Adjust Your Interest Rate Expectations

The US economy appears to be in very good shape and is likely to remain so for the rest of the year. If that’s good news overall, it’s also a thorn in the side of investors who are reaping the benefits of interest rate cuts. Driven by the euphoria around AI, growth stocks have dominated the investment landscape for many months. However, sentiment about the future path of interest rates is changing, derailing the enthusiasm around the growth theme. In my view, the potential for further deterioration is high and I suspect that the hype around AI and megacap growth may be coming to an end. However, this is not the time to sell the broad market as the resilience of the US economy will continue to support equities.

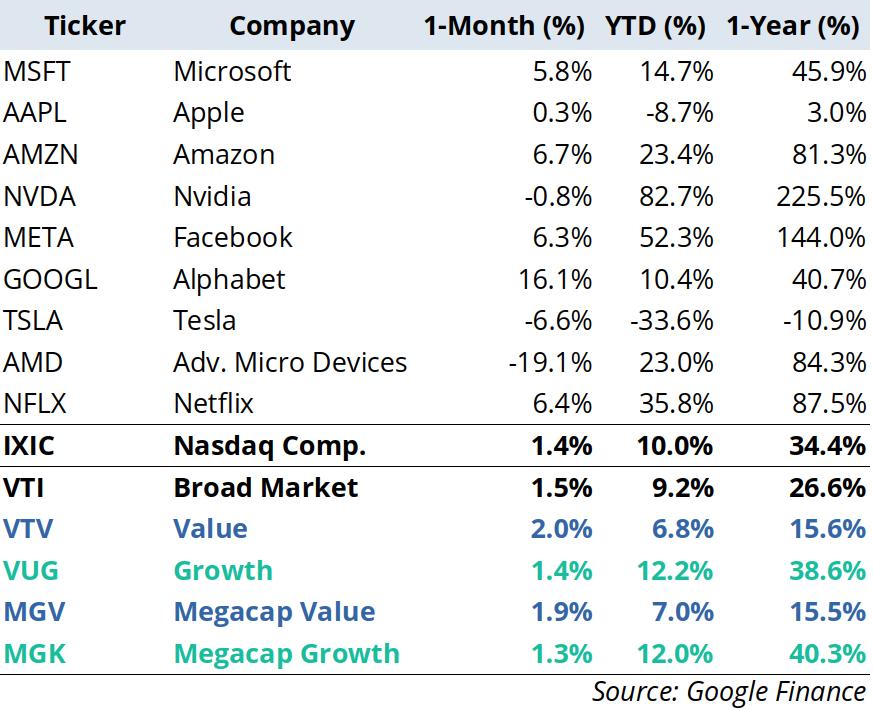

Looking at the performance of the largest holdings in Vanguard’s Megacap Growth ETF (NYSEARCA:MGK), I am reminded of the Nasdaq bubble of the late 1990s. The performance of companies like Nvidia, AMD and Facebook over the past year has been stunning, suggesting that these companies have found new ways to make money by adopting new technologies. This performance is reflected in the table below. The figures aren’t any better, as some of these companies have recently come under selling pressure. This is the case with Tesla, for example, which has been reporting sales figures that are largely below investors’ expectations. Most of these companies will end up disappointing to some extent, as expectations have been raised by a mix of the introduction of new technology, an overly optimistic interest rate scenario and a large pool of money looking for a way to invest. However, I will leave that discussion for another blog and focus on the changing scenario for interest rates and the US economy.

In December last year, 75% of the futures market was betting that the Fed would cut its target for the federal funds rate by at least 100 basis points during 2024. At that time, the odds of an even more aggressive rate cut path were substantial. Things have changed, however, and the odds of a 100 bps cut now stand at 21.4%. More recently, investors have adjusted their expectations in line with economic data and comments from Fed officials. The latest jobs report was particularly strong, with the already low unemployment rate falling further to 3.8% and the non-farm payrolls report showing that the US economy added 303,000 jobs. These figures provide further support for the Fed to keep interest rates at current levels for longer. In response, the stock market has been more volatile of late, with the high-flying megacaps and growth stocks underperforming value stocks over the past month.

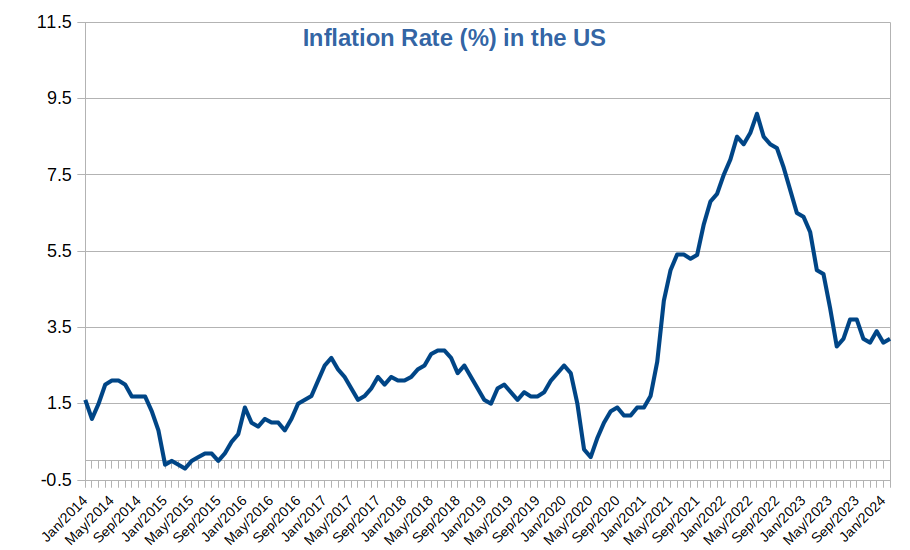

In addition to the strong economic data, we have inflation figures that are still above the Fed’s target. The latest CPI numbers show prices up 3.2% year-on-year. The near double-digit numbers we saw between March and September 2022 are gone, and inflation has been gradually declining since reaching 9.1% in June 2022 to its current level of 3.2%. This suggests that the current level of interest rates is playing its part in bringing inflation down. However, inflation seems to be stabilising around 3%, which is still above the target. Given the overall strength of the economy, the Fed is likely to hold off on reversing the interest rate cycle.

In light of the above, I believe that the odds associated with the various rate paths are still optimistic. The probability of no rate cuts is zero, the probability of one rate cut (at most) is 16% and the probability of two rate cuts (at most) is 46.3%. I think the probability of a maximum of two rate cuts will increase, which will continue to hurt growth stocks relative to value stocks. One of the main reasons for lower inflation rates is lower energy prices, but with the conflict in the Middle East heating up, these figures could come under renewed pressure. If there is a surprise, it will be in the form of no rate cut rather than several. This should put pressure on the growth theme. In addition, the current hype around mega tech stocks may prove to be unwarranted and investors are likely to adjust their forecasts more realistically. But with the US economy in such good shape, now is not the time to miss out. There’s no good reason to avoid equities. A good option would be to increase your holdings of value stocks. For broad market exposure, I like the Vanguard Value Index Fund ETF (NYSEARCA:VTV). This ETF holds 350 large-cap US stocks, including Berkshire Hathaway, Broadcom, JPMorgan Chase, UnitedHealth Group and Exxon Mobil. A big plus is its tiny expense ratio of just 0.04%. Compared with the broad market – Vanguard Value Index Fund (NYSEARCA:VTI) – VTV has underperformed over the past five years. But at a time when interest rates are high (and may remain so for longer than expected), growth is expensive, and the economy is still doing well, VTV may prove to be an excellent option.

Undoubtedly the outlook for a fall in interest rates in the us has detoirated. A cut would drive the BOE to cut rates but what happens if the suggested U.S. cuts dont happen. I would hope that the BOE would recognise that the UK is in a very different situation to the US with its buoyant economy where as the Uk has been in recession. I would hope that the UK would detach itself from the US and pay attention to the UK economy if even to make only one indicative cut. They raised rates too late in 2021 lets hope they dont leave it too late to cut rates now. Whilst CPI does not reflect the impact interest rates have (unlike the RPI) they are an input and therefore higher rates push inflation up to some degree. I think it unlikely but can see a situation in a years time where they bemoan the fact that we have deflation- if only we had acted in time!

I think there is a high chance of further inflation. Pensions and benefits and minimum wage have all just risen by 5% and more. This in my mind is inflationary. The next move in Bank of England rates may not be down.