Not All Doom and Gloom: Some Long Opportunities

Given markets spend more time going up than down, once a bull market is established nay-sayers start to creep out of the woodwork and there’s continually more and more talk of market failure, and statistically, sooner or later, it’ll be right. Of course, if that’s simply based on the same sort of ‘finger in the air’ nonsense as cults predicting the end of the world, then it’s certain to be wrong, except by accident. A word to the wise: take bets on the end of the world at any odds. I’ve been writing a lot lately about failures in the market, and justifying those comments with TA and observable market and economic phenomena. So today I thought I’d have a look at some stocks on the LSE that are good long watch list candidates.

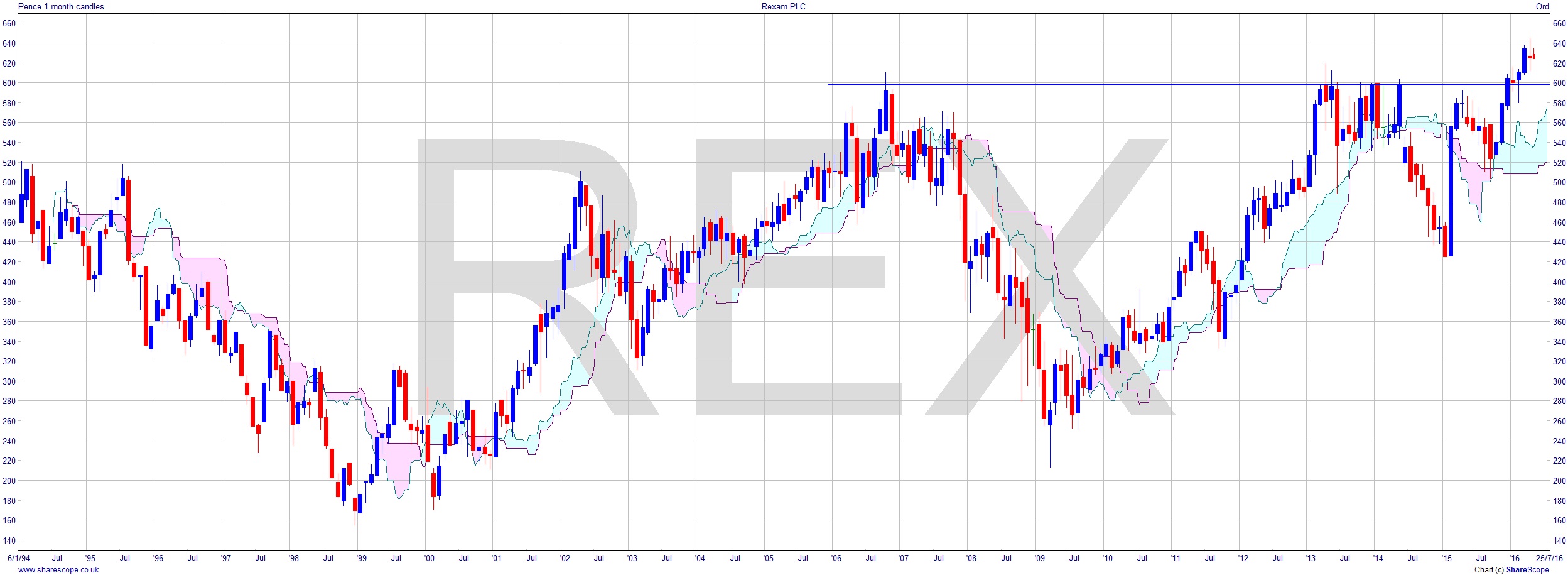

The first one is Rexam plc (REX). I didn’t know what they did, and for TA purposes it doesn’t really matter, but they make consumer packaging in the form of cans. Nice looking chart though. 600p resistance level which has been broken now. A pullback to 600p and a bounce could be a very nice buying signal. A note of caution is that every time it’s broken the ATH before it has then quickly failed. Perhaps a straddle approach then at this point, long and short outside the current range. It’s not necessary to use options to do straddles now as fixed odds betting allows what they call ‘boundary bets’, which are essentially the same thing. If the price goes above a certain level, or below another, you get paid.

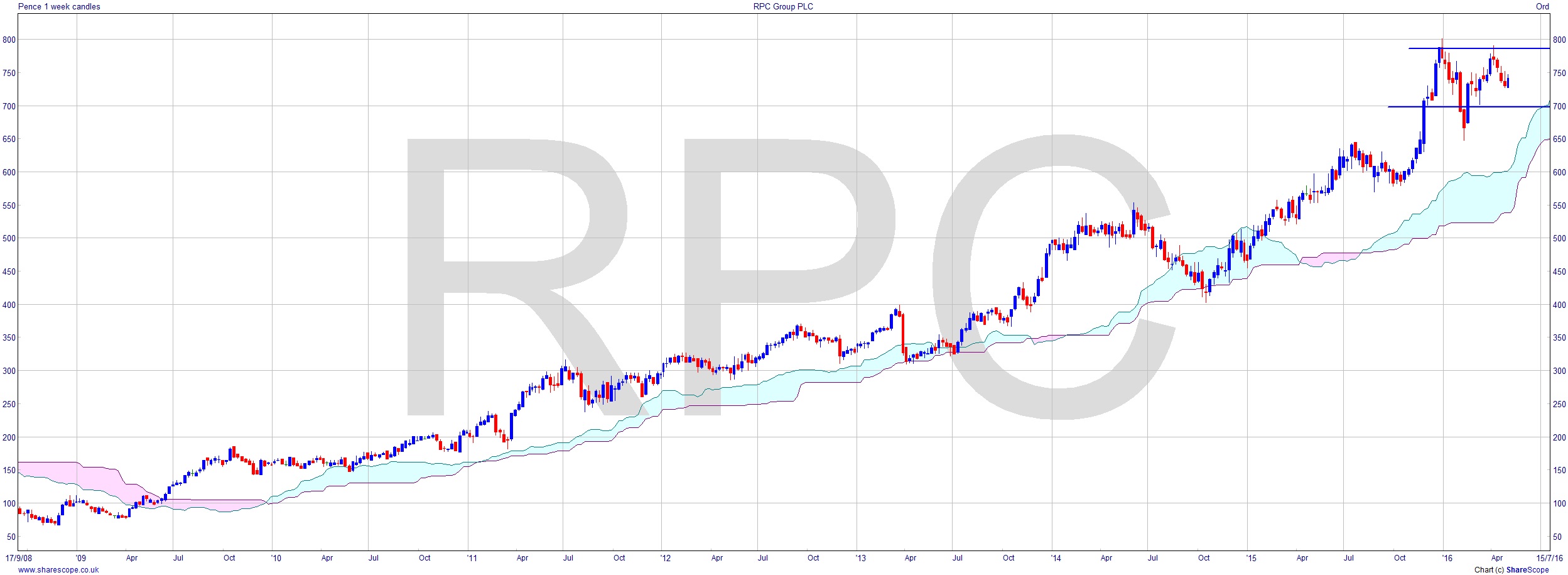

Another ‘looker’ is RPC Group plc (RPC). Funnily enough, it’s also in packaging, but this time plastic packaging. The shares is in a range at the moment but exhibits a nice intact upwards trend for the most part since ’09, and gaining in momentum, thus maintaining percentage gains over time. And no overheating, but I suspect if it goes on to rally up from here that’s how it will eventually end. Like Greggs plc. We’re now seeing a congestion area, and if this is a precursor to a measured move then it could go ballistic. Up 16 fold since 2009 this is a pretty impressive chart. Nicely above the cloud, but of course that does give potential downside whilst still remaining bullish, so watch out for a pullback, even across the cloud. That’s quite a downside risk. Timing will be key to making a success of the move should it happen.

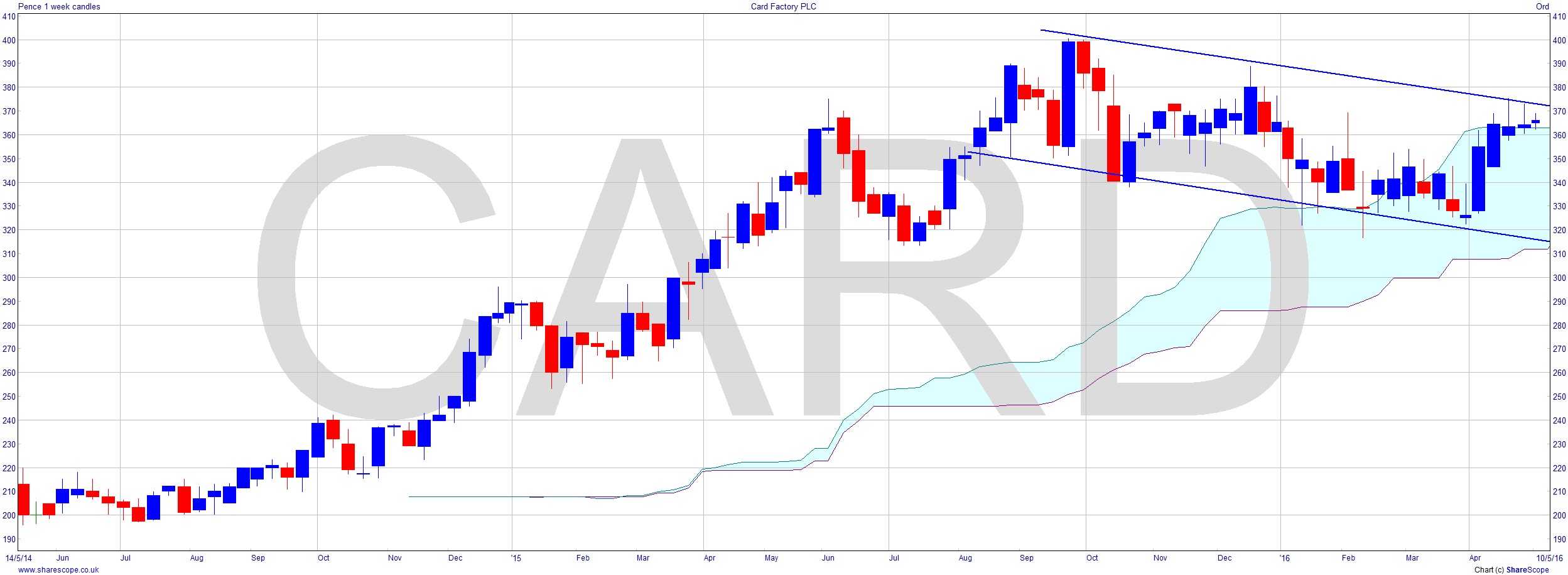

Card Factory plc (CARD) could be presenting a bull flag. It’s excitingly above the cloud just now and bullish in that it penetrated it, and unusually didn’t cross to the other side. Obviously there’s resistance at the ATH around 400p, but that’s a nice safety buffer for a scratch trade should it fail. Once it’s in new territory though above the ATH, there’s nothing to stop it and we could see 600p out of this one. From my own perspective I can’t imagine who even buys cards these days, and that’s what they sell, as the name suggests. It’s a good mark up one imagines. “Here’s a piece of card and an envelope for £3.” “That sounds expensive!” “Not at all. I’ve printed ‘Happy Birthday’ on it”. “Well it’s a bargain then!” It’s not. But people still buy them. Ours is not to reason why; ours is just to jump all over trading opportunities as they present themselves.

Comments (0)