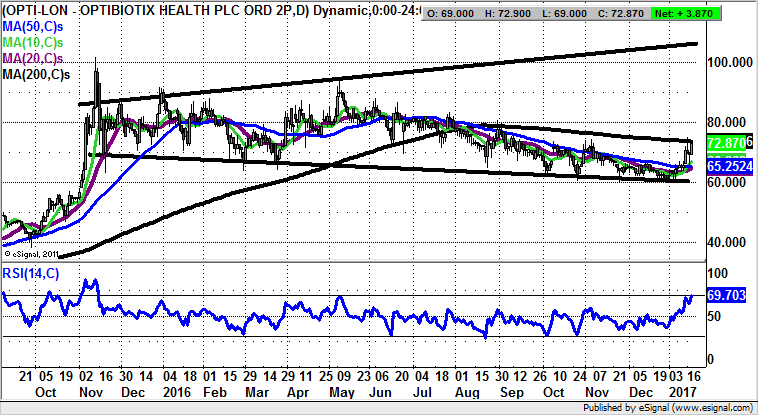

What can be seen on the daily chart in the journey from the autumn of 2015 is that we were treated to a break above the 40p region, with there being a brief near vertical move through 100p for November. Essentially, what can be deduced about the price action since then is that we have essentially been in consolidation mode within a broad triangle with its support line projection running towards 60p.

This implies that while above the floor of this formation on a weekly close basis, we are very much expecting the shares to deliver a decent new leg to the upside, and not just a temporary blip. Evidence for this would come from a weekly close above the 200 day moving average at 73.5p. As long as you wait on a clearance of the 200 day line, the upside here at Optibiotix should be 105p plus at the top of the triangle formation.

Comments (0)