Chart of the Day: SuperGroup

As I approach the age of 50, I have to confess that knowing what is trendy and what is not has become an issue. This matter has arisen with retailer SuperGroup, where we can see the price action of the Superdry brand staging a sharp turnaround.

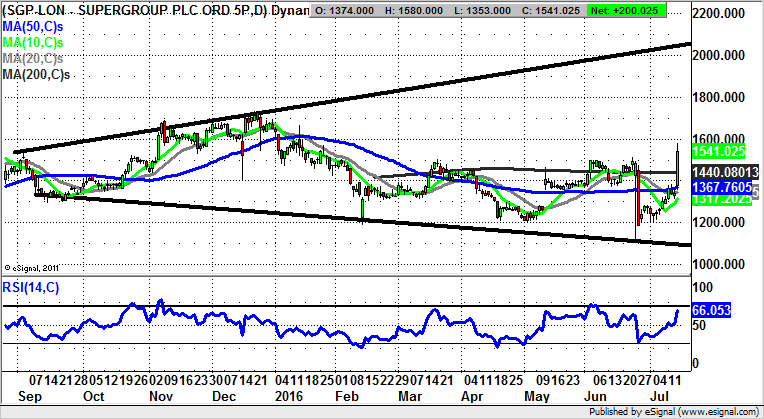

SuperGroup (SGP): Broadening Triangle Targets 2,000p

Conventional wisdom might suggest that there is a “sell by” date on most big name brands, at least as far as how long they retain their “in crowd” chic. However, in the case of retailer Supergroup it would appear that things have reached a plateau in a very agreeable manner. This is said in the wake of profits before tax for the year being up 16% and a special 20p dividend payout. Given the general consensus of how difficult things are in the High Street in a post BHS world, one can say that the good times continue to roll for the faux Japanese clothing company. From a technical perspective things are no less impressive given the sharp rebound for the shares off the floor of a broadening triangle, one which has been in place since as long ago as last September. Having bounced off 2015 support line last month, we have achieved a decent clearance of the 200 day moving average at 1,440p. The message at the moment is that provided there is no end of day close back below the 200 day line one would be expecting a move to the top of the triangle as high as 2,000p. The timeframe on such a move is as soon as the next 1-2 months.

Comments (0)