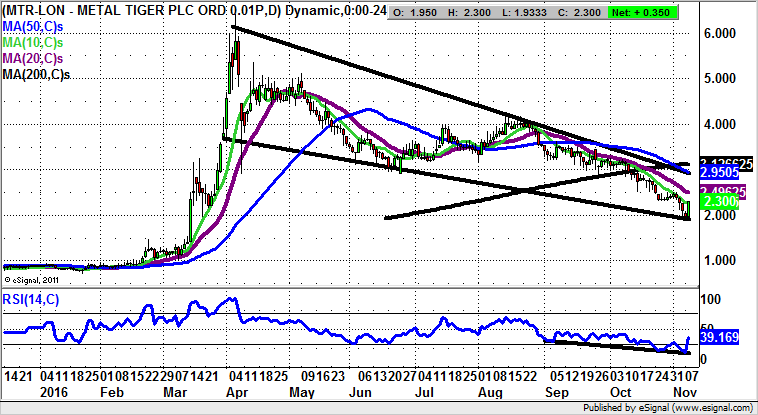

Metal Tiger (MTR): Back in business for the bulls

After some months in the wilderness it would appear from a technical perspective that shares of stock market darling Metal Tiger are back in business for the bulls.

What has been interesting regarding the sentiment surrounding Metal Tiger is that even though the stock has pulled back from 6p-plus at the beginning of April to below 2p this week, it remains a firm favourite amongst retail private investors. On occasion it can be said that such a fan base is not necessarily a great asset. But I do wish to give the company the benefit of the doubt, if only on the basis that the mining sector improvement since the beginning of the year appears to be robust, and traditionally it is the smaller plays which are best leveraged in such situations.

As far as the specific technicals here are concerned, there has been a bounce off both the March 2p support zone and the floor of a bullish falling wedge pattern from early this year. The view now is that while there is no end of day close back below the 1.93p floor of this week, the upside here should be the 200 day moving average at 3.12p by the end of this month. A weekly close above the 200 day line opens up the prospect of a retest of the best levels above 6p for Q1 2017.

Comments (0)