Jersey Oil & Gas: Current rally could stretch to 150p

It is of course the case that the smaller explorers are fraught with dangers, thrills and spills. But that is what makes a play like Jersey Oil & Gas (LON:JDG) all the more compelling. There is a sense of irony for fans of small oilers with relation to Jersey Oil & Gas in that the late lamented Xcite Energy was always mooted to be the subject of a potential farm out with energy giant Statoil. Now we see that the Verbier well, in which Statoil has a share of 18%, is the exciting prospect of the moment in the North Sea, and that next year we shall find out exactly what this potential treasure trove is made of.

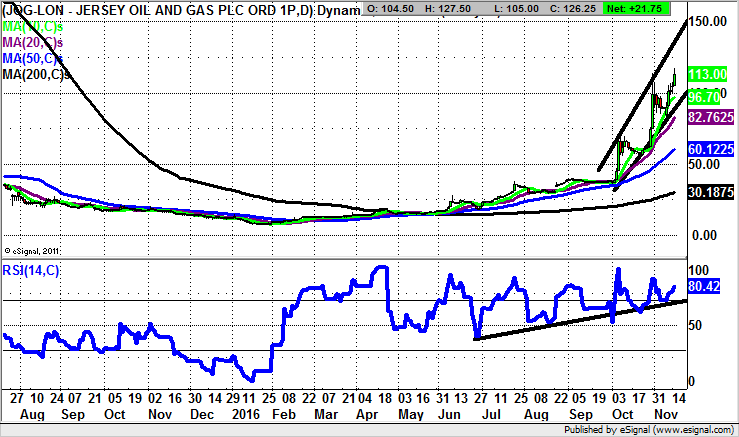

As for the price action of Jersey Oil & Gas on the daily chart, it can be seen how the key technical turnaround came in May with the recapture of the black 200 day moving average, then around 18p, and now up to 30p and rising well. More recently it can be seen how we can draw a rising trend channel from the beginning of last month, with the floor of the channel currently level with the 10 day moving average at 96p. The message at the moment is that one would be keen to chase the shares higher, even after all the gains, while there is no end of day close back below the 10 day line. The notional best case scenario target is 150p at the top of last month’s price channel, a destination which could be reached well before the end of this year.

Comments (0)