Egypt & France – Markets after Terror Attacks

I’ve heard some pretty prominent market commentators say some really dismissive and stupid things about Technical Analysis. Saying you can’t use a price chart to predict what’s going to happen to a price. Well you can, as I frequently demonstrate in these posts, and the fact that they don’t believe it is to our advantage. If everyone does the same thing it’ll either stop working or there’ll be no money to be made. So the fact that there are detractors is a good thing in my book. Facts don’t change just because people don’t believe or like them.

TA works because the price chart shows the barometer of human sentiment and that’s the driver of price. Of course other factors influence it. It would be equally ridiculous to say that fundamentals count for nothing, although in the shorter term, like an hour, they aren’t likely to be that relevant or helpful.

So when it comes to things like acts of terror, although they aren’t that high up the list of global risk impact, they do affect human sentiment in a disproportionate way. This is exacerbated by news saturation, again disproportionate in many cases, to the event. On the other hand, some events that are important are almost completely ignored. The one thing markets are affected by most is uncertainty.

Egypt has really taken a broadside on their tourist industry. No flights are going to Sharm el-Sheikh from the UK. We can’t be alone. The Egyptian economy is quite dependent on tourism so it must have a knock-on effect, at least in the short term.

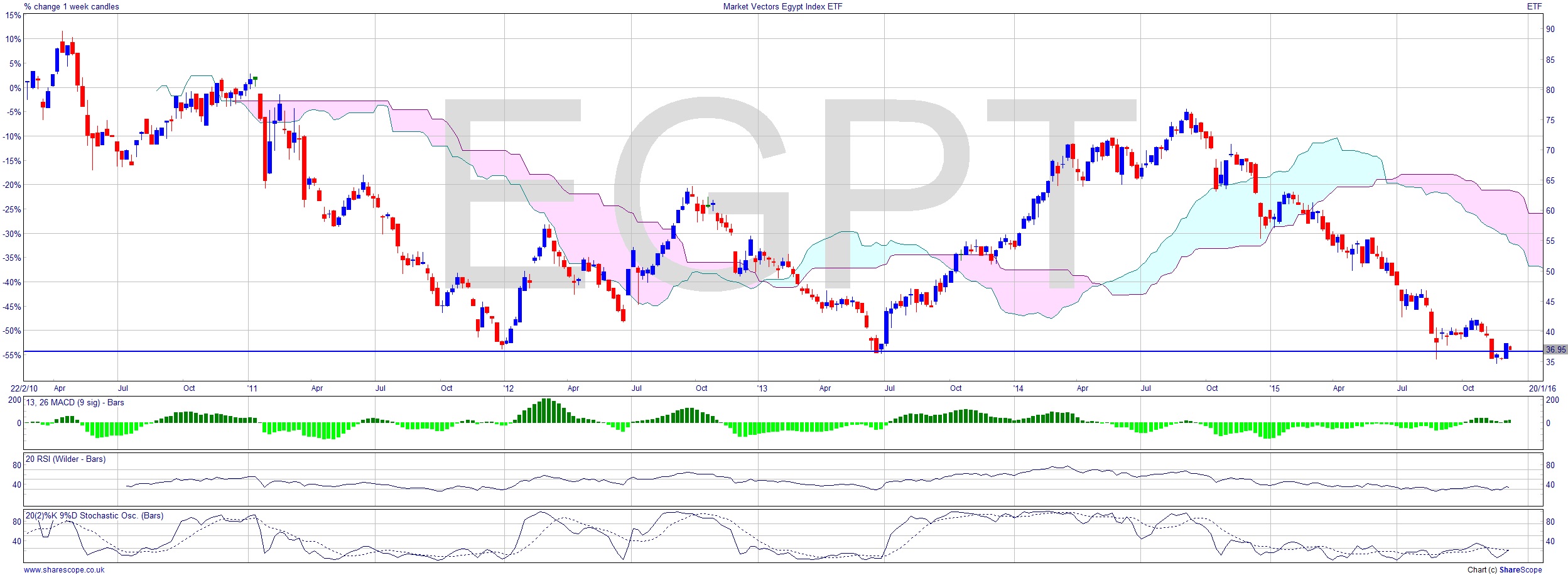

There aren’t many opportunities for us to participate in the Egyptian market but there is one ETF listed in New York: Market Vectors Egypt Index [EGPT]. It’s an easy read. We’re at an important support level which I’ve marked on the chart, and it would be reasonable to say they could be a Molotov Cocktail away from falling through it. Certainly one for the Man-made Disaster Watch List. That’s a very intact downward trend since July, and a second touch on the support level around 36.

France has been hit twice now with terrorist activity. Everyone seems all bent out of shape and shocked that Le Pen and her Far Right party are gaining in popularity. In 2008 I predicted a generation of civil unrest, and a general swing to the right in Europe. After the Charlie Hebdo massacre I predicted that Le Pen was assured the Presidency. Hardly surprising in the wake of Bataclan that her party has cleaned up in the local elections there just now.

TA for me must be framed by the predictable events that drive price. People in general are irrational. Not factoring that irrational, over-reaction to events into our expectations as investors can be problematic. We have to anticipate what public sentiment will do and see if there’s any support for our reading of sentiment on the chart.

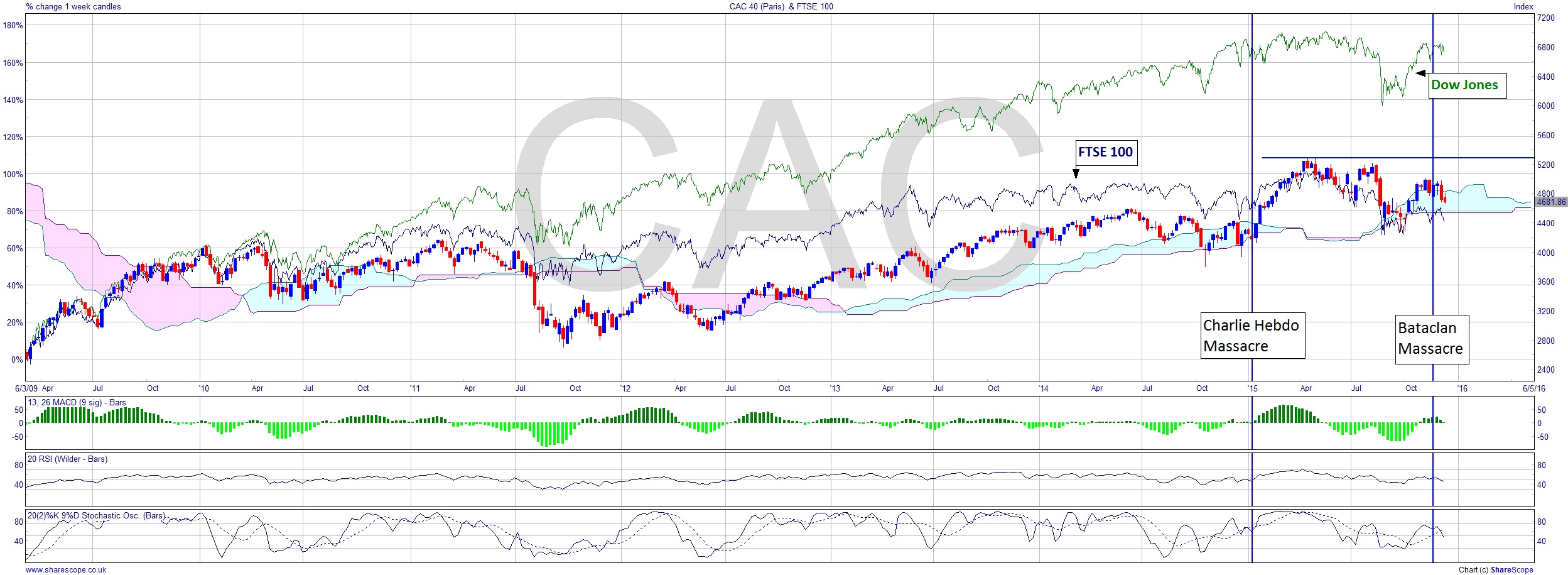

Unlike the Egyptian story, after Charlie Hebdo the French market rallied, and stronger than the FTSE did at the time, with the Dow having moved sideways at that point. I’ve marked Charlie Hebdo and Bataclan on the chart, and also the Dow and FTSE 100. The markets there have been robust and have largely ignored the incidents. That’s an interesting outcome. The CAC continues to augur signs of gains relative to the FTSE 100. That’s the Watch List item here: CAC versus FTSE 100.

Comments (0)