Not So Supermarkets

With the Tesco (TSCO) AGM coming up I took a look at supermarkets. It’s a jungle out there! It’s not an attractive sector. We know there’s been a battle on the High Street for market share and there have been casualties there. From the zero hour contract people, who you might reasonably think don’t have much of an incentive to make nice at work when preparing our food, to those that are cutting corners with health and safety, in what are not cheap brands, then sold by the big supermarkets.

Tesco used to be a brilliantly run company. Of course they weren’t really a super market. In the same way that the whole Clear Channel play in America is actually not about radio or advertising or even pop concerts – it’s about revenue from car parking at pop concerts – similarly Tesco, for a couple of decades, was about property portfolio and not frozen chickens and fresh veg.

There have been insidious moves by some manufacturers of foods that have simply put less of their product in the package at the same price, rather than appear to have a price increase, which is something which should be dealt with by trading standards as far as I’m concerned.

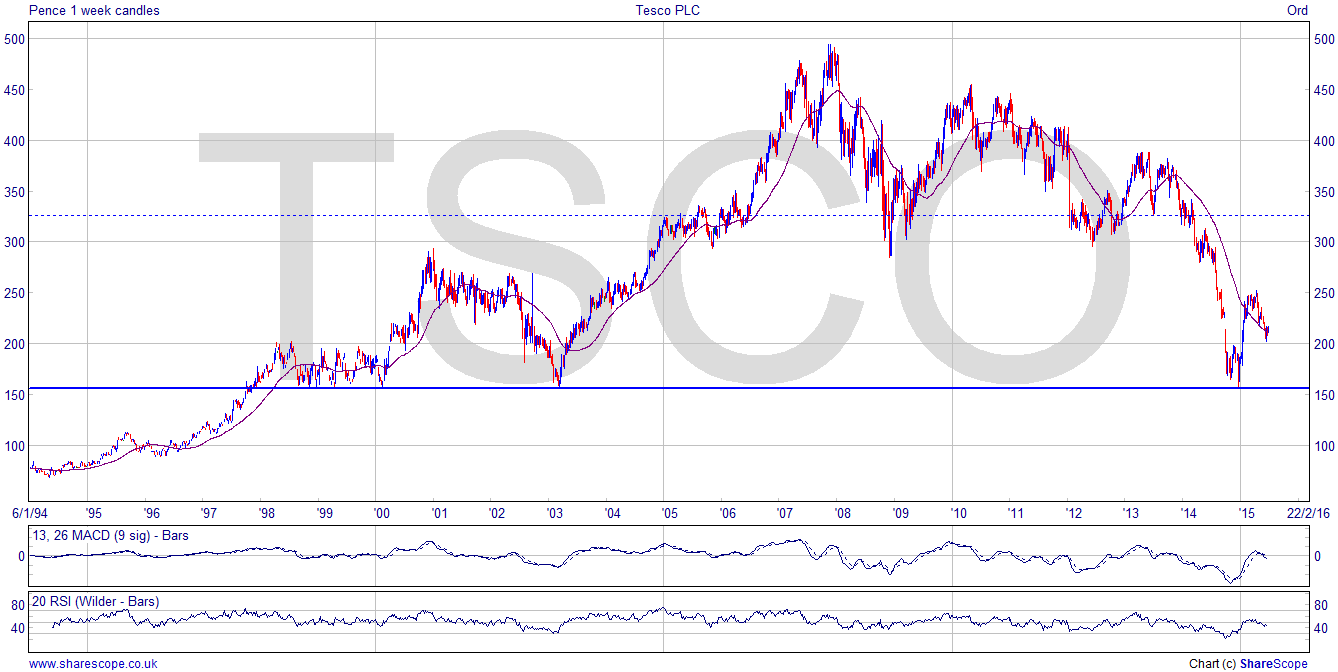

So, where are the big supermarkets’ shares right now? I’ve looked at a couple. Tesco is not looking too great. We can see support at the 160 level, but we haven’t seen a particularly strong move up from there. I’m not in love with the higher low of last month. I’ve put a dotted line at what is an important level. It’s 50% between the ATH and that massive support level at 160. It’s probably the highest achievable target that is realistic, if indeed we do see a rally. It’s at around 325. That said there is a well-defined stop above the support at 160. So with the present price at around 210 it’s not too bad on the risk reward front. But I’d struggle to find a good reason to buy it just now. Below that support at 160 it’s a bungee job, by the way.

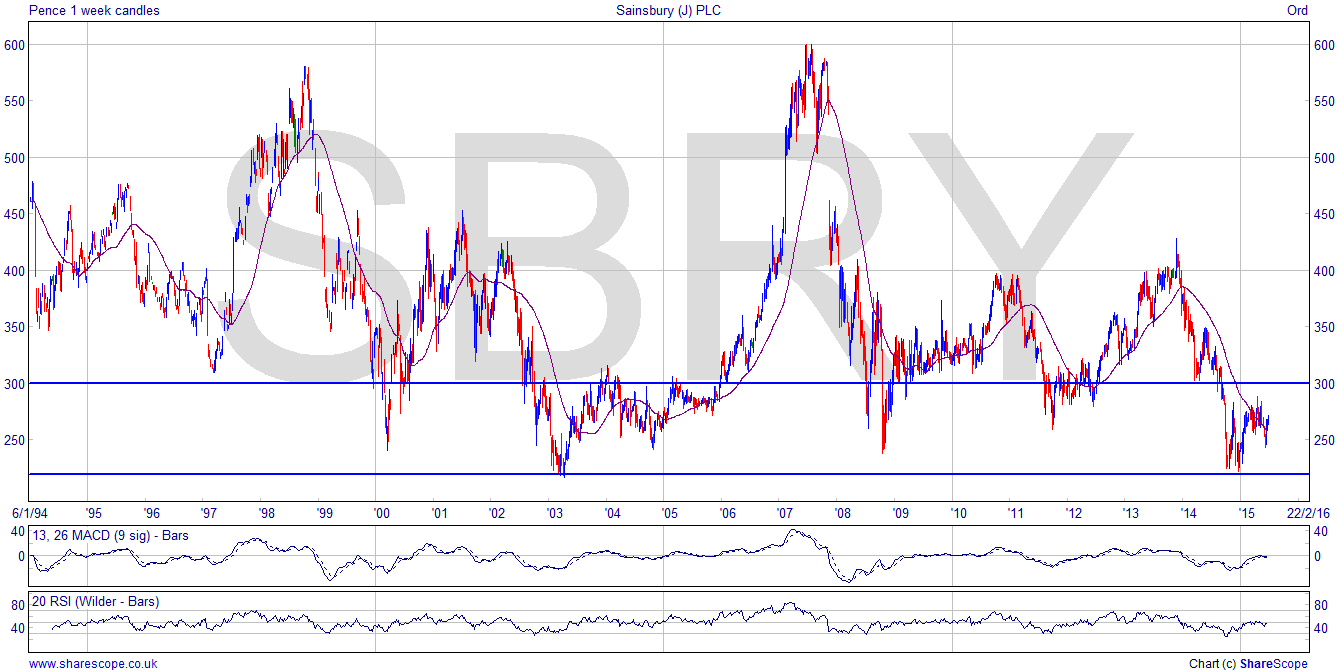

Sainsbury’s (SBRY) chart is a shocker. What the hell have these guys been up to?! The price is languishing in the 200-300 range. Again. It’s a pretty stagnant picture right now. I’d be interested in shorting Sainsbury if it fell below that support at 200. But the snag with that is below 200 I expect there’d be a queue of suitors for an acquisition. That is always a worry with shorting, as a bid generally makes the price rocket unexpectedly. Any short play on an attractive brand name should be adequately protected, for example, with a guaranteed stop. The 300 level, incidentally, is a Gann level – 50% of the ATH. Once passed we generally expect to see the next level down which is 50% of that level – so 150. That, therefore, would be my initial short target.

If you’re looking for a reason why investors aren’t getting excited about supermarket shares, look no further than the FTSE All-Share Sector Food & Drug Retailers chart. With yields at historic lows, at least since the start of the index around 7 years ago, then you might imagine they’re not considered income stocks at the moment! Are they going cheap is one question. The other question is as to whether we’re all being poisoned by cut corners struggling in this climate.

Comments (0)