Metal Tiger: Break of 200 day line points to 4p

Metal Tiger (LON:MTR) was a great private investor favourite for the first half of 2016, but it remains to be seen whether the company can achieve the same feat for the first part of this year…

It could be said that the end of 2016 did not go as well for Metal Tiger as many might have expected, especially given the glorious start to the year where the group really did benefit from the general return of enthusiasm for mining stocks, but also from home-grown exploration prospects.

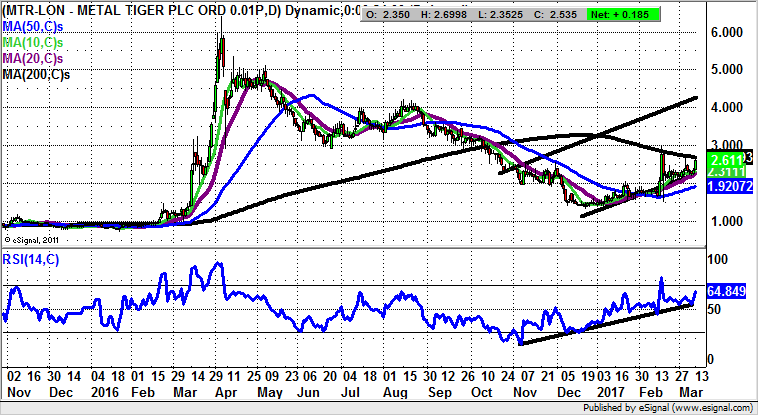

What we see now from the newswires is that momentum seems to be gathering, something which has improved the charting picture of late as well. In fact, things on the daily timeframe have been improving since as long ago as the middle of January, with the 50 day moving average now at 1.92p. This came even before the announcements regarding the new mineralisation in Botswana, with the copper belt zone there very much in play.

As far as the share price prospects are concerned, all that is really left to see is how quickly the 200 day moving average, now at 2.68p, is broken. The message at the moment is that as little as an end of day close above the 200 day line should be enough to propel shares of Metal Tiger up quite significantly.

The favoured scenario at this stage would be for a push higher towards the top of a rising trend channel in place since as long ago as November. The timeframe on such a move is regarded as being the next 1-2 months, something to take the stock back to post July resistance. Only back below the 50 day line now even begins to question the bull argument.

Comments (0)