Rotating from growth to value

With tech stocks up 40% year-to-date, it’s time to re-evaluate growth opportunities and seek out undervalued stocks, writes Filipe R. Costa.

The current rally seems endless, with equities having extended gains during August. The Dow rose 7.6%, the S&P 500 rose 7.0% and the Nasdaq 100 shot up by 11.0%, leading the gains. In Europe the Euronext 100 index rose 2.7% while the FTSE 100 having advanced 1.8%. With a few exceptions here and there, equities are rising across the globe, as investors feel ever more confident about a Covid-19 vaccine and experiencing a v-shaped economic recovery. However, current valuations are too stretched and heavily reliant on optimistic growth prospects. If the vaccine is delayed, economic growth is slower, employment struggles to recover, corporate profits are slightly revised down, or a butterfly flaps its wings with more strength than usual, we may see a stock-market crash.

At this point, the risk of investing in growth stocks is huge, not only because of the geopolitical and economic risks but also because of the lack of a safety net for potential downward revisions in profit expectations. With many tech stocks trading on triple-digit forward price-to-earnings multiples, it’s difficult to find a reason to follow the momentum trend. However, at a time when yields are at a low and central banks promise to extend their near-zero rates for years, it’s also difficult to get any decent income by investing in low risk securities. In light of all this, I believe that investors need to rotate from growth to value and jump out of the momentum bandwagon.

Stretched valuations

Forward price-to-earnings multiples have skyrocketed this year as equities reverted their pandemic losses and are currently hitting record high levels, particularly tech stocks. Optimism regarding vaccine development and a slower growth of infections improved recovery hopes and investors’ risk appetite. Money that was sitting in the sidelines and invested in money market products is now being redirected to riskier securities, as investors queue to follow the momentum trend. However, valuations are now too stretched, and many stocks exhibit record-high price-earnings multiples, which increases the risk for investors entering the market at this point. Forward price-to-earnings multiples for the Russell 1000 are near a 15-year peak. The run-up in price multiples has been exponential since March, as the rise in stock prices has been much larger than the accompanying rise in expected corporate profits. This trend is particularly pronounced in the US market. Another interesting feature about the current market is the dispersion of the price-to-earnings multiples. According to FTSE Russell research, this dispersion is at a high. After ranking the forward price-to-earnings multiples and separating them into five groups (quintiles), they point out that the spread between the highest and the lowest quintiles is currently wider than during the late-1990 tech bubble. With the Dow at evens and the Nasdaq up by 40%, the dispersion of price-to-earnings ratios could only increase. This is well reflected in the current forward price-to-earnings multiple, which currently sits at 27.9 for S&P 500 growth stocks but just 17.0 for S&P 500 value stocks.

Investors are betting on high growth, in particular for tech companies. While the current pandemic has led to some disruption of traditional values and will help to accelerate the digitisation of the global economy, replacing much of the high street with online, current expectations are too skewed. If, for some reason, growth prospects are revised down, stocks with very high valuations will stumble. The risks are high. If the economy doesn’t recover, household income will decline and tech stocks will be hard hit.

Investment case

The simplest way to avoid being hit by a potential market downturn is, of course, by means of selling every stock in a portfolio. However, as I pointed out above, there’s not many places where investors can put their money at a time when the reward on risk-free assets is near zero, if not negative. Additionally, while there may be some correction in the market, there is still upside potential. With this in mind, one idea is to tweak the equity portion of a portfolio in order to reduce downside risk while still being able to capture any remaining upside. In other words, we’re looking for undervalued stocks while ditching stocks that are disconnected from reality.

Positive sentiment usually boosts the small, hard to value stocks more than the established companies. When sentiment is buoyant, investors are attracted by stocks showing unstable cash flows and profits, high leverage and high growth potential. Tesla is a very good example of this. While the company never seems to end a year with a profit and sells just a tenth of the cars sold by GM, its current market cap is ten times higher. This means, investors are betting on skyrocketing growth for Tesla, which often proves to be more the result of sentiment rather than logic. When sentiment deteriorates, and money becomes more valuable, investors look for the safety offered by stable cash flows and profits, moderate leverage levels, and reasonable growth prospects. By that time, the tangible present becomes a lot more valuable than the intangible future, as investors realise that the estimated growth was too optimistic. If that’s the case, the stock is vulnerable and may experience a freefall.

Value stocks usually present themselves with low price ratios; that is, with low price-to-book, price-to-earnings, price-to-cash flow, price-to-sales, price-to-net tangible assets, or similar metric. Much can be said about the reasons for the low price ratios, but in general, when investors select a diversified portfolio of stocks with reasonable valuations, they’re much less exposed to downside risk, and are properly positioned for long-term performance. David Dreman neatly explains how price ratios can be used to select value and outperform the market in his invaluable book Contrarian Investment Strategies: the Psychological Edge, which I recommend for those wishing to further explore the topic. For the sake of selecting a portfolio of value stocks, we may either go down the route of hand picking a portfolio of high-ranking stocks, or via the lazy alternative of purchasing an already packed value portfolio, through an ETF. Today, I’m going down the easier route of selecting ETFs. From the perspective of a small investor, an ETF is not only simpler but is often the only way to get proper diversification and avoid unnecessary risks.

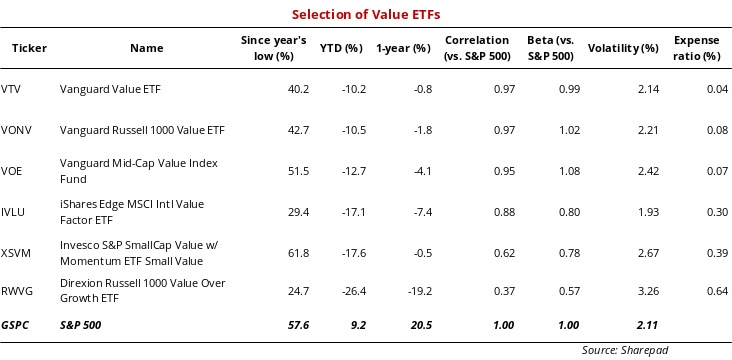

Choosing ETFs

Vanguard Value ETF (NYSEARCA:VTV)

VTV tracks the CRSP US Large Cap Value Index, which selects stocks from the top 85% of market capitalisation based on multiple value factors. VTV screens stocks using price-to-book,

forward price-to-earnings, historic price-to-earnings, dividend-to-price and sales-to-price ratios. VTV should be at the top of investors’ lists because it is the largest value ETF, with $52.5bn in assets under management, and it is also the cheapest, with an expense ratio of just 0.04%. Healthcare, financials and consumer goods take 54% of the fund’s assets. There are 347 stocks in the fund and top holdings include Johnson & Johnson, Berkshire Hathaway and Procter & Gamble. VTV is a good choice for a value tilt and also fits well into a long-term portfolio, as it invests in the safest US companies and doesn’t drag down performance through fees.

Vanguard Russell 1000 Value ETF (NASDAQ:VONV)

VONV tracks an index of US large and mid-cap value stocks. It’s cheaper than the Blackrock alternative, IWD. In general, Vanguard is cheaper than Blackrock, which may make all the difference for long-term investors. The number of holdings is much larger here than in VTV, as it invests in 842 stocks. At the same time, VONV reaches beyond the large-cap space to include significant exposure to mid-caps. This may increase risk at times, but the differences in terms of performance shouldn’t be large. VONV is a good alternative to the broad-based VTV. It is a large and cheap ETF with $3.8bn in assets under management and an expense ratio of 0.08%. Financial services, healthcare and consumer discretionary are the top sector exposures. Top holdings include Berkshire Hathaway, Johnson & Johnson and JP Morgan Chase, which are also top exposures of VTV.

Vanguard Mid-Cap Value Index Fund (NYSEARCA:VOE)

VOE tracks the CRSP US Mid Cap Value Index which classifies value stocks based on five different value factors. Investors looking for inexpensive, broad exposure to mid-cap value should consider this alternative. Its expense ratio is low at 0.07% and assets under management amount to $9.3bn. Exposure to financials, utilities and consumer goods amounts to 52% and top holdings include Eversource Energy, WEC Energy Group and Clorox Company. The fund invests in 212 stocks.

iShares Edge MSCI Intl Value Factor ETF (NYSEARCA:IVLU)

Investors looking for an international exposure to value stocks, may consider IVLU. It tracks an index of large and mid-cap developed ex-US equities. IVLU selects stocks using a value score calculated from three accounting ratios: price-to-book, price-to-forward earnings, and enterprise value-to-cash flow from operations. This approach is also shared by its sister fund EFV. However, it differs from EFV in weighting its portfolio holdings by the calculated value score instead of doing so by market cap, which gives it an improved value tilt. IVLU has an expense ratio of 0.30% and holds stocks from several countries including Japan (40.5%), UK (14.4%) and France (11.7%). Top holdings include Novartis, Toyota Motors and Sanofi.

Invesco S&P SmallCap Value with Momentum ETF Small Value (NYSEARCA:XSVM)

XSVM is different from the ETFs above, as it adds a momentum layer to its value tilt. One of the biggest problems faced by value investors is that a market may remain irrational for a very long period of time and the out-of-favour value stocks may remain that way for longer than an investor is willing to wait. To minimise this problem, XSVM adds a momentum layer to value in order to capture undervalued stocks, which are already rising.

XSVM tracks an index of S&P 600 small-cap stocks selected by value and momentum and weighted by value. Pulling the stocks from the S&P 600 small-caps, its index selects 240 stocks with the highest value score,

derived from price-to-book value, price-to-earnings and price-to-sales. It then picks the top half of these based on a momentum score, using 12-month performance excluding the most recent month and favouring stocks with lower volatility. The selected 120 stocks are weighted by their value score. Consumer discretionary, financials and industrials represent 62% of the fund and top holdings include INTL FCStone, Signet Jewellers and Genesco.

Direxion Russell 1000 Value Over Growth ETF (NYSEARCA:RWVG)

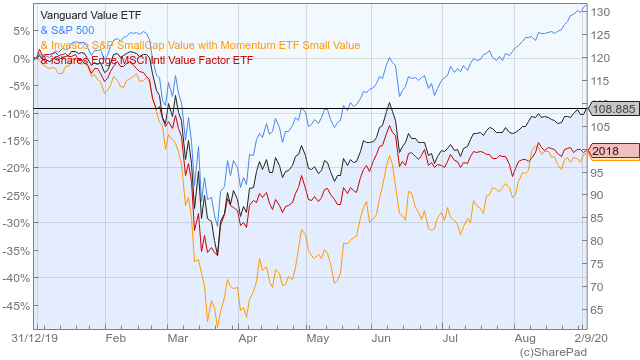

RWVG is a long-short fund. The key idea behind its conception is to provide a long exposure to value and a short exposure to growth, which means the fund is bullish on value and bearish on growth. RWVG holds a slightly leveraged exposure to Russell 1000 value stocks (150%) coupled with partial short exposure to Russell 1000 growth stocks (-50%). The exposure is reset every month to keep leverage at 1x. The expense ratio is the largest from our pick as it comes at 0.64%. This is the result of the monthly reset and the use of derivatives. RWVG may be a good option for investors that are seeking a larger tilt towards value and are willing to support higher risk. This risk is well reflected in its cumulative 24.7% loss year-to-date, which is the largest from our ETF selection. This is the consequence of growth dominating returns this year. However, if value replaces growth, RWVG would top all other funds.

Final comments

After a 40% rise in a tough year, it’s hard to find any value among the tech stocks. While the US election, the development of a Covid-19 vaccine and the accommodative monetary policy will certainly continue to favour stocks, the risks are mounting, as valuations are too stretched. Still, many believe this is not the time to leave the stock market yet, in particular due to the lack of yield opportunities in low risk securities. Thus, rotating from growth to value may be one very good option.

It’s difficult to achieve a pure value play in the market through an ETF, as they’re unable to invest in less liquid stocks due to their size. It’s also difficult for a small investor to actively build a value portfolio, as transaction costs and diversification issues can undermine the idea. Still, the six ETFs reviewed above can give a decent tilt towards value. VTV, VONV and VOE are broad-based options, which don’t differ much from the S&P 500 but are cheap, liquid and offer the tilt most investors are looking for. Investors looking for an international play on value may opt for IVLU, which excludes US stocks. XSVM offer investors a double play on value and momentum. Starting with a value selection, the fund then screens the more favourable stocks, those which are already rising. Lastly, RWVG is a more complex long-short play, which buys value and sells growth. This fund shows the worst performance year-to-date but it’s the best prepared to outperform when value prevails over growth.

Comments (0)